Archives of “January 18, 2019” day

rssTomorrow is Too Late

Trading has many ups and downs and can easily cause us to feel defeated.

Trading has many ups and downs and can easily cause us to feel defeated.

However, defeat can only be disastrous if we classify it as disastrous.

Losses, defeats, failures, etc. have been a part of history for every person who has reached high levels of success. The difference with the successful people is that they analyze the situation immediately. Those that tend to fade away are those that wait until tomorrow or maybe never to review and discover why the results were not what they expected.

To be successful we must accept every result as a part of our growth and to apply those findings today. Don’t wait until tomorrow, because tomorrow may be too late.

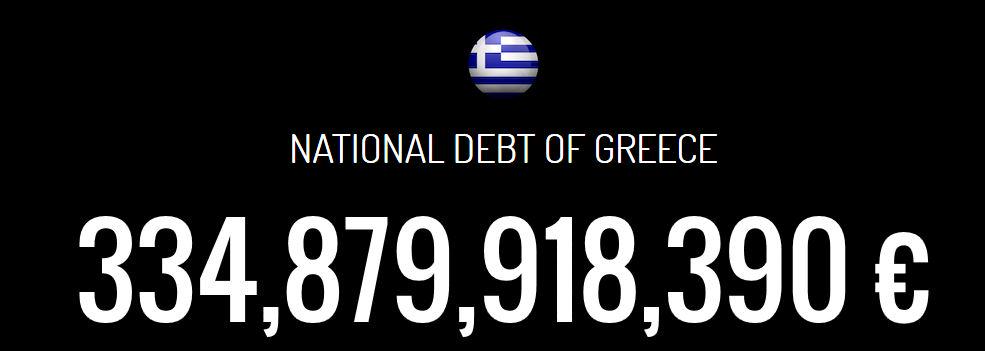

Greece -You could wrap $1 bills around the Earth 1,465 times with the debt amount! Unrecoverable.

5-minute MBA ( 6 Lessons )

Lesson 1:

A man is getting into the shower just as his wife is finishing up her shower, when the doorbell rings.

The wife quickly wraps herself in a towel and runs downstairs.

When she opens the door, there stands Bob, the next-door neighbor.

Before she says a word, Bob says, ‘I’ll give you $800 to drop that towel.’

After thinking for a moment, the woman drops her towel and stands naked in front of Bob, after a few seconds, Bob hands her $800 and leaves.

The woman wraps back up in the towel and goes back upstairs.

When she gets to the bathroom , her husband asks, ‘Who was that?’

‘It was Bob the next door neighbor,’ she replies.

‘Great,’ the husband says, ‘did he say anything about the $800 he owes me?’

Moral of the story:

If you share critical information pertaining to credit and risk with your shareholders in time, you may be in a position to prevent avoidable exposure. (more…)

Volatile vs. Smooth

“Conventional economic reasoning says that if two stocks have similar expected future cash flows and similar dependence on the market, we prefer the one that is less volatile. But might we not see some advantage to stock in volatile company A, which has survived many crises, over stock in safe, untested company B? Perhaps A’s stresses have allowed evolution of the characteristics that will succeed in the future, whereas B is narrowly positioned for the conditions of the past. In the future, perhaps A’s volatility will allow it to move faster into opportunities and away from dead ends, and to evolve as conditions change.”

– Aaron Brown, Red-Blooded Risk

Why does academia assume lower volatility is better?

How many real world instances have you seen confirming that more volatile = more robust, while smooth = over managed, artificial, and possibly brittle?

What are some of the advantages of embracing volatility — managing it versus shunning it?

Placing Time Limits On Reading Others

This Mail recieved from one of the Trader ! Q: It seems like the more I read different analysis and opinions of the market the worse I trade. Is this common? When I just stick to my basic chart-reading and my own instinct I do better. When I take advice and trade off of another’s opinion, the trade seems to fail. What’s up with this?

Q: It seems like the more I read different analysis and opinions of the market the worse I trade. Is this common? When I just stick to my basic chart-reading and my own instinct I do better. When I take advice and trade off of another’s opinion, the trade seems to fail. What’s up with this?

A: There’s a Danish proverb that says that “he who builds according to every man’s advice will have a crooked house.” The same is true with trading and the experience you share is quite common.

While there are some excellent role models out there to read and learn from, it takes time and lots of experience to be able to properly filter through the noise and learn how to recognize subjective and/or faulty analysis. It really is a unique skill and one that is not very common unless you’ve been at it for awhile and/or developed that skill through your education and career.

Although most traders don’t feel confident about their strategies to be able to trade in complete isolation (at least not for very long), there is a tremendous benefit from doing so. In my view, traders are now being flooded with too much real-time data, information, and opinions and they’re struggling to cope, make sense of it, and then focus on what matters. Remember, more information and analysis does not translate into better performance and we all have to place strict time limits on the energy we devote to reading the thoughts of others. Instead of visiting hundreds of websites and watching Blue Channels…Just visit this blog nothing else

EGO-The Trader’s biggest enemy

The trader’s biggest enemy is their own EGO.

Ego: a person’s sense of self-esteem or self-importance.

Ego: a person’s sense of self-esteem or self-importance.

1. The new traders with big egos always have but confidence in their trading ability before developing competence in trading. New traders that trade before educating themselves are ignorant of their own ignorance.

2. Ego driven traders think they are special and will beat the market, even without putting in the work. They feel this way even though there is no evidence from their past trading success.

3. Most stubbornness in traders arises from the egos refusal to change, to learn, or to accept they are wrong about something.

4. The ego will make you hold a trade that is going against you, in the hope that you can prove yourself right when it reverses.

5. The biggest cause of trading too big of a position size, is ignoring risk management in favor of confidence in an unknown outcome.

6. Arrogant traders will focus on being right about predictions more than developing a robust trading methodology.

7. Ego driven traders put being right above being profitable. Their goal is ego gratification, not profitable trading.

Successful traders trade a plan based on logic, reason, probabilities, historical prices, and risk management.

The most dangerous business animal?

Steve Jobs asked about Apple's system for innovating

Thomas Edison asked in 1908 if the age of invention was over