My points to consider:

1. If you have an investment that is not working, or one that is beating you with heavy fees, then you have made a choice. If you don’t want that–stop. If you don’t stop you can always watch a video like this, blame someone else, and refuse to take any personal responsibility. Ignorance is no excuse. It’s your life. Take control.

2. Passive investing (i.e. indexes, buy and hold, etc.) might appear as an option, but how would you feel if you have been buying and holding the Japanese Nikkei 225 since 1989? Not very good is my bet.

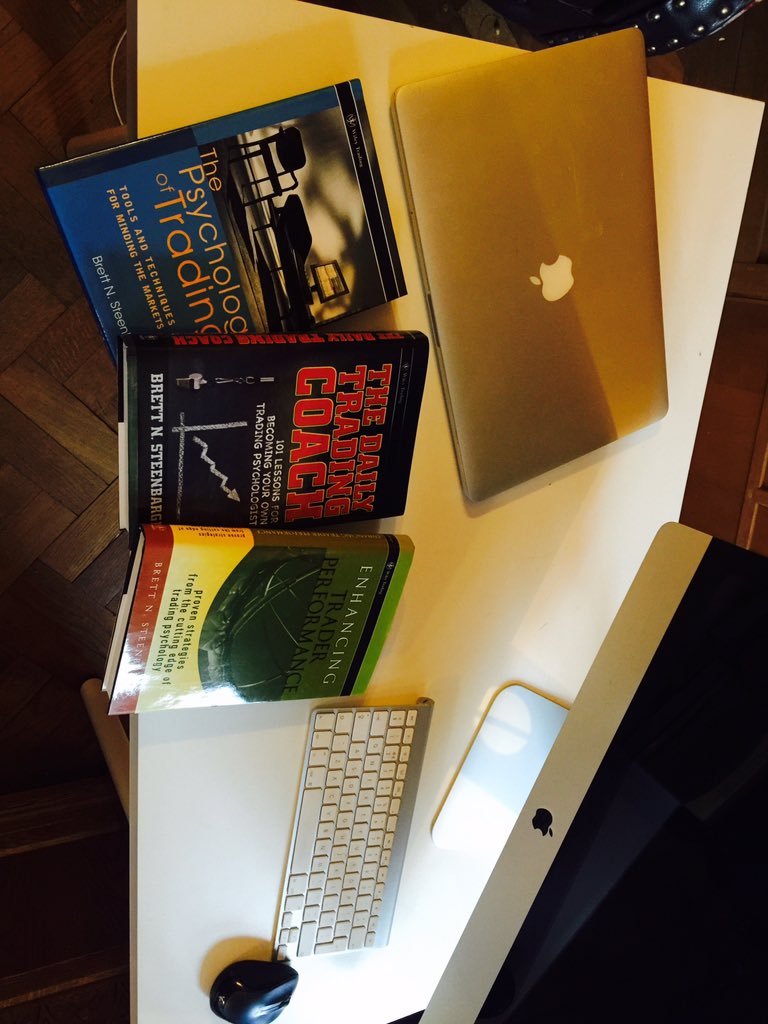

3. I teach trend following. The trend following traders in my work illustrate trend following success, but my work is not an advertisement for anyone except me. Can trend following funds charge fees? Yes. However, in their defense the trend following performance numbers in all of my books are ‘after fees’.

4. Brokers are bullshit. If you like bullshit then you get what you want out of life by listening to brokers.

5. This video promotes the efficient-market hypothesis (EMH). Academics promote EMH like there is no tomorrow. Two big reasons? Many of these academics have rock solid tenure at the best universities and also make millions selling EMH text books. Everyone has a motivation, but I will hold my books up against this video every day of the week.

Confidence can be an important psychological tool for the trader – important enough to make the difference between a winning trade and a losing trade. When you develop your trading plan, it is obviously important that you have confidence in its accuracy and usefulness and in your belief that you can follow your plan closely and execute it successfully.

Confidence can be an important psychological tool for the trader – important enough to make the difference between a winning trade and a losing trade. When you develop your trading plan, it is obviously important that you have confidence in its accuracy and usefulness and in your belief that you can follow your plan closely and execute it successfully.

This started as a quirky post but quickly turned into something probably more useful. I admit the post is based on personal experiences. Luckily, I do not make these mistakes any more….at least not very often ;). Enjoy!

This started as a quirky post but quickly turned into something probably more useful. I admit the post is based on personal experiences. Luckily, I do not make these mistakes any more….at least not very often ;). Enjoy!

at

at