Archives of “January 2019” month

rssFundamentals & Economic Data had Gone……Where ?

Yes ,Only Chart ………..Nothing else !!

Last Thursday………..What we told u ?Do U remember ?

Don’t Touch anything,Don’t Hold long……….Huge PANIC on card in Market !

Any of the Analyst in India can tell us …What Happened to RELIANCE ?From 1069 to 945 in 14 sessions.

What Happened to Result ?Fundamentals……..GRM ??

Doing BLA BLA on TV channels is very easy…But Once u Trade ..Then u will see what happens ??

Technically Yours/ASR TEAM/BARODA

Enemies of profitable trading

Overconfidence

The perfectionist may never be really convinced that a certain market setup is right to enter into a position and the overconfident trader may neglect certain signals that the setup is not worth trading on.

The perfectionist may never be really convinced that a certain market setup is right to enter into a position and the overconfident trader may neglect certain signals that the setup is not worth trading on.

A trader may become overconfident after a few successful trades. It’s very hard to fight the ‘I am the market God’-emotion. Making a number of consecutive successful trades is not necessarily a sign you have figured out how the markets work, the same way a losing streak is not a sign you’re a bad trader.

After a huge success it’s tempting to trade a larger size or accept more risk. The general idea is that simply because of the huge profit in the previous trade, more size and/or risk is acceptable in the next. But when you think about it, a realized profit is part of your account now, it’s no different than money made on earlier trades, it is money you worked hard for. There can be good reasons to increase trading size or risk, but that should be part of a plan, not just an impulsive decision based on a feeling of being ‘invulnerable’.

Ask yourself, which feeling is worse: losing yesterday’s profit, or losing the profit made 10 days ago? If that feels different, the first one being less worse, then it may be wise to stop trading for a few days after a good trade. During those days, the profit will slowly change from being ‘an extra’ to being ‘part of your trading account’. In other words, you get used to it and handle it with more care.

Overconfidence can also come from a (strong) conviction that the market has to go a certain direction based on a personal opinion about the economy, politics, the FED, interest rate, unemployment numbers etc etc. This kind of confidence has been discussed before. The remedy is simple: don’t trade the news.

Trader Vic’s Principles of Trading

It’s a helpful book to return to when market conditions get tough. A great place to start is Vic’s “business philosophy,” as encapsulated in three rules:

1. Preservation of Capital

2. Consistent Profitability

3. Superior Returns

Below is Sperandeo in his own words:

Preservation of Capital

Preservation of capital is the cornerstone of my business philosophy. This means that, in considering any potential market involvement, risk is my prime concern. Before asking, “What personal profit can I realize?”, I first ask, “What potential loss can I suffer?”

…There is one, and only one, valid question for an investor to ask: “Have I made money?” The best insurance that the answer will always be “Yes!” is to consistently speculate or invest only when the odds are decidedly in your favor, which means keeping risk at a minimum. (more…)

3 Intraday Messages

Yesterday sent 3 mssges to our Subscribers.

-Unexpected money minted in all 3 calls.

-U all might had enjoyed crashed in Tisco ,Real Estate stocks ,ADAG Stocks and ofcourse in Reliance too.

Great photographers never take a picture until everything is set up correctly and the subject is in focus.If they have not analyzed the situation before taking the picture, their results will not be successful.

Traders need to follow the same steps. Your mind must be in focus and we must have a solid foundation in place before we execute a trade or else we will not have a high chance for success

Updated at 8:15/23rd Feb/Baroda

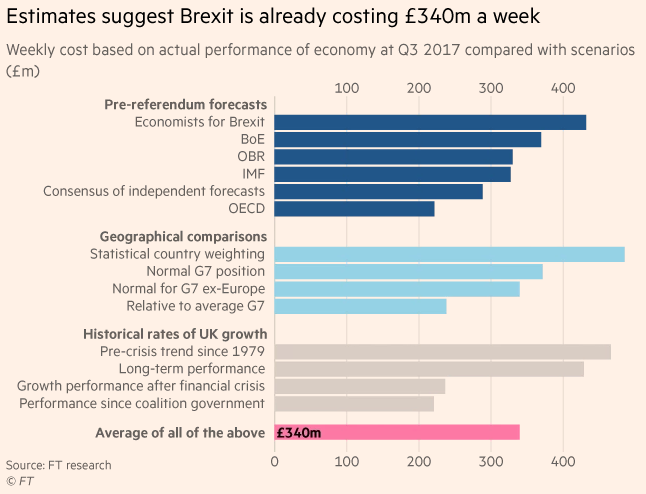

Estimates suggest Brexit is already costing 340m a week

DR VOTE NO

Find Mistake : The puzzle that has puzzled millions around the world.

Stop trying to be perfect

Stop trying to be perfect. Great trading is not about perfection, it’s about probabilities. If you go to a restaurant and order a steak, you don’t need to eat the bone, gristle and fat to enjoy the steak. And you don’t need to sell the top or buy the bottom to make a killing in the market. Just look for the sweet spot and dig into that. If you leave some profits on the table, that’s ok. You’re still going to leave the table feeling confident, in control and with a full stomach.

Stop trying to be perfect. Great trading is not about perfection, it’s about probabilities. If you go to a restaurant and order a steak, you don’t need to eat the bone, gristle and fat to enjoy the steak. And you don’t need to sell the top or buy the bottom to make a killing in the market. Just look for the sweet spot and dig into that. If you leave some profits on the table, that’s ok. You’re still going to leave the table feeling confident, in control and with a full stomach.