Click & Read

Archives of “January 2019” month

rssTrading Quotes

| The tape tells the truth, but often there is a lie buried in the human interpretation Jesse Livermore |

| Charts not only tell what was, they tell what is; and a trend from was to is (projected linearly into the will be) contains better percentages than clumsy guessing R. A. Levy |

| The biggest risk in trading is missing major opportunities, most of enormous gains on my accounts came from 5% of trades. Richard Dennis |

| Your human nature prepares you to give up your independence under stress. when you put on a trade, you feel the desire to imitate others and overlook objective trading signals. This is why you need to develop and follow trading systems and money management rules. They represent your rational individual decisions, made before you enter a trade and become a crowd member. A. Elder |

A good start.

10 rules for Rookie Day Traders

1. The three E’s: enter, exit, escape

Rule No. 1 is having an enter price, an exit price, and an escape price in case of a worst-case scenario. This is rule number one for a reason. Before you press the “Enter” key, you must know when to get in, when to get out, and what to do if the trade doesn’t work out as expected.

Escaping a trade, also known as using a stop price, is essential if you want to minimize losses. Knowing when to get in or out will help you to lock in profits, as well as save you from potential disasters.

2. Avoid trading during the first 15 minutes of the market open

Those first 15 minutes of market action are often panic trades or market orders placed the night before. Novice day traders should avoid this time period while also looking for reversals. If you’re looking to make quick profits, it’s best to wait a while until you’re able to spot rewarding opportunities. Even many pros avoid the market open.

3. Use limit orders, not market orders

A market order simply tells your broker to buy or sell at the best available price. Unfortunately, best doesn’t necessarily mean profitable. The drawback to market orders was revealed during the May 2010 “flash crash.” When market orders were triggered on that day, many sell orders were filled at 10-, 15-, or 20 points lower than anticipated. A limit order, however, lets you control the maximum price you’ll pay or the minimum price you’ll sell. You set the parameters, which is why limit orders are recommended. (more…)

Intentions

“Intention = Result. The thing you state as your intention may not be your real intention. In that case, you intend to not manifest your statement intention as part of a larger (secret) intention. For example, you promise to show up on time and show up late. Your intention may be to gain attention by making people wait for you.“

“Intention = Result. The thing you state as your intention may not be your real intention. In that case, you intend to not manifest your statement intention as part of a larger (secret) intention. For example, you promise to show up on time and show up late. Your intention may be to gain attention by making people wait for you.“

So many people fixate on rules and techniques, but forget “intentions”. As you approach your daily life, contemplating how you will find the big score, have you thought about your true intentions? The trading psychology part of the equation is just as important as the quant side of the equation.

10 Wall Street Pick-up Lines to Avoid

“If your proposed marriage contract has 47 pages, I suggest you not enter.”

This quote by Charles Munger hammers home the role of trust in an investment relationship.Michael Kitces of Nerds Eye View wrote a post entitled “What is the philosophy of your financial planning firm? It deals with what an advisor doesn’t believe in and what he/she wouldn’t recommend to clients. Engaging an advisor whose philosophy is based on trust, and who chooses to be a fiduciary for clients has many benefits for the average investor. Unfortunately, most financial advisors are not fee-only RIAs. Those who are only looking to have a “suitable relationship” with their customers may structure their business philosophy in a different manner. Many advisory firms have embraced a culture of sales and monthly quotas. Clearly that is a philosophy, but it is not necessarily a good one for the end user. If you find yourself surrounded by financial types using any of these types of pitches, be very afraid.

1. “Its like a CD.”

2. “Buying on margin will greatly increase your returns.”

3. “This fund did really well last year.”

4. “As long as the music is playing, you have to get up and dance.”

5. “Do you want the confirmation sent to your office or your mansion?”

6. “I have a very strong work ethic. The problem was my ethics in work.”

7. “I’ve got the guts to die. What I want to know is have you got the guts to live?”

8. “Greed is good.”

9. “Don’t pitch the b*tch.”

10. “Screw the credit derivative desk, I don’t understand half the sh*t they do anyway.” (more…)

Politics/religion. Very tuff subjects esp for Twitter so i will leave it alone. I preach Tolerance Equality HAPPINESS

100 TRADING TIPS

1)Nobody is bigger than the market.

2)The challenge is not to be the market, but to read the market. Riding the wave is much more rewarding than being hit by it.

3)Trade with the trends, rather than trying to pick tops and bottoms.

4)There are at least three types of markets: up trending, range bound, and down. Have different trading strategies for each.

5)In uptrends, buy the dips ;in downtrends, sell bounces.

6)In a Bull market, never sell a dull market, in Bear market, never buy a dull market.

7)Up market and down market patterns are ALWAYS present, merely one is more dominant. In an up market, for example, it is very easy to take sell signal after sell signal, only to be stopped out time and again. Select trades with the trend.

8)A buy signal that fails is a sell signal. A sell signal that fails is a buy signal.

(more…)

(more…)

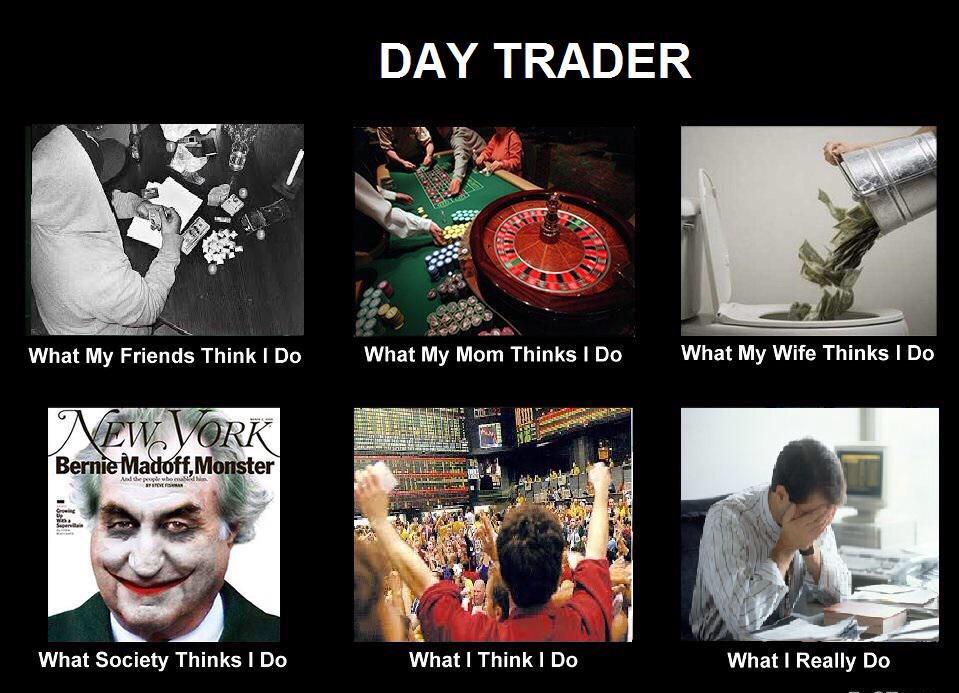

The reality of trading

Average True Range (ATR) – A Magical Tool

Average True Range is an indispensable tool for designers of good trading systems. It is truly a workhorse among technical indicators. Every systems trader should be familiar with ATR and its many useful functions. It has numerous applications including use in setups, entries, stops and profit taking. It is even a valuable aid in money management. The following is a brief explanation of how ATR is calculated and a few simple examples of the many ways that ATR can be used to design profitable trading systems.How to calculate Average True Range (ATR):

- Range: This is simply the difference between the high point and the low point of any bar.

- True Range: This is the GREATEST of the following:

- The distance from today’s high to today’s low

- The distance from yesterday’s close to today’s high, or

- The distance from yesterday’s close to today’s low

True range is different from range whenever there is a gap in prices from one bar to the next. Average True Range is simply the true range averaged over a number of bars of data. To make ATR adaptive to recent changes in volatility, use a short average (2 to 10 bars). To make the ATR reflective of “normal” volatility use 20 to 50 bars or more.

Will write more with Examples …Next week !!

Technically Yours