Archives of “January 2019” month

rssGeorge Soros on trend following

Best Quote About Gold I've ever Read

Share of Global Economy From 1980 to 2014

Jim Chanos Presentation On China

Short seller Jim Chanos has been bearish on China for a while now. Here is a presentation he made making his case. It is 57 Minutes long.

China Banks Tightening Standards for Loans To Property Sector (iMarketNews)

Shanghai equities at lowest since Oct (People’s Daily Online)

Economic fears pull US copper futures below $3/lb (Reuters India)

China curbs companies’ capital raising (FT.com)

Tightening fears give rise to China ‘buy’ opportunities (FT.com)

Chinese Tightening Unlikely to Cause Copper Collapse (WSJ.com)

Chinese mortgage rates rise as loan clampdown bites (Reuters)

There are also geopolitical issues going on about the internet, currency and arms sales. So interesting times folks. FYI, Chanos correctly shorted Moody’s while Buffett was buying in May 2007.

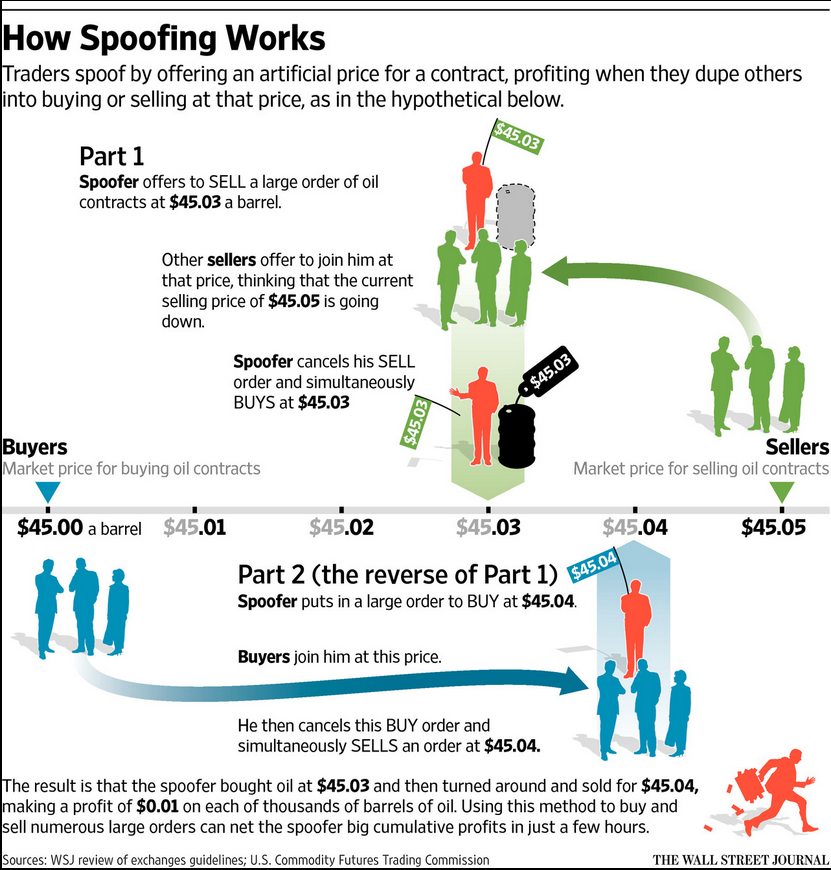

This Type of Trading Practice Going In India From Last Many Years-Nothing New

A memorable passage from Epictetus

Be not deceived, every animal is attached to nothing so much as to its own interest. Whatever then seems to hinder his way to this, be it a brother or a father or a child, the object of his passion or his own lover, he hates him, guards against him, curses him. For his nature is to love nothing so much as his own interest; this is his father and brother and kinsfolk and country and god. At any rate, when the gods seem to hinder us in regard to this we revile even the gods and overthrow their statues and set fire to their temples, as Alexander ordered the shrines of Asclepius to be burnt when the object of his passion died. Therefore if interest, religion and honour, country, parents and friends are set in the same scale, then all are safe; but if interest is in one scale, and in the other friends and country and kindred and justice itself, all these are weighed down by interest and disappear. For the creature must needs incline to that side where ‘I’ and ‘mine’ are; if they are in the flesh, the ruling power must be there; if in the will, it must be there; if in external things, it must be there.

Be not deceived, every animal is attached to nothing so much as to its own interest. Whatever then seems to hinder his way to this, be it a brother or a father or a child, the object of his passion or his own lover, he hates him, guards against him, curses him. For his nature is to love nothing so much as his own interest; this is his father and brother and kinsfolk and country and god. At any rate, when the gods seem to hinder us in regard to this we revile even the gods and overthrow their statues and set fire to their temples, as Alexander ordered the shrines of Asclepius to be burnt when the object of his passion died. Therefore if interest, religion and honour, country, parents and friends are set in the same scale, then all are safe; but if interest is in one scale, and in the other friends and country and kindred and justice itself, all these are weighed down by interest and disappear. For the creature must needs incline to that side where ‘I’ and ‘mine’ are; if they are in the flesh, the ruling power must be there; if in the will, it must be there; if in external things, it must be there.

If then I identify myself with my will, then and only then shall I be a friend and son and father in the true sense. For this will be my interest—to guard my character for good faith, honour, forbearance, self-control, and service of others, to maintain my relations with others. But if I separate myself from what is noble, then Epicurus’ statement is confirmed, which declares that ‘there is no such thing as the noble or at best it is but the creature of opinion’.

Tomorrow is Too Late

Trading has many ups and downs and can easily cause us to feel defeated. However, defeat can only be disastrous if we classify it as disastrous. Losses, defeats, failures, etc. have been a part of history for every person who has reached high levels of success. The difference with the successful people is that they analyze the situation immediately. Those that tend to fade away are those that wait until tomorrow or maybe never to review and discover why the results were not what they expected. To be successful we must accept every result as a part of our growth and to apply those findings today. Don’t wait until tomorrow, because tomorrow may be too late. |

How Trader Personality Affects Trading

A recent pilot study addresses the interesting topic of how a trader’s personality affects his or her trading performance. The researchers focused on six personality traits and their impact upon trading:

* Locus of control – The degree to which a trader believes that the ability to be successful is within his or her control;

* Maximizing tendency – The degree to which individuals seek optimum outcomes from their decisions, not just outcomes that meet or exceed expectations;

* Regret susceptibility – The tendency to look back on outcomes of decisions and focus on negative aspects, creating regret;

* Self-monitoring – People’s tendency to track and control their own thoughts, feelings, and behaviors;

* Sensation seeking – The degree to which people seek varied and stimulating experience;

* Type A behavior – The degree to which individuals are driven to achieve. (more…)

What do you think which is the most important mistake in trading that we should avoid among these?

1. Trading with money you can’t afford to lose

2. The need to be “certain”

3. Words that will kill you! HOPE—WISH—PRAY

4. Not Acting on your plan

5. Not knowing how to get out of a losing trade

6. Having an ego

7. Falling in love with a sector or script