Thought For A Day

-And remember, past performance is not necessarily indicative of future results.

Per capita income of Indians grew by 14.5 per cent to Rs 46,492 in 2009-10 from Rs 40,605 in the year-ago period, as per the revised data released by the government today.

Per capita income of Indians grew by 14.5 per cent to Rs 46,492 in 2009-10 from Rs 40,605 in the year-ago period, as per the revised data released by the government today. The new per capita income figure estimates on current market prices is over Rs 2,000 more than the previous estimate of Rs 44,345 calculated by the Central Statistical Organisation (CSO).

Per capita income means earnings of each Indian if the national income is evenly divided among the country’s population at 117 crore.

However, the increase in per capita income was only about 6 per cent in 2009-10 if it is calculated on the prices of 2004-05 prices, which is a better way of comparison and broadly factors inflation.

Per capita income (at 2004-05 prices) stood at Rs 33,731 in FY10 against Rs 31,801 in the previous year, the latest data on national income said.

The size of the economy at current prices rose to Rs 61,33,230 crore in the last fiscal, up 16.1 per cent over Rs 52,82,086 crore in FY’09.

Based on 2004-05 prices, the Indian economy expanded by 8 per cent during the fiscal ended March 2010. This is higher than 6.8 per cent growth in fiscal 2008-09.

The country’s population increased to 117 crore at the end of March 2010, from 115.4 crore in fiscal 2008-09.

There are four basic principles of price behavior which have held up over time. Confidence that a type of price action is a true principle is what allows a trader to develop a systematic approach. The following four principles can be modeled and quantified and hold true for all time frames, all markets. The majority of patterns or systems that have a demonstrable edge are based on one of these four enduring principles of price behavior. Charles Dow was one of the first to touch on them in his writings.

There are four basic principles of price behavior which have held up over time. Confidence that a type of price action is a true principle is what allows a trader to develop a systematic approach. The following four principles can be modeled and quantified and hold true for all time frames, all markets. The majority of patterns or systems that have a demonstrable edge are based on one of these four enduring principles of price behavior. Charles Dow was one of the first to touch on them in his writings.

Principle One: A Trend Has a Higher Probability of Continuation than Reversal

Principle Two: Momentum Precedes Price

Principle Three: Trends End in a Climax

Principle Four: The Market Alternates between Range Expansion and Range Contraction!

1. “Twenty years from now you will be more disappointed by the things that you didn’t do than by the ones you did do.” ~ Mark Twain

2. “The market can stay irrational longer than you can stay solvent.” ~ John Maynard Keynes.

3. “I never buy at the bottom and I always sell too soon.” ~ Baron Rothschild

4. “When the facts change, I change my mind. What do you do, sir?” ~ John Maynard Keynes

5. “Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.” ~ Warren Buffett

6. “It is not our duty as speculators to be on the bull side or the bear side but upon the winning side.” ~ Jessie Livermore in Edwin Lefevre’s Reminiscences of a Stock Operator

7. “The principles of successful speculation are based on the supposition that people will continue in the future to make the mistakes that they made in the past.” ~ Thomas F. Woodlock

8. “It never was my thinking that made the big money for me. It was always my sitting tight. Got that?” ~ Mr. Partridge in Edwin Lefevre’s Reminiscences of a Stock Operator

9. “They say you never grow poor taking profits. No, you don’t. But neither do you grow rich taking a four-point profit in a bull market.” ~ Jessie Livermore in Edwin Lefevre’s Reminiscences of a Stock Operator

10. “Remember that prices are never too high for you to begin buying or too low to begin selling. But after the initial transaction, don’t make a second unless the first shows you a profit.” ~ Jessie Livermore in Edwin Lefevre’s Reminiscences of a Stock Operator

11. “A loss never bothers me after I take it. I forget it overnight. But being wrong – not taking the loss – that is what does the damage to the pocketbook and the soul.” ~ Jessie Livermore in Edwin Lefevre’s Reminiscences of a Stock Operator (more…)

I AM RESPONSIBLE FOR MY THOUGHT, FEELING AND ACTION

I AM RESPONSIBLE FOR MY THOUGHT, FEELING AND ACTION

I ACCEPT THE PRESENT AS REALITY AND TAKE ACTION ACCORDINGLY

I TAKE WHAT THE MARKETS GIVE ME AND AM GRATEFUL FOR THESE GIFTS

I AM WILLING TO MAKE MISTAKES, LEARN FROM THEM, FORGIVE MYSELF AND MOVE ON

I AM FLEXIBLE AND ADAPTABLE

I CAN EASILY AND TRUTHFULLY SAY “I DON’T KNOW”

I TRUST MYSELF TO DO WHAT IS IN MY BEST INTEREST

THE MARKET IS MY BEST TEACHER

I LEARN SOMETHING NEW EVERY DAY

I AM BECOMING A BETTER TRADER

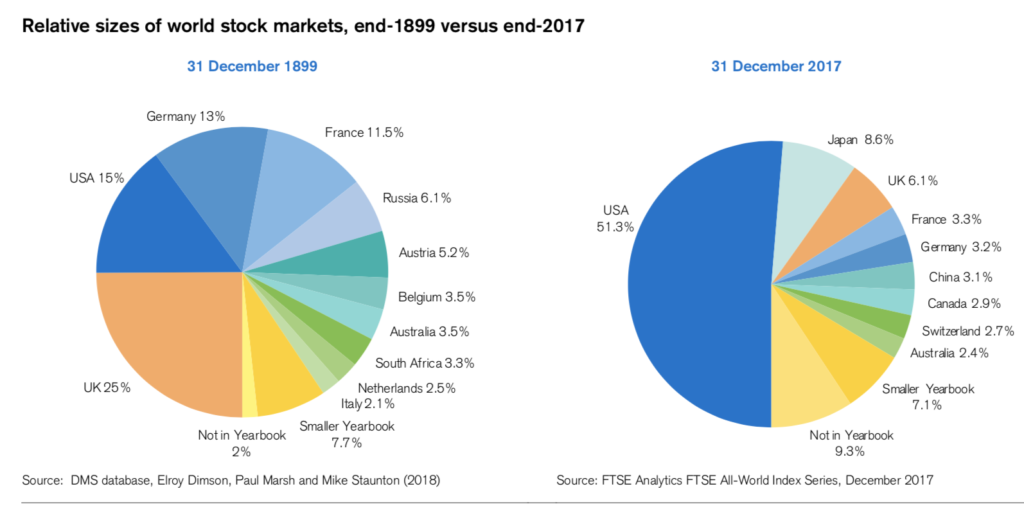

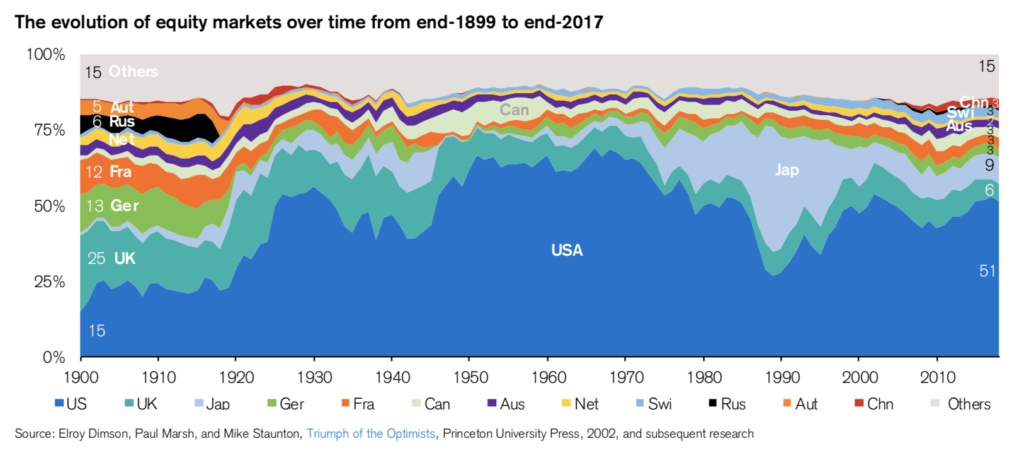

Via Credit Suisse

Meb Faber’s Idea Farm reminds us that the Credit Suisse Global Investment Returns Yearbook 2018 should be oin your reading list. It is chock full of wonderful charts and tables and notes.

Two images struck me as so very insightful and revealing.

The first is the relative sizes of world stock markets, from 1900-2017. As you can see above, the US was a mere 15% of the global pie at the start of last century; today it is over half (by capitalization). That makes me wonder if those prior levels of high U.S. returns will be sustainable for the next century.

Second, look at the ebbs and flows in the chart below, titled evolution of equity markets over time from end-1899 to end-2017. The USA has seen its global share rise and fall several times. Note how Japan ballooned up during 1990s & 90s; it became almost half of the global market cap.

The lesson for investors is three part: Be aware of your own home country bias; understand how this balance shifts over time; and hold a globally diversified portfolio.

Review your own portfolios (investment, retirement, etc.) If you find your holdings significantly overweight US stocks, consider more exposure to Emerging Markets and Developed Ex-US. You will likely reduce overall volatility, lower risk, and could actually improve your returns.

Via Credit Suisse