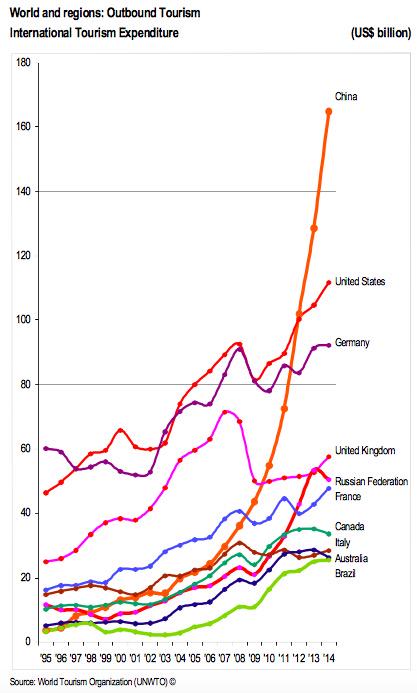

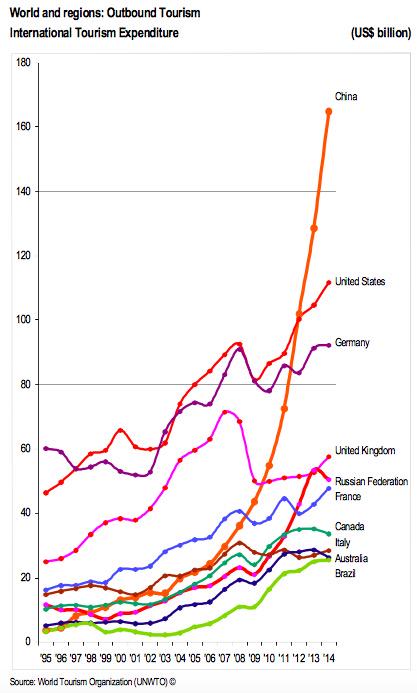

1 CHINA 2 us 3 germany 4 uk 5 russia

1 CHINA 2 us 3 germany 4 uk 5 russia

This quote is the perfect corollary to Livermore’s. Just as he preached “sitting”, letting your winners ride is the same idea. If you have on a position and it’s working, let it make you money. Don’t cut it prematurely for the sake of booking a small profit. Don’t get scared and exit on the first reaction, when all of your trading rules dictate staying in. If it’s a winner, and it’s working, then let it ride. Winners are good—embrace them.

The important flip side is how to treat losing trades. The first lesson is that losers have to be cut at some point. Otherwise, a losing trade can keep eating away at your P&L, undoing the profits from any winning positions. If you cut losses at a pre-defined level, then they stop—and presumably your wins can be larger than your losses.

The math behind this is compelling. If you assume that your average winner make 1.6x what your average loser loses, then you only need to be right 40% of the time in order to make money consistently. By keeping the leash short on your losses, then you can let the math of statistical expectation work in your favor. Cut losses and let your winners ride.

There is another aspect to this. A loser isn’t just a trade where you get stopped out at a pre-defined loss limit. Imagine a trade that isn’t making money and has just been languishing on your books—this is also a loser. Cut it, free up financial and mental capital and move on.

-According to a new Oxford University study, 55 percent of India’s population of 1.1 billion, or 645 million people, are living in poverty. Using a newly-developed index, the study found that about one-third of the world’s poor live in India.

-As measured by the new index, half of the world’s poor are in South Asia (51 percent or 844 million people) and one quarter in Africa (28 per cent or 458 million). While poverty in Africa is often highlighted, the Oxford research found that there was more acute poverty in India than many African countries combined. Poverty in eight Indian states—Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Orissa, Rajasthan, Uttar Pradesh, and West Bengal—exceeded that of the 26 poorest African countries.

–The study examined poverty across 28 Indian states, concluding that “81 percent of people are multidimensionally poor in Bihar—more than any other state. Also, poverty in Bihar and Jharkand is most intense—poor people are deprived in 60 percent of the MPI’s weighted indicators. Uttar Pradesh is the home of largest number of poor people—21 percent of India’s poor people live there. West Bengal is home to the third largest number of poor people.”

-Only 31 percent of India’s population had access to improved sanitation in 2008.

–Another study that used a household income of $US2 a day as the poverty benchmark found that India not only has more poor people than sub-Saharan Africa, but also has a higher level of poverty. In India, 75.6 percent of the population, or 828 million people, live below the poverty line as compared to 72.2 percent, or 551 million people in sub-Saharan Africa.

In the 1950’s modern bread used to cost 10 paise, 1971 – 75 paise, 1980 – Rs 1.0, Today – Rs 16. All thanks to uninterrupted deficit budgeting . The definition of poverty line is something like Rs 3500 per YEAR and 27% of the population is below it. If you take the poverty line to be something to be more realistic like Rs 3500 per MONTH – you would have 70% of our population below the poverty line.

Ride Your Winners – Never Get Out Unless the Trend Changed

Get Out When the Volatility and Momentum Become Absolutely Insane

Take Note of Intraday Chart Points

While it may sound innocent enough, hope can be the great profit-killer for traders and investors alike. Hope is a dangerous emotion because it can cause irrational thinking. Hope is the reason some traders add to losing positions — because they are convinced they are correct and hope the market will eventually vindicate them. Unfortunately, the market does not operate under these rules. When you’re trading a stock based on technical analysis, the market is always right.

Before every trade you make, you must make a pact with yourself to sell the stock if it fails to do what you anticipated. If hope sneaks into the picture, prepare yourself for larger losses.

One of intelligent honest things that Livermore did was to get out of one market by selling a related market, inducing the other traders to think that there was weakness in one market which would carry over to the related market. The art of indirection and letting people use their own intelligence and inferences to come to their own conclusion. for example if he wanted to get out of cotton, he’d sell some coffee. If he wanted to get out of a common, he’s sell the preferred or a related company that owned a big chunk of it, like sell Christiana which owned general motors et al. This technique one wonders how often is it used today. When it happens, is it artful indirection or chance? How to quantify and what predictions to be made? Would the robots be smart enough to do this?

One of intelligent honest things that Livermore did was to get out of one market by selling a related market, inducing the other traders to think that there was weakness in one market which would carry over to the related market. The art of indirection and letting people use their own intelligence and inferences to come to their own conclusion. for example if he wanted to get out of cotton, he’d sell some coffee. If he wanted to get out of a common, he’s sell the preferred or a related company that owned a big chunk of it, like sell Christiana which owned general motors et al. This technique one wonders how often is it used today. When it happens, is it artful indirection or chance? How to quantify and what predictions to be made? Would the robots be smart enough to do this?