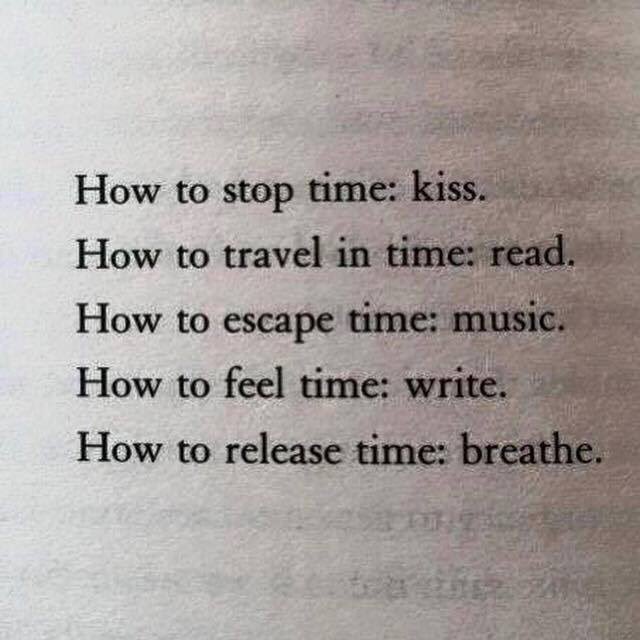

Worth Reading :

Plse refer to my most recent comments, from 24th May, and 26th April. Things are playing out nicely. This is just a ‘tactical’ update. In my cmmt of the 24th May I set out 2 possible paths for the new bear market we are in, and I want to clarify a little:

1 – 1st, the bigger strategic theme is clear and unchanged – global growth HAS peaked and the deflation trend is clear for the next 3/6mths. This is strategically bullish the USD and USTs (think 1 vs the EURO, and low 2% 10yr yields). And this is strategically BEARISH risk assets (think mid-800s S&P in 3/6mths, and the iTraxx XO index up above 750bps). The strategic asset allocation outlook STRONGLY favours QUALITY as defined by balance sheet strength, balance sheet transparency (which therefore excludes most financials), market position, AND the ability to be a price setter (not taker).

The game changers are: A) a massive turnaround in China towards new stimulus & a new credit creation binge etc – for now very unlikely IMHO; B) a massive turnaround in corporate behaviour resulting in a leverage, capex, investment, hiring & spending binge – extremely unlike for now and for the rest of this yr; C) a new US fiscal package (pretty impossible now), so the most likely and only really viable remaining option is a MASSIVE DEBASEMENT/MONETISATION move led by the Fed (but no doubt globally co-coordinated) thru the announcement of a NEW (say) USD5trn QE package, aided/abetted by maybe another USD5trn of funny money printing by the BoE, the ECB, ther BoJ, the PBOC, the SNB etc etc………HOWEVER, I don’t expect this last bullet to be used until things get REAL UGLY (see above para for levels). If u know u have only 1 bullet left in the rifle – and unless you are amazingly stupid – u don’t try to shoot the charging grizzly bear when its 50 yards away. No, you wait till its 5/10yards away…WHEN we get this final bullet out of the rifle it had BETTER not miss, as if it ‘misses’ we would then have the mother of stagflationnary busts in history where bonds get crushed due to debasement, taking risk assets out with them too. If this is the outcome – and this is really I think a late 2010/2011 story – then trust me, 2008 really will seem like the Good Old Days…..lets hope Uncle Ben not only has the rifle ready, but also that his scope is well lined up and that he has been practising hard… (more…)