While total clairvoyance as to future price movement is unrealistic. It is my goal as a trader to assimilate as much information as possible with the goal of playing out scenarios that tie in together. It’s not always easy to do, yet understanding trading does not occur in a vacuum and markets do exhibit funny things get you mentally prepared to deal with these outlier events. Those that can think for themselves and need not rely on templatized news releases for their ideas usually put themselves in a position to benefit from their forward thinking. We have heard many times about leaders who saw an industry trend before it happened. This was no accident. It came as a result of their understanding of their field and what could change it for the better. Traders who gain an understanding of how things can potentially play out and factor that into their trading strategy go a long way to keeping their objectivity when things unfold in a fast and volatile market. |

Archives of “January 3, 2019” day

rssTour Warren Buffett's office

100% You will lose Money

| You are entering a position out of EMOTIONS or ANTICIPATION at wrong price level in a WRONG scrip with GREED or HOPE with no pre-entry exit in the place – even worst, once in a trade, riding the position with HOPE without STOP LOSS even if it goes against the entry – adding more to average down in the entirely wrong trade – at last running out PATIENCES and out of FRUSTRATION booking huge LOSS. Even the position is in PORFIT there is no STOP LOSS or pre-entry EXIT in place – exiting the position abruptly in FEAR booking just a small profit with FEAR that market may take this small profit too – these random small profits unable to compensate earlier big losses! To cover big losses you try more and more RANDOM trades and above process continues – end result it challenges your EGO and creates more FEAR, more AGONY – cycle continues with small profits and big losses – until account is wiped off. |

Don’t trade for the thrill-Jesse Livermore

“The desire for constant action irrespective of underlying conditions is responsible for many losses on Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages. Remember this: When you are doing nothing, those speculators who feel they must trade day in and day out, are laying the foundation for your next venture. You will reap benefits from their mistakes.”

“The desire for constant action irrespective of underlying conditions is responsible for many losses on Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages. Remember this: When you are doing nothing, those speculators who feel they must trade day in and day out, are laying the foundation for your next venture. You will reap benefits from their mistakes.”

Once you realise the cost of trading and the benefits of being able to sit tight in a market you learn a valuable lesson.

Once you’ve learnt this lesson, you can look at all the other investors on Wall Street and realise how they are actually helping you in your quest.

They’re all trading in and out of the market, every day racking up huge commission fees and losing money. This reveals the opportunity for you to take advantage of. By sitting on your hands and waiting for the profits to roll in, by only making calculated bets.

Always trade according to the trend and according to your plan.

The desire for action will be strong but you need to resist. Because that is the gambling mindset. The professional trader mindset simply sits tight and waits for the opportunities to come to him.

Remember that when you trade, you don’t only pay a fee to your broker and a commission but you pay the spread too.

Top countries for a long, healthy life

India -Deficit fears

Daniel Tenengauzer, co-head of global emerging markets fixed income strategy and economics at BofA Merrill Lynch Global Research, is not convinced by the buzz surrounding India. ‘Compared to the rest of Asia, India is not the best story.’

Daniel Tenengauzer, co-head of global emerging markets fixed income strategy and economics at BofA Merrill Lynch Global Research, is not convinced by the buzz surrounding India. ‘Compared to the rest of Asia, India is not the best story.’

‘My problem with the Indian story is fiscal. The government spends a lot of money which has increased the country’s current account deficit. The fiscal deficit for this year is -10.6% – China’s is half of that.’

The Most Dangerous Trade -Book Review

Of all the ways to make money in the financial markets, being a short seller is one of the toughest. The short seller is fighting the upward bias of the equity markets as well as the wrath of deep-pocketed, litigious individuals with vested interests in the stocks he is targeting. He has to be both a sleuth and a promoter; after all, what good is all his detective work if other investors don’t know what he uncovered and don’t join him in putting downward pressure on the stock?

Of all the ways to make money in the financial markets, being a short seller is one of the toughest. The short seller is fighting the upward bias of the equity markets as well as the wrath of deep-pocketed, litigious individuals with vested interests in the stocks he is targeting. He has to be both a sleuth and a promoter; after all, what good is all his detective work if other investors don’t know what he uncovered and don’t join him in putting downward pressure on the stock?

In The Most Dangerous Trade: How Short Sellers Uncover Fraud, Keep Markets Honest, and Make and Lose Billions (Wiley, 2015), Richard Teitelbaum, a financial journalist, has written illuminating profiles of ten top short sellers, complete with their investing strategies. Combining interviews with well-researched back stories, he explores the highs and lows (and there are a lot of lows) of short selling.

Bill Ackman, Manuel Asensio, Jim Chanos, David Einhorn, Carson Block, Bill Fleckenstein, Doug Kass, David Tice, Paolo Pellegrini, and Marc Cohodes are the featured investors. We learn about their early years, how they ended up being short sellers, even the significance of their fund names. Why Muddy Waters, for instance? Block, trying to find a good name for his nascent firm, recalled a Chinese proverb: “Muddy waters make it easy to catch fish.”

We read about positions that worked and those that didn’t—and what these investors learned from the latter. We learn how they construct their portfolios (including long positions) and how they try to mitigate risk (sometimes with options).

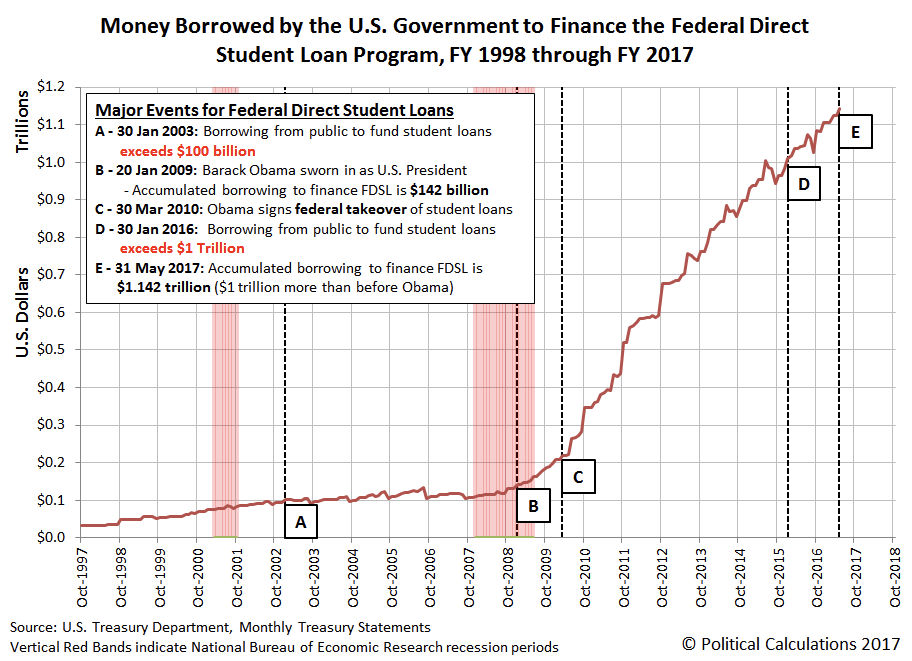

US Student Loan Explosion

Learning From Losers

Traders will typically approach a large loss in one of two ways. First is the dumb way, and that is to become a petulant whiner and throw a fit. Next is the more-constructive way, and that is to use the loss as a means of developing as a trader and to “quote” — learn from your mistakes. But there is a third way. And that is to view the loss as the cost of information.

Traders will typically approach a large loss in one of two ways. First is the dumb way, and that is to become a petulant whiner and throw a fit. Next is the more-constructive way, and that is to use the loss as a means of developing as a trader and to “quote” — learn from your mistakes. But there is a third way. And that is to view the loss as the cost of information.

I don’t mean the cost of doing business per se. This is not typically associated with large losses. Small losses, yes. Because to make money you have to lose some along the way, as casinos do every day. And not the cost of tuition where the market charges a fee to school us. No, I mean information.

Instead of asking yourself about where you placed your stops and getting all personal about the whole thing, ask yourself what happened. Why did the market move the way it did? If you haven’t suffered a capital depletion, you are not likely to demand an answer and more likely to throw off the question with a wave of the hand and a shrug. “Who knows, who cares. I only play odds.”

Markets are a beast and if you want to play with them, you’ll have to be careful. Wear protective goggles and gloves. If you want to tame them though, you’ll need to wrestle with them. And sometimes you lose some body parts along the way.

How Leeson broke the bank -Must read

It was the 1980s. Traders were young and greed was good. Nick Leeson, a working class lad from Watford, the son of a plasterer, was chuffed to land a job in the purportedly-glamorous world of the City of London in 1982.It was a relatively low-grade job, but he quickly made a name for himself. He worked his way up, becoming a whiz-kid in the hardworking atmosphere of the far eastern currency markets.

Soon, he was Barings Bank’s star Singapore trader, bringing substantial profits from the Singapore International Monetary Exchange. By 1993, a year after his arrival in Asia, Leeson had made more than £10m – about 10% of Barings’s total profit for that year.In his autobiography Rogue Trader, Leeson said the ethos at Barings was simple: “We were all driven to make profits, profits, and more profits … I was the rising star.”He and his wife Lisa enjoyed a life of luxury that the money brought.

He earned a bonus of £130,000 on his salary of £50,000

Nicholas Leesson ,the trader who brought down the Barings Bank in Februrary ,1995 ,is a made to order example of the business of not facing up to a loss ad getting out.He’s also a perfect example of the dangers of adding to a losing postioin in hopes of digging your way out.The Barings Bank was the bank that lent the United States the money to make the Louisiana Purchase.When Nicholas Lesson finished his trading for the bank ,Barings was sold for the equivalent of $ 1.40. (more…)

in Februrary ,1995 ,is a made to order example of the business of not facing up to a loss ad getting out.He’s also a perfect example of the dangers of adding to a losing postioin in hopes of digging your way out.The Barings Bank was the bank that lent the United States the money to make the Louisiana Purchase.When Nicholas Lesson finished his trading for the bank ,Barings was sold for the equivalent of $ 1.40. (more…)