Who's Buying Iran's Oil?

Here are the rules – they are not unique or new. They are time tested and successful investor approved. Like Mom’s chicken soup for a cold – the rules are the rules. If you follow them you succeed – if you don’t, you don’t.

It seems like a simple thing to do but when it comes down to it the average investor sells their winners and keeps their losers hoping they will come back to even.

You haggle, negotiate and shop extensively for the best deals on cars and flat screen televisions. However, you will pay any price for a stock because someone on television told you too. Insist on making investments when you are getting a “good deal” on it. If it isn’t – it isn’t, don’t try and come up with an excuse to justify overpaying for an investment. In the long run – overpaying will end in misery.

As much as our emotions and psychological makeup want to always hope and pray for the best – this time is never different than the past. History may not repeat exactly but it surely rhymes awfully well.

As with item number 2; there is never a rush to make an investment and there is NOTHING WRONG with sitting on cash until a good deal, a real bargain, comes along. Being patient is not only a virtue – it is a good way to keep yourself out of trouble.

Any good investment is NEVER dictated by day to day movements of the market which is merely nothing more than noise. If you have done your homework, made a good investment at a good price and have confirmed your analysis to correct – then the day to day market actions will have little, if any, bearing on the longer-term success of your investment. The only thing you achieve by watching the television from one minute to the next is increasing your blood pressure.

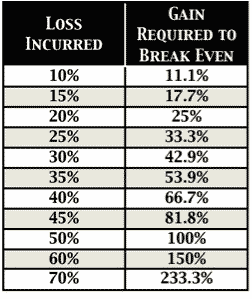

Taking RISK in an investment or strategy is not equivalent to how much money you will make. It only relates to the permanent loss of capital that will be incurred when you are wrong. Invest conservatively and grow your money over time with the LEAST amount of risk possible.

The populous is generally right in the middle of a move up in the markets but they are seldom right at major turning points. When everyone agrees on the direction of the market due to any given set of reasons – generally something else happens. However, this also cedes to points 2) and 4); in order to buy something cheap or sell something at the best price – you are generally buying when everyone is selling and selling when everyone else is buying.

These are the rules. They are simple and impossible to follow for most. However, if you can incorporate them you will succeed in your investment goals in the long run. You most likely WILL NOT outperform the markets on the way up but you will not lose as much on the way down. This is important because it is much easier to replace a lost opportunity in investing – it is impossible to replace lost capital.

As an investor, it is simply your job to step away from your “emotions” for a moment and look objectively at the market around you. Is it currently dominated by “greed” or “fear?” Your long-term returns will depend greatly not only on how you answer that question, but how you manage the inherent risk.

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham

Ever wonder what goes on behind the scenes? What kind of thinking and reasoning goes behind creating those sophisticated financial trading forumlas that create billions of dollars every year? Even more, do you wonder what kind of math wizard it takes to create these formulas?

Quants, or quantitative managers, are the math wizards and computer programmers in the engine room of our global financial system who designed the financial products that almost crashed Wall st.

The credit crunch has shown how the global financial system has become increasingly dependent on mathematical models trying to quantify human (economic) behaviour. Now the quants are at the heart of yet another technological revolution in finance: trading at the speed of light.

Below is a pretty interesting video that reveals the type of people and thinking that goes into creating these forumlas.

Making money in the financial markets is not only challenging but just surviving an account blow up is also a win for many new traders. There is one thing that ultimately determines your success in the markets. It is not your stock picking skills, your trend following or even trading a robust method. The dividing line between the winners and the losers in trading and investing is risk management. If you trade all in and risk it all over an over you will eventually blow up your account, and the funny thing is that it will likely be on your ‘can’t miss’ trade that is just way to obvious to everyone and is a crowded trade. Traders that believe have 10 losing trades in a row are impossible will discover it is very possible. Each trade should be large enough to return enough to make it worth your while, but small enough to make it inconsequential to your results in the long term. Trading small not only eliminates the financial risk of account ruin that is ever present in a market environment that is not conducive to your methodology but small risks also keep your logical brain in control of your trading and your emotions on the side lines.Nothing is more painful in my opinion than to build up an account during a great string of wins only to give it back with a string of losses in a different market environment. Small bets and staying out when he market waves get wild is a great formula to avoid big draw downs. You can still win big when you are right by letting a winner run but always lose small when you are wrong. The bet size on each trade will make or break ever trader at some point usually sooner than later. (more…)

Successful trading has absolutely nothing to do with making money and everything to do with trading successfully. Making money will only ever be a by-product of successful trading. Successful trading is not a by-product of making money. When you attach trading to money and money to emotions and emotions to money you’ll have taken your first loss but you won’t know it yet.

Successful trading has absolutely nothing to do with making money and everything to do with trading successfully. Making money will only ever be a by-product of successful trading. Successful trading is not a by-product of making money. When you attach trading to money and money to emotions and emotions to money you’ll have taken your first loss but you won’t know it yet.

Trading has everything to do with personal psychology, rules, systems, discipline, focus and skill. Like anything else that’s skill based, once you start it takes time and practice to become skilful. Ultimately trading is about making decisions between two choices, to buy or sell. As simple as these two choices are the variables that effect the decisions surrounding them can be as complex as the human mind can make them.

Correct knowledge and the ability to change behavior are the most important parts of successful trading.

Correct knowledge and the ability to change behavior are the most important parts of successful trading.