This is Great

* “Opportunity is missed by most people because it is dressed in overalls and looks like work.” – Thomas Edison. * “The scientists of today think deeply instead of clearly. One must be sane to think clearly, but one can think deeply and be quite insane.” – Nikola Tesla * “Concentrate all your thoughts upon the work at hand. The sun’s rays do not burn until brought to a focus.” – Alexander Graham Bell * “A problem well stated is a problem half-solved.” – Charles Kettering * “The best thinking has been done in solitude. The worst has been done in turmoil.” – Thomas Edison * “There is nothing in a caterpillar that tells you it’s going to be a butterfly.” – R. Buckminster Fuller * “A successful person isn’t necessarily better than her less successful peers at solving problems; her pattern-recognition facilities have just learned what problems are worth solving.” – Ray Kurzweil * “It doesn’t matter if you try and try and try again, and fail. It does matter if you try and fail, and fail to try again.” – Charles Kettering * “What we do during our working hours determines what we have; what we do in our leisure hours determines what we are.” – George Eastman * “God, to me, it seems, is a verb not a noun, proper or improper.” – R. Buckminster Fuller * “Everything comes to him who hustles while he waits.” – Thomas Edison * “When one door closes, another opens; but we often look so long and so regretfully upon the closed door that we do not see the one which has opened for us.” – Alexander Graham Bell * “We often say that the biggest job we have is to teach a newly hired employee to fail intelligently… to experiment over and over again and to keep on trying and failing until he learns what will work.” – Charles Kettering |

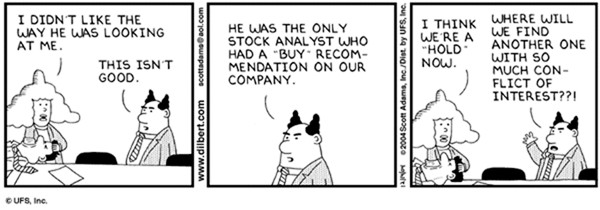

![]() 1. “The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.” Psychological mistakes are at the same time the biggest source of danger for an investor and the biggest source of opportunity when other people succumb to those mistakes. If you can keep your head about you when everyone else is losing theirs, you can profit in ways which beat the market. Howard Marks: “The absolute best buying opportunities come when asset holders are forced to sell.”

1. “The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.” Psychological mistakes are at the same time the biggest source of danger for an investor and the biggest source of opportunity when other people succumb to those mistakes. If you can keep your head about you when everyone else is losing theirs, you can profit in ways which beat the market. Howard Marks: “The absolute best buying opportunities come when asset holders are forced to sell.”

2. “Rule No. 1: Most things will prove to be cyclical. – Rule No. 2: Some of the greatest opportunities for gain and loss come when other people forget Rule No. 1.” Nothing good or bad goes on forever. And yet people extrapolate sometimes as if a phenomenon will go on indefinitely. “If something cannot go on forever it will eventually stop” famously said Herbert Stein. Situations in which mean reversion does not happen are rare enough as to make a mean reversion assumption a consistent friend to the investor.

3. “We don’t know what lies ahead in terms of the macro future. Few people if any know more than the consensus about what’s going to happen to the economy, interest rates and market aggregates. Thus, the investor’s time is better spent trying to gain a knowledge advantage regarding ‘the knowable’: industries, companies and securities. The more micro your focus, the great the likelihood you can learn things others don’t.” Focusing on the simplest possible system (an individual company) is the greatest opportunity for an investor since a company is understandable in a way which may reveal a mispriced bet. Howard Marks puts it simply: “We don’t make macro bets.”

4. “We can make excellent investment decisions on the basis of present observations, with no need to make guesses about the future.” This video has excellent material from Marks on why trying to make macroeconomic predictions is bound to fail: https://www.youtube.com/watch?v=2It1fzcBoJU If great investors like Marks, Buffett, Munger, Lynch etc. can’t make macro forecasts, do you think economists can? If you do believe they can, “Where are the economists’ yachts?” Howard Marks notes that anyone can be right “once in a row” especially when the range of possible outcomes is small.

5. “There are two essential ingredients for profit in a declining market: you have to have a view on intrinsic value, and you have to hold that view strongly enough to be able to hang in and buy even as price declines suggest that you’re wrong. Oh yes, there’s a third; you have to be right.” Being a contrarian for its own sake is suicidal. Not being a contrarian at all means by definition you can’t outperform the market. Being genuinely contrarian means you are going to be uncomfortable sometimes. Howard Marks adds: “To achieve superior investment results, your insight into value has to be superior. Thus you must learn things others don’t, see things differently or do a better job of analyzing them – ideally all three.” (more…)