You have to love trading to do the work that takes you over the hump to winning.

Successful traders are not born, they are built through hard work and discipline.

Trading is not complicated, discipline, perseverance, risk management, passion, and a winning method that fits your personality is all you need. If you have them you will win, if you are missing one you lose.

Where you are currently as a trader is not where you have to stay, the right homework done with an open mind can move you into a different place.

Trading skill is built through work ethic.

You must dedicate yourself to winning at trading. Every day you improve by working at it. (more…)

Archives of “January 2, 2019” day

rssSteven Drobny, The Invisible Hands (Book Review )

In his preface to the new edition of The Invisible Hands: Top Hedge Fund Traders on Bubbles, Crashes, and Real Money (Wiley, 2014) Steven Drobny contends that “real money investors rem

ain stuck in their antiquated ways. They will view their investments from a notional allocation standpoint, and diversify their holdings by asset class names, not by underlying risk characteristics.” Investors are unprepared for another crisis, despite the fact that “quantitative easing is coming to an end, and tremendous uncertainty exists everywhere.” Hence the renewed timeliness of the interviews, conducted in the spring of 2009, with traders who managed to navigate the financial crisis of 2008.

With the exception of Jim Leitner, who was also interviewed for Drobny’s Inside the House of Money, the managers—ten who run global macro hedge funds and one real money manager—remain anonymous. Drobny “chose the anonymous route to increase candor as well as keep the focus on the ideas as opposed to the personalities.” (p. xxx)

The Invisible Hands is a terrific book even though many of the strategies described in it are difficult if not impossible for the individual investor to implement. But the thinking behind these strategies and the way their risk is managed are often so compelling that everyone who is active in the markets can learn a tremendous amount from the interviews. Moreover, even though most of the contributors are anonymous their life stories are fascinating, sometimes even inspiring. (more…)

Negative NEWS ?

Traders are going to be greeted with more EUR negative headlines when they sit down at their trading desks. Nothing new here but it’s bound to weigh on early trading sentiment.

Traders are going to be greeted with more EUR negative headlines when they sit down at their trading desks. Nothing new here but it’s bound to weigh on early trading sentiment.

Updated at 10:21/18th MAY/Baroda

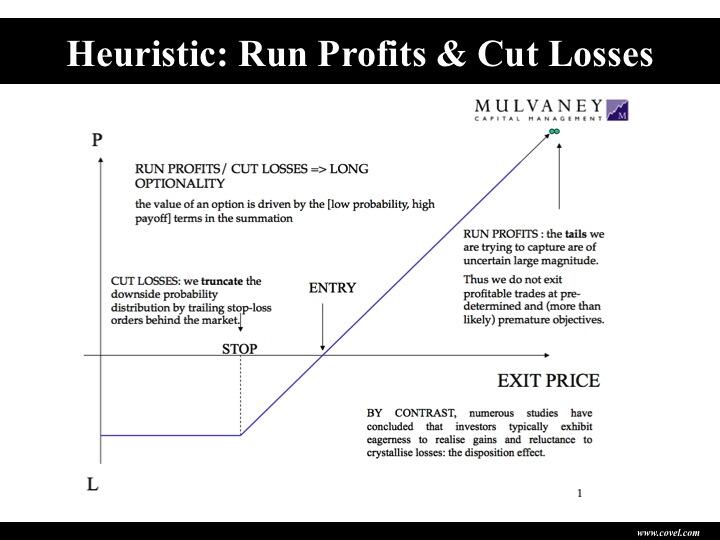

Ride winners, cut losers. Nice visual

The 10 Commandments

1. Thou shall not go against the trend.

If it be down, let it be down. The market is bigger and stronger than you.

Follow the market but be one step ahead of the crowd.

2. Thou shall not follow the herd instinct

Just because many people are buying a certain stock does not mean you should follow suit. If people want to buy rubbish stocks, that is their bad luck. Don’t make it yours.

3. Thou shall treat the market as a business, not a casino

The stock market is not meant to be a casino and you should not be there to gamble.

4.Thou shall not buy high-debted and no-earnings stocks

All companies that folded are highly geared with negative earnings. Don’t buy rubbish shares; don’t buy somebody’s liabilities.

5. Thou shall only buy solvent companies with good-growth prospects

Present earnings are important, but future earnings are more important. That’s why we have companies selling at high PER (Price earnings ratios).

6. Thou shall not be overconfident

Overconfidence leads to overtrading. Once you overtrade, you may not be able to control your own emotion. Fear may set in when the market is not going the way you expect it. It may disrupt your plan, turning your profitable trade into a loss.

7. Thou shall invest within the comfort zone

Don’t be too greedy; don’t play with borrowed money. Debt is a disease. It can cause you a lot of problem if you are not careful.

8. Thou shall be patient

The market is designed to transfer money from the impatient to the patient. You must have very good reasons before you switch counters. Very often, the shares you sell move up faster than the shares you buy.

9. Thou shall be disciplined

Don’t change your strategy at the eleventh hour. If you have placed a stop-loss in your chart, don’t remove it unless it is replaced with a trailing stop-loss.

10. Thou shall be knowledgable

Investment in knowledge pays the best dividend. No one is so skillful that he cannot better his best. Keep learning for knowledge is boundless

"The journey of a thousand miles begins with one step." – Lao Tzu

In post-Soviet Moscow, pancakes serve you

Three Tips to Better Handle Losses

It is very unlikely that a medication is going to help you feel better about a trading loss. There is no simple fix to the emotional problem of losses. No one likes to lose money, and a loss can be very painful. But, being able to take losses is also a part of the trader’s job description. One of our tasks as traders is to take losses as a routine function of the trading role.

It is very unlikely that a medication is going to help you feel better about a trading loss. There is no simple fix to the emotional problem of losses. No one likes to lose money, and a loss can be very painful. But, being able to take losses is also a part of the trader’s job description. One of our tasks as traders is to take losses as a routine function of the trading role.

To help make losses more of a routine event rather than an event that throws us into emotional turmoil, here are three key tips to help you better handle losses:

1. Have a trading edge. Define your setups well and be sure they have an edge. By an edge I mean that these setups have a certain probability of winning over a large number of trades. In other words, based on your experience or historical testing, your trade setup should possess a positive expectancy that over, say, 100 trades some percentage (e.g., 67%) will be winners and produce a sufficient profit over loss to make the trade worthwhile. If you don’t have a trading edge, you are likely trading random patterns and you are likely to have many, many losses. (more…)

Good trading is usually just a waiting game

Quotes From Legendary Traders

“I absolutely believe that price movement patterns are being repeated; they are recurring patterns that appear over and over. This is because the stocks were being driven by humans- and human nature never changes”.

“I absolutely believe that price movement patterns are being repeated; they are recurring patterns that appear over and over. This is because the stocks were being driven by humans- and human nature never changes”.

-Jesse Livermore (Considered by many to be the greatest stock market operator ever. Made 100 million dollars in 1929 stock market crash. Made several other multi-million dollar fortunes in his trading career).

————————————————————————————————————

“You have to cut your losses fast. The secret for winning in the stock market does not include being right all the time. The key is to lose the least amount possible when you are wrong”.

-William J. O’Neil (In my opinion, the best stock market operator in the world today. Has made an incredible fortune trading the stock market. O’Neil is the founder of Investors Business Daily. Much of my stock market education and training has been from William J. O’Neil).

————————————————————————————————————

“Whatever method you use to enter a trade, the most critical thing is that if there is a major trend, your approach should assure that you get in that trend”.

-Richard Dennis (Turned 400 dollars into a fortune of at least 200 million dollars by using his remarkable trading skills).

———————————————————————————————————–

“I am primarily a trend trader. In order of importance to me are: (1) the long-term trend, (2) the current chart pattern, and (3) picking a good spot to buy or sell”.

-Ed Seykota (One of the greatest traders of all time. Turned 5000 dollars into an incredible 15 million dollars or more).

———————————————————————————————————–

“The most important rule of trading is to play great defense”.

-Paul Tudor Jones (An amazingly consistent and successful trader. In 2006, earned a whopping 750 million dollars).

———————————————————————————————————–

“Being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong”.

-Bernard Baruch (Fantastic trader who earned ten’s of millions of dollars in the first part of the 20th century).

———————————————————————————————————–

“The greatest safety lies in putting all your eggs in one basket and watching that basket”.

-Gerald M. Loeb (Amassed many millions in the stock market during his long career).

——————————————————————————————————– (more…)