| The Biggest source of agony and frustration in trading comes from our expectations of what a market should or should not do !Agony becomes intense when we fail to act to correct our orignal assumption of our market expectations ! |

Archives of “January 2019” month

rssForint Slide Accelerates As Hungarian Default Risk Now 14 Wider To 277bps

Poor, poor Europe. Every room one shines a light in, the cockroaches don’t even bother to scurry to safety any more. Yet what is glaringly obvious takes a media-reported soundbite to awake people. So is the case with Hungary today. After opening 7 tighter, Hungarian CDS are now 14 bps wider to 277bps. As the attached chart shows, the Hungarian Forint is now in freefall. Yet if investors are concerned about Hungary, they should take a look at some of its less lucky Eastern European neighbors which, just like Hungary, have been considered to be strong for so long.

11 Rules For Better Trading

Trading in the markets is a process, and there is always room for self improvement. So as we start the new year, here are my 11 rules that help me navigate the markets. By no means is this list exhaustive or exclusive.

Trading in the markets is a process, and there is always room for self improvement. So as we start the new year, here are my 11 rules that help me navigate the markets. By no means is this list exhaustive or exclusive.

Rule #1

Be data centric in your approach. Take the time and make the effort to understand what works and what doesn’t. Trading decisions should be objective and based upon the data.

Rule #2

Be disciplined. The data should guide you in your decisions. This is the only way to navigate a potentially hostile and fearful environment.

Rule #3

Be flexible. At first glance this would seem to contradict Rule #2; however, I recognize that markets change and that trading strategies cannot account for every conceivable factor. Giving yourself some wiggle room or discretion is ok, but I would not stray too far from the data or your strategies.

Rule #4

Always question the prevailing dogma. The markets love dogma. “Prices are above the 50 day moving average”, “prices are breaking out”, and “don’t fight the Fed” are some of the most often heard sayings. But what do they really mean for prices? Make your own observations and define your own rules. See Rule #1.

Rule #5

Understand your market edge. My edge is my ability to use my computer to define the price action. I level the playing field by trading markets and not companies.

Rule #6

Money management. Money management. Money management. It is so important that it is worth saying three times. There are so few factors you can control in the markets, but this is one of them. Learn to exploit it.

Rule #7

Time frame. Know the time frame you are operating on. Don’t let a trade turn into an investment and don’t trade yourself out of an investment. (more…)

10 Habits of Successful Traders

1. Follow the Rule of Three. The rule of three simply states that a trade will not be made unless you can carefully articulate three reasons for doing so. This eliminates trading from an indicator alone.

1. Follow the Rule of Three. The rule of three simply states that a trade will not be made unless you can carefully articulate three reasons for doing so. This eliminates trading from an indicator alone.

2. Keep Losses Small. It is vitally important to keep losses small as most all of large losses began as small ones, and large losses can put an end to your trading career.

3. Adjust Stops. When a trade is working move your stop loss up in order to lock in gains.

4. Keep Commissions Low. There is a cost to trading but there is no reason to overpay brokerage fees. A discount brokerage is just as good as a premium brand name one.

5. Amateurs at the Open, Pros at the Close. The best time to enter trades are after lunch when the professionals are looking to get in at a better price than one provided in the morning.

6. Know the General Market Trend. When trading individual stocks make sure you trade with the general market trend or condition, not against it.

7. Write Down Every Trade. Doing this will allow you to learn what is working and what is not. It will also help you determine what types of trades work best for your personality.

8. Never Average Down a Losing Position. It is a loser’s game when you add to a loser. You add to winning positions because they are winners and are proving themselves to be such.

9. Never Overtrade. Overtrading is a direct result of not following a well thought out plan, deciding it is best to trade off emotion instead. This will do nothing but cause frustration and a loss of money.

10. Give 10 Percent Away. Money works the fastest when it is divided. When we share we prime the economic pump of the universe.

Trading is a game of rules. We either make the decision to abide by them or we break them. We do the latter at our own peril.

Patience is the Key to Success not speed.Time is a Cunning Speculator's best friend if he uses it right

An Anomaly about Top Performance Traders

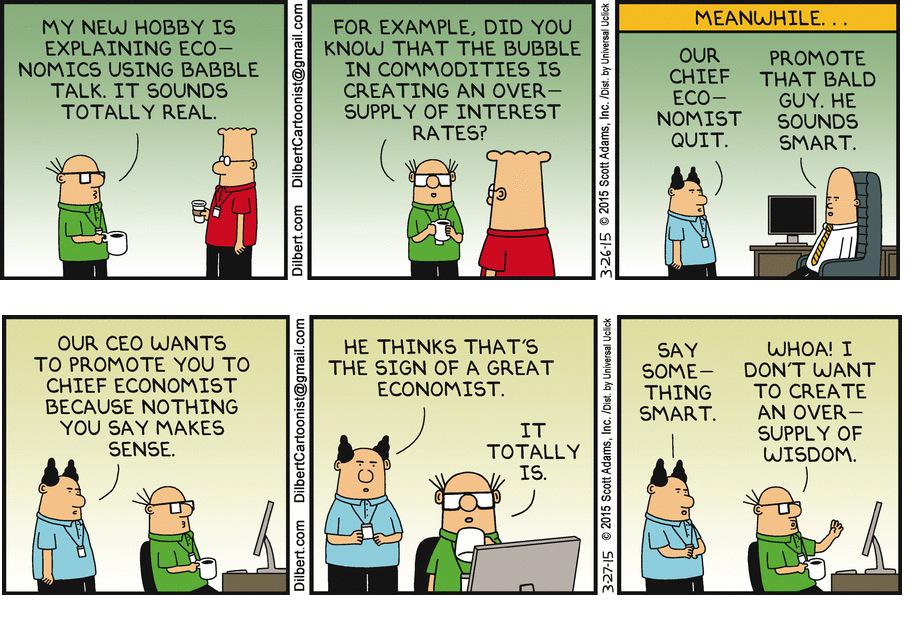

Indian Economists ..This way They Working ?

Investment Banker

People Nowadays

Characteristics of Bear Market

- Sellers are in control

- Oversold often stays oversold for a long time

- Markets drop a lot faster than they go up

- Bear markets burn and churn accounts with long only exposure

- Volume and liquidity can dry up but price can still drop significantly

- ‘Cheap’ can get a lot ‘cheaper’

- Hope is slowly destroyed

- Vicious bear market rallies try to suck in traders to trap them

- Expect lots of gaps to the downside

- It takes a long time until market participants throw in the towel

This is appropriate trading behaviour during bear markets:

- Either in cash or short

- Sell the rallies mentality

- Do NOT buy the dips

- Do not even think about going long if you are not an active and experienced trader