In trading, we can all agree that fewer conditions or filters results in better conclusions, better understanding, and less curve fitting. Conditions or filters block information. Too filters can result in less new insight and fewer opportunities. Here is where trading is a good lesson for life. As we grow older our tendency is to filter out information, people, paths. It’s partly a necessity to avoid the bad or overload, but good things can be missed. Our experience tends to specialize our knowledge and narrow our focus. Though this has some benefit in expertise what opportunities or knowledge or growth may be missed. Ignoring, filtering or refusing to hear or listen to ideas we disagree with or that are different than our own may lead to narrow mindedness, missed opportunity to change and important information. For younger people it might be seen as closing doors. Meeting new people, hearing new ideas, going to new places. Nobel laureates advise not to tighten parameters too tightly as the surprise result may reveal itself. I recommend opening up parameters, let the fresh air in. Let’s not become grumpy old men. We’ve seen closed small minded people and don’t look on them with respect. Broad vision is necessary to see above and beyond the noise. You really need to force yourself against the tendency to close the mind. |

Archives of “January 2019” month

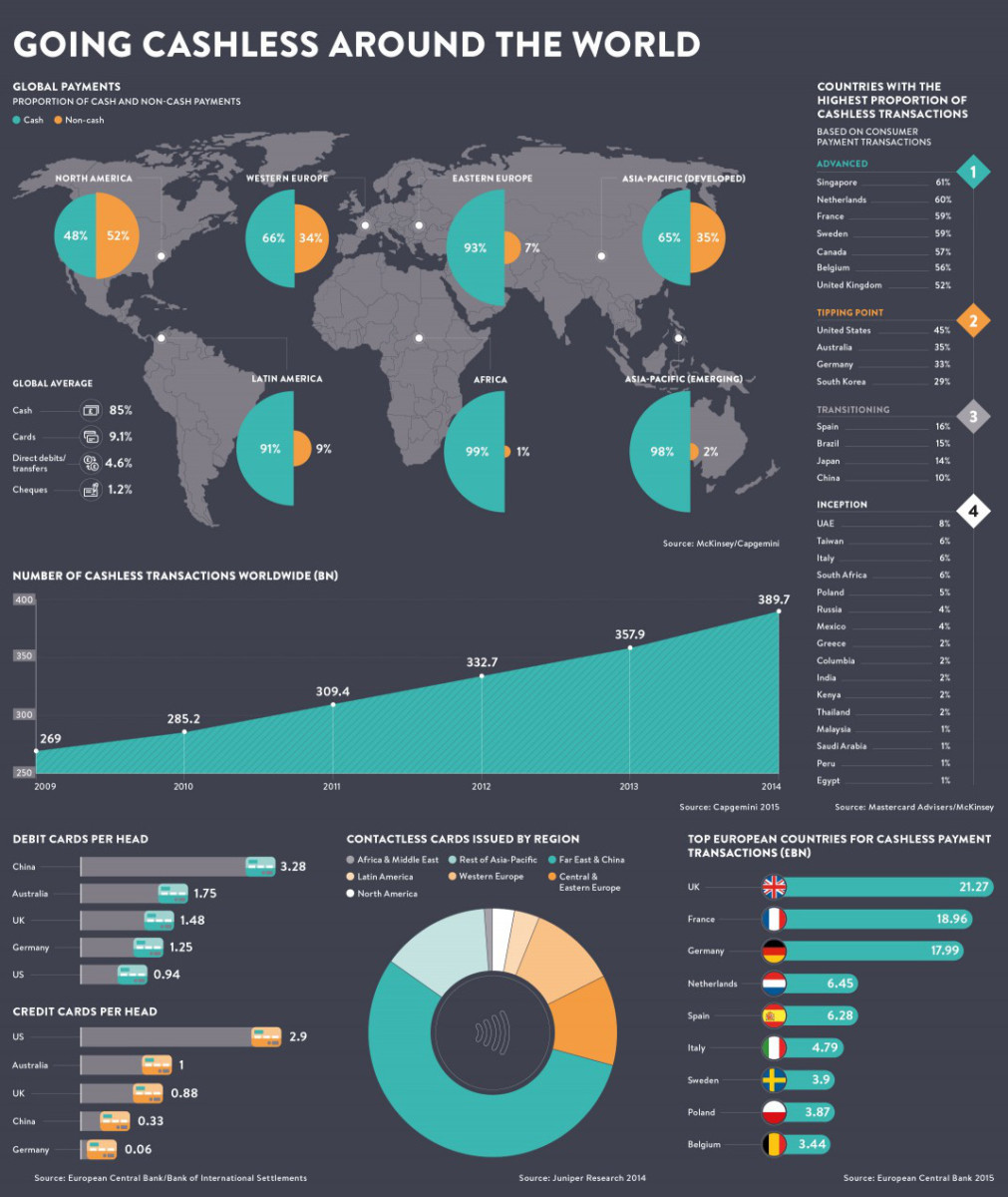

rssGoing Cashless Around the World

Manifesto For 2015

Manifesto For 2015

Government has no right to confer economic benefit.

The benevolence of individuals, not government, creates a just community.

Rich and poor share responsibility to build society.

The greatest philosophy of governance is the balance of executive, legislative and judicial authority.

Civility is a worthy goal.

Government is incompetent in most areas in which it is currently active.

Theocracy kills.

Our challenges are planetary.

Humans are lonely without animals.

Glorifying thugs is civil suicide.

Union members are not the only people who work.

Be circumspect in speech, for sowing wind reaps the whirlwind.

Propaganda attacks reason.

Wealth is a great good.

Benevolence is a great good.

Achievement is a great good.

The family is a great good.

Friendship is a great good.

Think & Act ………

Excellence Is A Drive From "Inside"

A gentleman was once visiting a temple under construction. In the temple premises, he saw a sculptor making an idol of God. Suddenly he saw, just a few meters away, another identical idol was lying.

A gentleman was once visiting a temple under construction. In the temple premises, he saw a sculptor making an idol of God. Suddenly he saw, just a few meters away, another identical idol was lying.

Surprised he asked the sculptor, “Do you need two statutes of the same idol”. “No” said the sculptor. “We need only one, but the first one got damaged at the last stage”. The gentleman examined the sculptor. No apparent damage was visible.

“Where is the damage” asked the gentleman.

“There is a scratch on the nose of the idol. Where are you going to keep the idol”.

“The sculptor replied that it will be installed on a pillar 20 feet high. When the idol will be 20 feet away from the eyes of the beholder, who is going to know that there is scratch on the nose?” The gentleman asked.

“The sculptor looked at the gentleman, smiled and said “God knows it and I know it “.

The desire to excel should be exclusive of the fact whether someone appreciates it or not. Excellence is a drive from “Inside” not “Outside“.

Fibonacci humor…

There are no shortcuts in life. Secret? Work hard, slow & steady wins race. Be humble. Avoid envy/jealousy

How to Work Better

False Beliefs About Trading the Markets

1) What goes up must come down and vice versa.

That’s Newton’s law, not the law of trading. And even if the market does eventully self-correct, you have no idea when it will happen. In short, there’s no point blowing up your account fighthing the tape.

2) You have to be smart to make money.

No, what you have to be is disciplined. If you want to be smart, write a book or teach at a university. If you want to make money, listen to what the market is telling you and trade to make money — not to be “right.”

3) Making money is hard.

Nope. Sorry. Making money is actually easy. Statistically, you’re going to do it about half the time. Keeping it, now that’s the hard part. (more…)

Mind

People lose money in the markets because the person who places the trade very often is not the same person who manages and closes the trade. Quite literally another self has taken over–another mind

People lose money in the markets because the person who places the trade very often is not the same person who manages and closes the trade. Quite literally another self has taken over–another mind