If you call yourself a "hunter" and wanna hunt a lion…. do it with your bare hands. Make it a fair fight.

Soros: “The Myth”

Soros’ “The Alchemy of Finance” is a seminal investment book… it should be read, underlined, and thought out page-by-page, concept-by-idea. He’s the best pure investor ever… probably the finest analyst of the world in our time.”

-Barton Biggs

Soros: “The Reality”

“My father will sit down and give you theories to explain why he does this or that. But I remember seeing it as a kid and thinking, Jesus Christ, at least half of this is B.S., I mean, you know the reason he changes his position in the market or whatever is because his back starts killing him. It has nothing to do with reason. He literally goes into a spasm, and it’s his early warning sign.”

-George Soros’ son, Robert

George Soros on Himself

“My approach works not by making valid predictions but by allowing me to correct false ones.”

-George Soros

Soros and Exits

“When George is wrong, he gets the hell out. He doesn’t say, ‘I’m right, they’re wrong.’ He says, ‘I’m wrong,’ and he gets out, because if you have a bad position on, it eats you away. All you do is think about it — at night, at your home. It consumes you. Your eye is off the ball completely. This is a tough business. If it were easy, meter maids would be doing it.”

– Alan Raphael (Ex-Soros CIO)

As most experienced traders will tell you, the most difficult thing about trading well is that you’ve got to learn for yourself how to stop protecting your ego and readily own up to mistakes quickly before they do significant and lasting real damage. No matter how hard you try, you will never be able to entirely separate your ego away from your trading. Those who tell you that you can, are, in my view, just wrong and have little understanding about how to trade well. As long as you are human, you are going to trade with both emotion and ego, but the better traders among us simply learn how to work with both in ways that limit their negative influence. |

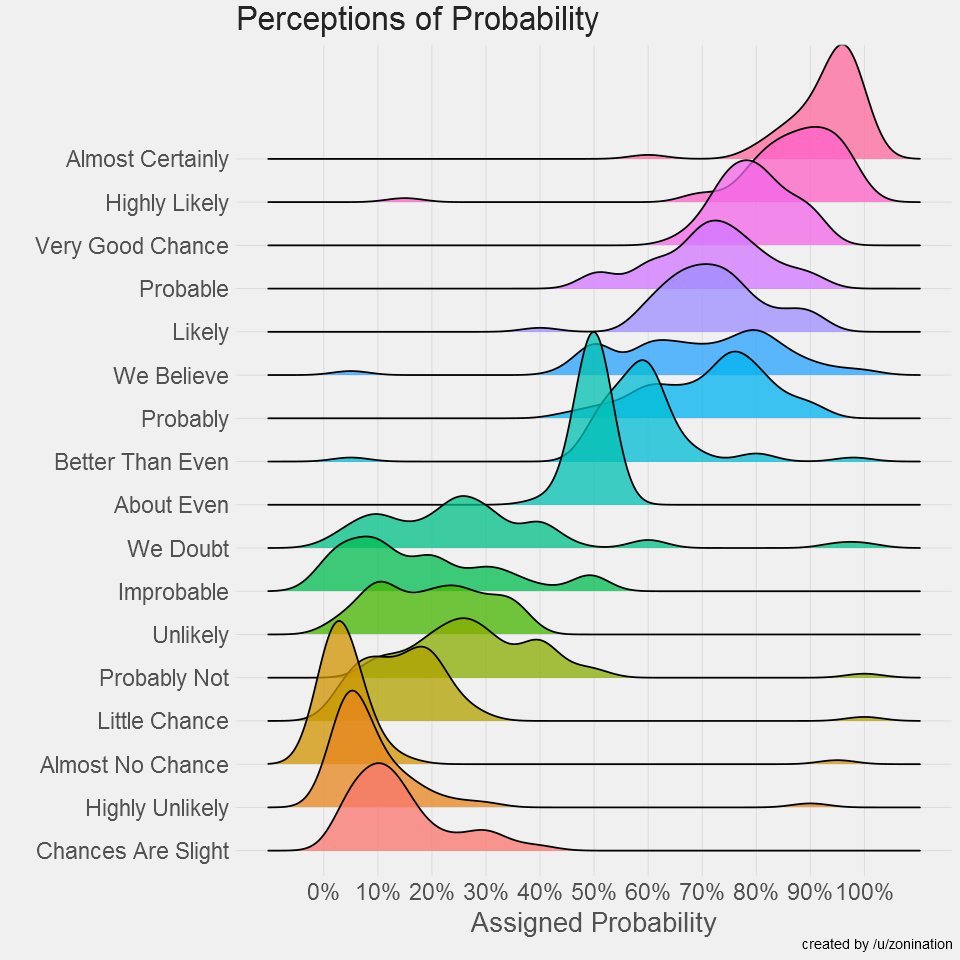

In order to understand behavioral finance and crowd behavior on the capital market, first of all we need to understand the factors that influence the trader mindset. Traders are “misled” by many things. Let us put these factors in two main categories, depending simply on their source, external or internal.

In order to understand behavioral finance and crowd behavior on the capital market, first of all we need to understand the factors that influence the trader mindset. Traders are “misled” by many things. Let us put these factors in two main categories, depending simply on their source, external or internal.

The most important external factor is “everyone else”, the trading crowd, the general opinion. We form an opinion about the others. We believe them to be either smart or stupid, either right or wrong, then choose one of the two main psychological trading strategies: “go along to get along” or be a contrarian. Then we have other external factors like payoffs, scale, psychological and academic background, social structure, external advisory and resources. (more…)

Let’s face it, no matter the outcome of a trade-lose, win, draw, and even the miss-traders are rarely satisfied with the result. This is exactly why it is so important that we utilize the two most powerful words in a stock trader’s vocabulary..and no… it does not involve four letters! The following is a list that you can use these two words with. You will get my point. Of course you can add to it if you like.

I missed the trade…SO WHAT!

This trade did not work…SO WHAT!

I excited a profitable trade too early…SO WHAT!

I excited with a loss too quickly…SO WHAT!

My stock gapped against me…SO WHAT!

The stock recovered without me…SO WHAT!

A stock I was bullish on was downgraded by an ANALyst…SO WHAT!

A stock I was bearish on was upgraded by an ANALyst…SO WHAT!

The market is not trending…SO WHAT!

The market is consolidating…SO WHAT!

The market is breaking support…SO WHAT!

The market is busting out of resistance…SO WHAT!

The economy stinks but the market is going higher…SO WHAT!