Think High ,Think Big

I admit I have difficulties separating myself from the monkeys.

I admit I have difficulties separating myself from the monkeys.

During trading strategy development, most of the time I have found that a ‘good’ strategy by many criteria can’t actually beat out the performance of the random trades by monkeys. So the question is what constitutes intelligence? Is performance the sole criterion that separates intelligence from non-intelligence? If not, what else? What can make me say, “ok monkeys, I can’t beat you in performance, but this thing makes me much more intelligent than you”?

Et voila la difference.

No joke.

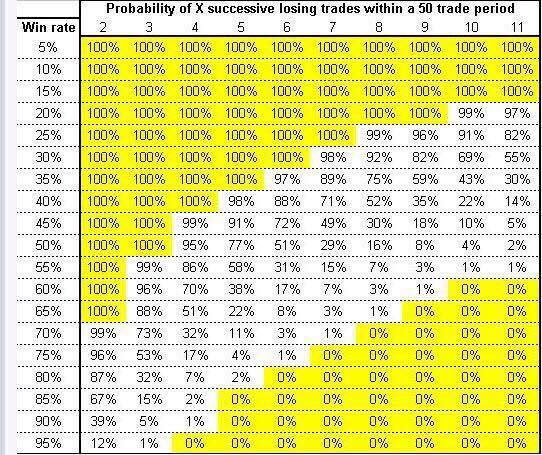

You look for an “edge,” i.e. an asymptotic probability weighted mean that is > 0. (more…)

In the markets there are many different types of traders and many motivations that drive them. Everyone has heard of different types of traders based on their trading method: Swing Traders, Day Traders, Momentum Traders, etc. But what about different types of traders based on their psychology, their very purpose? Some trade for fun and excitement, others trade purely for ego. Other love the game and still others are in it only to make money. In the greatest game on earth it is surprising that many traders have different motivations, in reality the only correct motivation is to make money, that should be the real goal of any trader. Here are a list of ten types of traders I have observed on social media. We have all likely been more than one of these types at some time or another while trading. But we need to focus like a laser on the only real reason we should be trading: to make money and once we have made it, to keep it.

Which are you?

Consider this excerpt:

Benjamin Graham, who believed in buying wonderful companies at a fair price rather than a fair company at a wonderful price, defines an investor as “an individual whose investment provides two quantitative qualities – safety of principal and an adequate rate of return.” There are many intricacies within business ownership investments, but does everyone in the stock market consider these particulars when investing in business ownership? Of course not, because not everybody in the stock market is an investor. Individuals who desire to become investors must enter the arena with goals that have a long-term investment horizon. Warren Buffett, a global financial market guru and head of Berkshire-Hathaway, puts it best when he says: “It’s bad to go to bed at night thinking about the price of a stock. We think about the value of a company and the company results; the stock market is there to serve you, not instruct you.”Hence, an investor does not buy a price and will not be affected by the ups and downs of the market. A sound investor buys well-managed businesses, with strong earnings growth and significant barriers to entry that will provide long-term security. A ‘purchaser of price’ is a speculator; a ‘purchaser of solid businesses’ with sound fundamentals is an investor.

Mark Croskery

It is my conclusion that playing the market is partly an art form, it is not just pure reason. If it were pure reason, then somebody would have figured it out long ago. That’s why I believe every speculator must analyze his own emotions to find out just what stress level he can endure. Every speculator is different, every human psyche is unique, every personality exclusive to an individual. Learn your own emotional limits before attempting to speculate, that is my advice to any one who has ever asked me what makes a successful speculator. If you can’t sleep at night, because of your stock market position than you have gone too far, if this is the case then sell your position down to the sleeping level.

On the other hand, I believe everyone who is intelligent, conscientious and willing to put in the necessary time, can be successful on Wall Street. As long as they realize the market is a business like any other business – they have a good chance to prosper.

10) Those who are willing can be taught almost anything.

9) Great people want to help others achieve great success.

8) Success in business requires tremendous concentration. Outside distractions must be avoided.

7) Sometimes it is best to leave politics to politicians.

6) Everyone fails at some point in his life. The true winners rebuild after their failures.

5) To put on a trade when everything is going against you requires character and commitment.

4) Rules are rules. Stick to them.

3) Adapt with the times. Be willing to be malleable.

2) Always leave yourself outs. Never commit everything to one position or to one person.

And the number one lesson:

1) The market is bigger, stronger and badder than you. Always respect it for the beast it is.