Archives of “January 15, 2019” day

rssOptions Market Stages

The journey of a trader

A thought for today…and all days

Where Are You Placing Your Bet?

Some love risk. Others avoid it till the grave. Whether you take it head on or run in the other direction it will always catch you. Risk cannot be avoided so you better know how to put the odds in your favor. Consider the following:

You want to see life as a continuum running on a loop back and forth from risk to reward. If you want a big reward, take a big risk. If you want an average reward and an average life, take an average risk. Easier said than done, however, if you want the big reward. Our system is notorious for playing Whac-A-Mole with achievers.

From an early age, people are conditioned by families, schools, and virtually every other shaping force in society to avoid risk. To take risks is inadvisable; to play it safe is the message. Risk can only be bad. However, winners understand risk is highly productive, and not something to avoid. Taking calculated risks is different from acting rashly. Playing it safe is the true danger. Far more often than you might realize, the real risk in life turns out to be the refusal to take a risk.2 If life is a game of risk, then to one degree or another, being comfortable with assessing odds is the only option for a fulfilling life.

Consider trading from a “startup” business perspective. Every business is ultimately involved in assessing risk. Putting capital to work to make it grow is the goal. In that sense, all business is the same. The right decisions lead to success, and wrong ones lead to insolvency. Blunt, but true. There are ways to go in the right direction, however. Ask yourself these questions:

- What is the market opportunity in the market niche?

- What is your solution to the market need?

- How big is the opportunity?

- How do you make money?

- How do you reach the market and sell?

- What is the competition?

- How are you better?

- How will you execute and manage your business?

- What are your risks?

- Why will you succeed? (more…)

7 Stages of Trading Wisdom

1) You feel no pressure to do anything 2) You have no feeling of fear 3) You feel no sense of rejection 4) There is no right or wrong 5) You recognize that this is what the market is telling me, this is what I do. 6) You can observe the market from the perspective as if you were not in a position, even when you are. 7) You are not focused on the money, but on the structure of the market |

31 Precepts for Traders

These precepts are trading and investing guidelines that give a compass heading to trading integrity.

I offer them to you in their raw form. Some may make sense, others not. Please feel free to question, challenge, refine and edit with your responses.

- We are who we are and we start from where we start

- Each of us brings unique strengths to the markets

- Every morning we agree to play as delighted beginners

- Reality Pays. The more our minds model the market, the more in synch we get

- We build on our strengths and manage everything else.

- The outcome we have is the outcome we want

- If what you are doing isn’t working over and over again, re-examine your internal models

- Our internal process is more important than anything else because it drives everything else

- You have the resources to improve your mental trading game. Coaching just helps find them

- We begin our trading practice slowly and build it with flow and grace

- Lean into fear. Fear is a primary cause of failure

- If you are frustrated with the markets, that means they aren’t following the internal model you have projected on them

- We increase the level of our awareness rather than the intensity of trading

- As we expand our awareness, our interventions will happen sooner and be more creative and effective

- We respect ourselves and celebrate our profits no matter how large

- If we can experience a new behavior for a moment, we can experience it for a minute, an hour, a week, a year.

- Change happens when we experience a new behavior that is aligned with who we are, feels emotionally satisfying in the moment and takes us to where we want to go

- Avoidance is buying pain on credit with interest

- If self-criticism made us trade better we would all be rich

- We allow the markets to breathe through us

- The markets are messy, our information is imperfect, our systems will fail and we can still make money

- All trading systems are successful in some markets, all trading systems will eventually fail in all markets

- The markets don’t care about you or your position

- We seek the practice rather than the result

- Learn about yourself with the delight of an anthropologist finding a lost tribe

- We make internal maps of the market, but our maps are always distorted

- Our negative responses are created by our maps, not the market

- By changing our map, we change how we respond to the markets

- All our trading errors have an ultimate positive purpose or intention

- There is no “failure” just feedback

- You have all the resources you need, although some may be out of your awareness

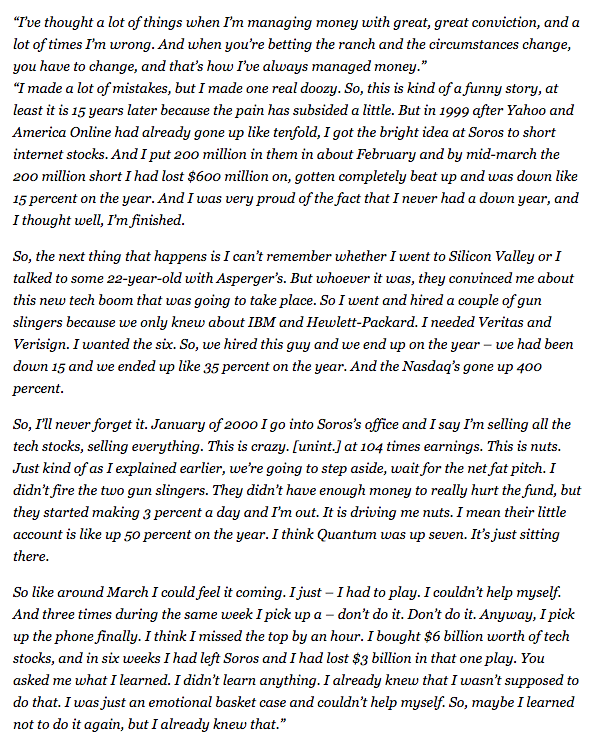

This is an old well-known Druckenmiller story, perhaps the most valuable one. Worth keeping in circulation