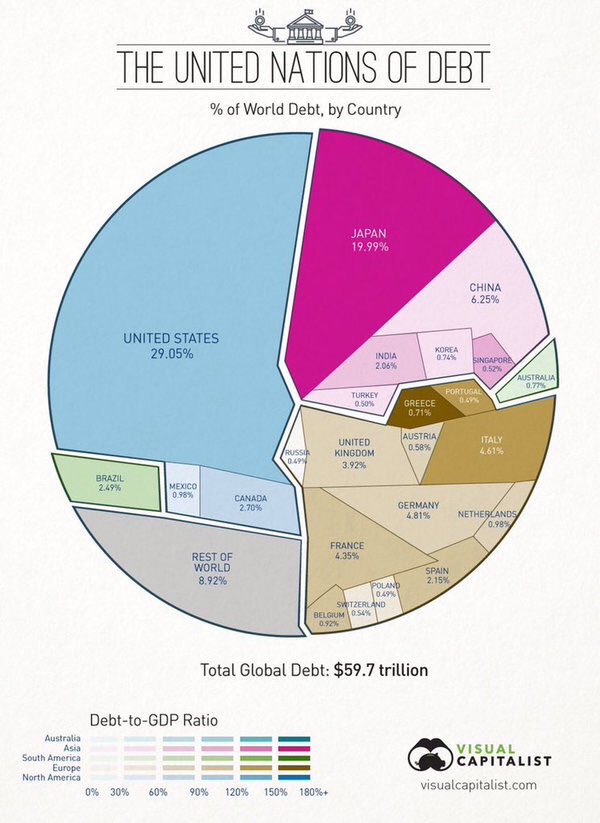

World debt, by country

Bridgewater founder with ‘radically transparent’ approach to investing has the last laugh

Almost 40 years ago, a young Harvard graduate called Ray Dalio was trading futures at a brokerage called Shearson Hayden Stone. His boss was one Sandy Weill, who would go on to become famous as chairman and chief executive of Citigroup.

It was a promising start in finance. But the promise did not last long: Wall Street legend has it that after just a year in the job Dalio was sacked for taking a stripper to a client presentation.

Such a debut could have led to the rookie drifting off into obscurity – or just as easily have been the beginning of prolonged fame. Yet neither happened.

Instead, the son of a jazz musician sloped off and founded his own hedge fund, Bridgewater, from a two-bedroom apartment. It took three decades operating out of Westport, Connecticut before people outside the sector started to talk about Dalio once again.

The credit crisis was the trigger that propelled the money manager’s name back into Wall Street conversation, after providing him with the platform to outshine rivals and reap massive rewards.

This week the 62-year-old’s fortune was put at $10bn (£6.3bn) in Forbes’s latest list of billionaires. Last month he was lauded as the most successful hedge fund manager in history, after new rankings compiled by LCH Investments showed the $13.8bn that his Bridgewater Pure Alpha fund made in 2011 had propelled Dalio past the grandaddy of hedge fund investing, George Soros, in terms of returns to investors. (more…)

People lose money at the stock market for very simple reasons:

People lose money at the stock market for very simple reasons:

1. They don’t have a method at all. They rely on other people opinions.

2. People don’t have a winning method. The method they are trading has a negative expectancy. Being disciplined about stop losses and position sizing won’t help, if you are trading a losing method. Expectancy changes with volatility. When your method stops providing satisfying results, you either find another that is working in the current market conditions or stay on the side until things change.

3. Those who have a winning strategy often don’t use it. They get emotional and forget about their strategy.

“Good trading is 10% technology and 90% psychology. People defeat themselves. It doesn’t matter how often you repeat basic trading principles when almost no one will practice them” (Maoxian)

Everybody knows the four cardinal rules of trading, but so few people follow them — 1) Trade with the trend. 2) Cut losses short. 3) Let profits run. 4) Manage risk.

There is a big difference between knowing something and applying it. Most people don’t use what they know.

Economists were seduced by physics because it made their claims seem more scientific. Their belief was in the concept of equilibrium, in which it would be impossible to profit from trading around a circle of goods or a circle of currencies without actually producing anything. Of course, that is possible, and that did happen, and that’s because you’re never really at equilibrium.

PESSIMISM

Pessimism is defined as a tendency to stress the negative or unfavorable or take the gloomiest possible view. Obviously, the successful trader is not pessimistic. If so, then he would never trade in the first place or if he did, he would only trade short; a “permabear” if you will. A purely pessimistic trader would also doubt his edge, doubt any market direction, only trade after the move has happened, cut his winners short while allowing his losers to run, overtrade, under invest, etc etc. In other words, a purely pessimistic trader would break all the rules.

OPTIMISM

Optimism is defined as the inclination to anticipate the best possible outcome while believing that most situations work out in the end for the best. The unsuccessful trader, especially the beginning trader, is optimistic about getting rich in the stock market. No matter what every trade will eventually make money he reasons. The optimistic trader also loads up on a “sure thing”, seeks to justify every trade via confirmation bias, adds to losers, brags about winners while hiding losers, refuses to develop as a trader, etc etc. Just as with pessimism, the optimistic trader breaks the rules.