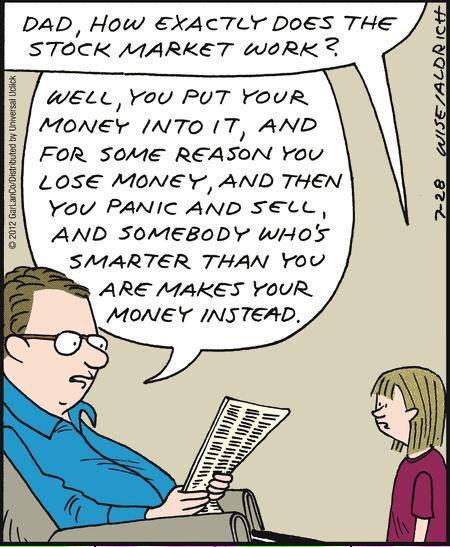

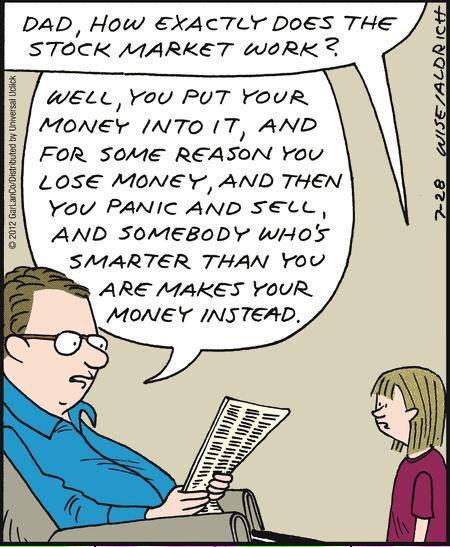

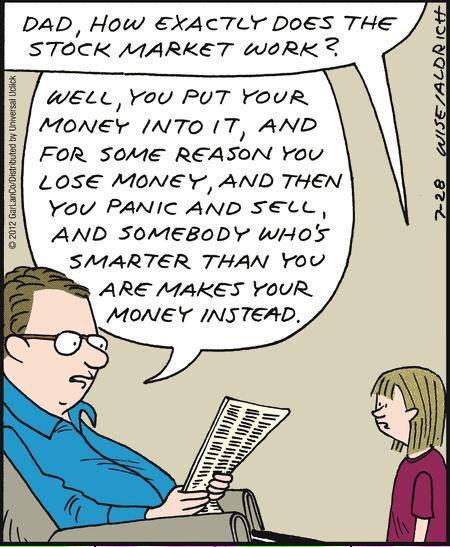

Trading Without a plan explained

There are five key things that make all the difference in profitable trading:

Focus on a system with bigger wins than losses, big wins makes robustness a much easier thing to find. A 1:3 risk/return ratio makes it much easier to be profitable even with more losses than wins.

Focus on a system with bigger wins than losses, big wins makes robustness a much easier thing to find. A 1:3 risk/return ratio makes it much easier to be profitable even with more losses than wins.

Trade in the direction of the trend, in my experience buying dips in a bull market and selling into strength in a bear market is a much easier process than calling tops and catching falling knives.

Trade small versus your buying power, most systems fail because traders simple trade too big causing losses and being wrong to set them back far too much. Small losses are easy to come back from a string of big losses is fatal.

Trade price action not opinions. Be quick to cut losses and patient to ride winners. Getting stuck on what you think should happen could be fatal when the market disagrees with you.

Your goal as a trader is to find an edge over the 90% of traders that lose money, once you have that edge the more you trade the right signals the better chance you have of being profitable. Before you have an edge the volume of trades work against you as your luck runs out.

Paul Tudor Jones II is one of the most successful hedge fund managers. He has never suffered a losing year. His fund has returned 23% annualized gain since its inception in 1986. Paul Tudor is a momentum trader, who believes that price move and trend unfold only because of investors’ behavior. Markets have consistently experienced “100-year events” every five years. While I spend a significant amount of my time on analytics and collecting fundamental information, at the end of the day, I am a slave to the tape and proud of it. I see the younger generation hampered by the need to understand and rationalize why something should go up or down. Usually, by the time that becomes self-evident, the move is already over. There is no training — classroom or otherwise — that can prepare for trading the last third of a move, whether it’s the end of a bull market or the end of a bear market. There’s typically no logic to it; irrationality reigns supreme, and no class can teach what to do during that brief, volatile reign. The only way to learn how to trade during that last, exquisite third of a move is to do it, or, more precisely, live it. Fundamentals might be good for the first third or first 50 or 60 percent of a move, but the last third of a great bull market is typically a blow-off, whereas the mania runs wild and prices go parabolic. |

Taking losses is a tough part of doing business on Dalal Street and no one is immune to making mistakes. In fact, professionals know that the sin isn’t in taking a loss, but rather not taking a loss and letting a loser continue to eat away at the equity in a portfolio.

Losers not dealt with are like a cancer which can quickly spread throughout the body if it is left untreated.

I will not allow yesterday’s success to lull me into today’s complacency, for this is the greatest foundation of failure. — Og Mandino

“You cannot teach anybody anything. You can only help them discover it within themselves.” Galileo (1564 – 1642)

“Trading to win” means surrendering to the moment without trying to control it. It means to let go of fixed preconceptions about what you must do, and to liberate your self-conscious sense of self and selfprotective thoughts, which color the way you experience life and the market. When you can do this, you are in the here and now of your trading, and can bring your maximum potential to bear on the tasks before you.

“Trading to win” means surrendering to the moment without trying to control it. It means to let go of fixed preconceptions about what you must do, and to liberate your self-conscious sense of self and selfprotective thoughts, which color the way you experience life and the market. When you can do this, you are in the here and now of your trading, and can bring your maximum potential to bear on the tasks before you.

One of the great things about the market is that it doesn’t give a damn about you. The market doesn’t care what color you are or if you are short or tall or if you live or die. The market doesn’t care whether you play or leave.