A) absolute trust in myself to do what’s necessary when it’s necessary, B) discipline to follow my rules/method even when it’s going through a rough period (which all methods do), C) the unquestioning belief that I don’t know what’s going to happen next and that trading is just a probabilities game, D) that my success isn’t about the system/method – it’s about me and my attitude toward the market and trading, and E) the complete confidence that I really can make consistent profits from my trading over time.

A) absolute trust in myself to do what’s necessary when it’s necessary, B) discipline to follow my rules/method even when it’s going through a rough period (which all methods do), C) the unquestioning belief that I don’t know what’s going to happen next and that trading is just a probabilities game, D) that my success isn’t about the system/method – it’s about me and my attitude toward the market and trading, and E) the complete confidence that I really can make consistent profits from my trading over time.

Archives of “January 10, 2019” day

rssWhat's The Price of Your Dreams ? MAKE THE GAME WINNABLE

- “There is only one thing that makes a dream impossible to achieve: the fear of failure.” -Paulo Coelho

- You win by living on your own terms–as well and as fully as you can, for as long as you can.

- If you’re chasing someone else’s goal, you always lose.

- Most people overestimate what they can do in a year, and they massively underestimate what they can accomplish in a decade or two.

A Few Things About Risk

People have an amazing ability to discount risks that threaten their livelihood. That’s dangerous because people who should be the most experienced experts in a field may be the least able to objectively assess their industry.

Risk has a lot to do with culture. Europeans and Canadians are generally wary of the stock market. For Americans, it’s a pastime. The French prefer raw milk. Americans are warned against it. Canadians are banned from it. Europeans are terrified of nuclear exposure. Americans couldn’t care less. Walk through an international airport and you’ll see one person wearing a face mask to prevent the spread of illness and another letting their kid crawl on the floor. Everyone wants to believe they’re thinking objectively, but most of the time you’re just reflecting the cultural norms of where you were born.

Success is an underrated risk. Jason Zweig once wrote: “Being right is the enemy of staying right — partly because it makes you overconfident, even more importantly because it leads you to forget the way the world works.”

Risk’s greatest fuels are debt, overconfidence, impatience, a lack of options, and government subsidies.

Its greatest enemies are humility, room for error, and government subsidies.

Nothing in the world can give a damn less than risk. Risk doesn’t care about your political views or your morals. It doesn’t care what your view of the market is, or what you were taught in school. It’s an indiscriminate assassin and a master at humbling ideologies.

ARE YOU IN LOVE WITH MARKETS?

Imagine for a minute your relationship with markets. How would you characterize that relationship? Is it an adversarial relationship? A hot-and-cold, confusing relationship? A fulfilling relationship?

Many traders talk about markets as if they are battlegrounds and they prepare for combat each day. Other traders, frustrated, talk about markets been manipulated.

How we related to markets very much impacts our trading experience. If we think of the market as casino, we will frame one kind of experience. If we treat markets as battlegrounds, our experience will be quite different.

Now imagine what it would be like to be in loved with markets: to find in them something unique, special and valued. A person who is in love with markets will be market focused even outside normal trading hours.

They are not simply preparing for day’s trading; they are passionately interested in deepening their market experience, learning everything they can about markets.

Amazing: The difference a good photographer can make like A Great Technical Analyst (Everything in Eyes )

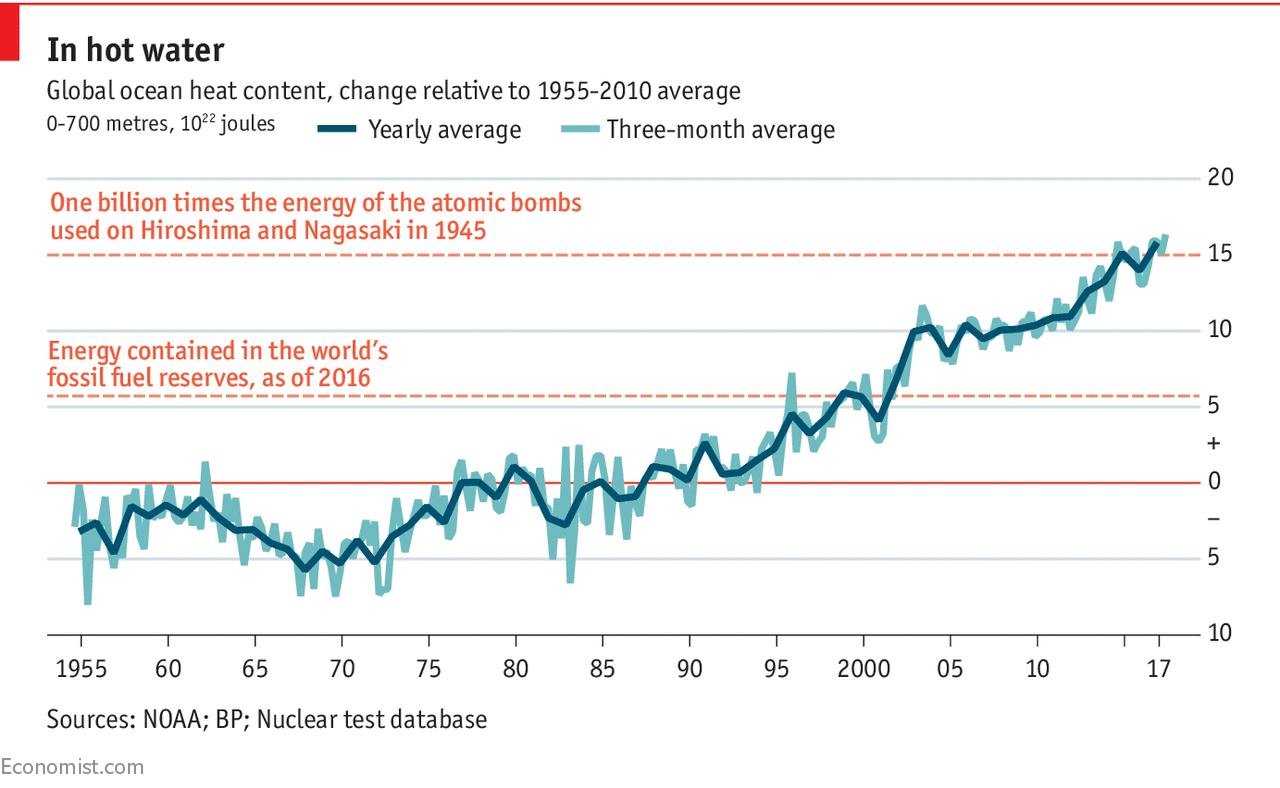

The temperature of the ocean is rising

Confidence

Many times, you won’t feel quite right about a buy or sell decision. If this feeling persists after you have done all your research and you have followed the rules to this point, don’t take the trade. Too many times, individuals try to rationalize a decision. Don’t try to find a good reason for making a bad decision. Your decision must be made with confidence.

Many times, you won’t feel quite right about a buy or sell decision. If this feeling persists after you have done all your research and you have followed the rules to this point, don’t take the trade. Too many times, individuals try to rationalize a decision. Don’t try to find a good reason for making a bad decision. Your decision must be made with confidence.

Good Trades- 10 Points

1.Good trades are generally winners from the very start.

2. Good trades do not take a lot of thinking about; they are triggered through robust entry signals.

3. Good trades aren’t really stressful. With the right position sizing and entry level it should not

cause high stress but instead confidence in your decision.

4. Good trades don’t have to be baby sat and watched for every tick. Good trades can be left alone to work.

5. Good trades are not hard to hold because they are in the direction of the trend for your time frame and get little heat put on them.

6. Good trades hit your price target or trailing stop before your stop loss.

7. Time is on the side of a good trade; the longer you can stay with it the more money you make.

8. Good trades inspire you to stay in them as they become more profitable while bad trades make you want out of them as they lose money.

9. Good trades are psychologically hard to get into because they are generally against the consensus. Bad trades are hard to get out of because you have to admit you are wrong.

10. Good trades make you happy; bad trades make you miserable.

Always Have Positive Approach

Perfect description of a stock market mania. From “The Money Game” (1967), Adam Smith.