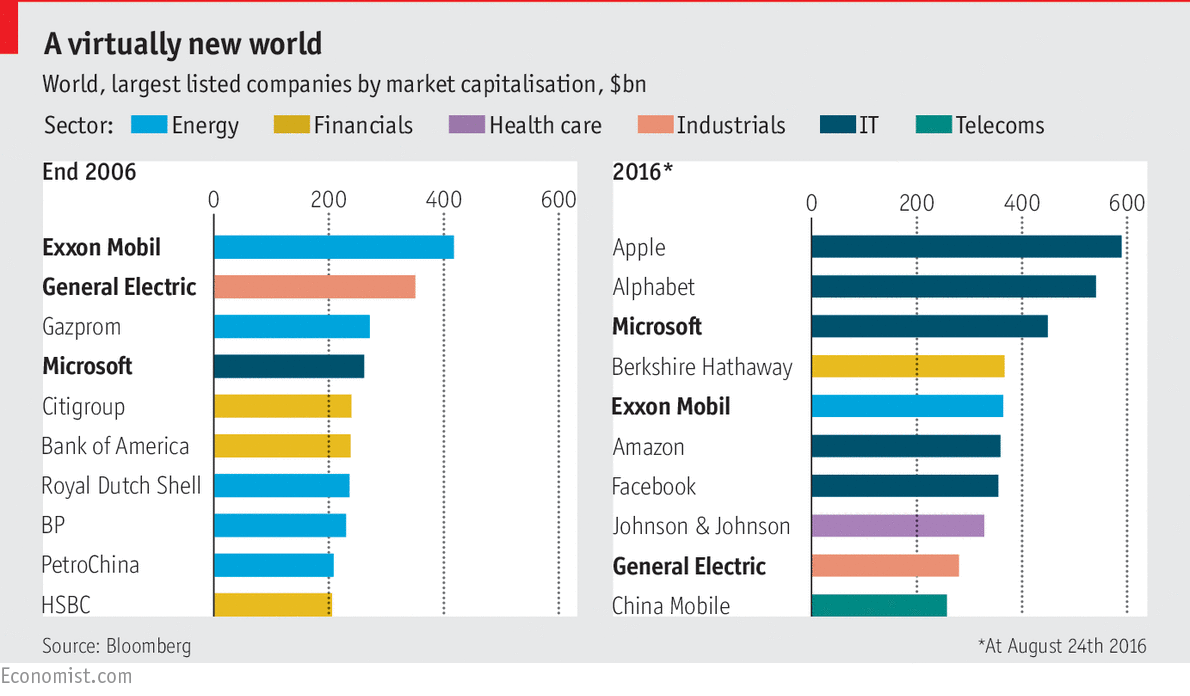

Here's a chart of how the mkt performed for the past decade. We're in 39th week

“One of the most difficult things to get investors and traders to understand is that no matter how much they investigate an investment, they will probably do better if they did less. This is certainly counter-intuitive, but the way that our brains function almost guarantees that this will happen. This kind of failure also happens to those investors frequently regarded as the smartest. In essence, the more information that investors have, the more opportunity that they have to choose the misinformation that suits their emotional purposes.

Speculation is observation, pure and experiential. Thinking isn’t necessary and often just gets in the way. Yet everywhere we turn, we read and hear opinion after opinion and explanation on top of explanation which claim to connect the dots between economic cause and market effect. Most of the marketplace is long on rationale and explanation and short on methods.

A series of experiments to examine the mental processes of doctors who were diagnosing illnesses found little relationship between the thoroughness of data collection and accuracy of the resulting diagnosis. Another study was done with psychologists and patient information and diagnosis. Again, increasing knowledge yielded no better results but did significantly increase confidence, something which the smartest among us are most prone to have in abundance. Unfortunately, in the markets, only the humble survive.

The inference is clear and important. Experienced analysts have an imperfect understanding of what information they actually use in making judgments. They are unaware of the extent to which their judgments are determined by just a few dominant factors, rather than by the systematic integration of all of their available information. Analysts use much less available information than they think they do.

In trading most new traders allow hope and fear to dictate their trading. They have a losing trade and instead of selling it and getting out they instead hope it will come back to even allowing the loss to grow. Another error for new traders is that when they have a winning trade they fear that the profit will disappear so they sell for a small gain and miss the big trend in their favor. When hope and fear controls the trader they end up with big losses and small gains. A formula for ruin.

Instead the rich trader is fearful of losses getting bigger so they sell quickly when losing, risking a maximum of 1% of their capital on any one trade. Rich traders are able to think clearly and trade rationally knowing exactly what they are risking, when their stop is hit, they get out. This enables them to keep all their losses small.

When a trade is immediately a winner for a rich trader they hope it will run 100 points in their favor. Rich traders enable this to be possible with a trailing stop, they do not get out of a winning trade until a key price reversal has happened that tells them that the trend is actually reversing.

Rich traders are fearful of losses growing bigger and hope that their winners will continue on a monster trend. This mindset allows them to be on the right side of trends and avoid any huge losses. This is why the best traders in the world are trend followers and win consistently. Do you want to join their club? Then do not let fear and hope dictate your trading decisions use them correctly.

2 books all traders should have in their library

“Spain is not Greece.” Elena Salgado, Spanish Finance minister, February, 2010. “Portugal is not Greece.” The Economist, April 2010. “Greece is not Ireland.” George Papaconstantinou, Greek Finance minister, November, 2010. “Spain is neither Ireland nor Portugal.” Elena Salgado, Spanish Finance minister, November 2010. “Ireland is not in ‘Greek Territory.’”Irish Finance Minister Brian Lenihan. November 2010. “Neither Spain nor Portugal is Ireland.” Angel Gurria, Secretary-general OECD, November, 2010. “Spain is not Uganda” Spanish PM Rajoy. June, 2012. |