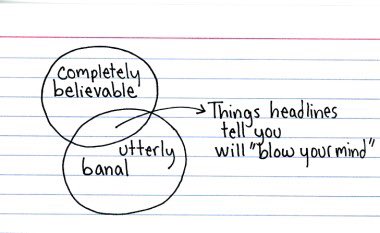

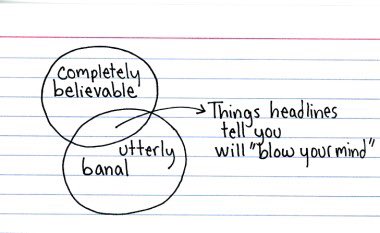

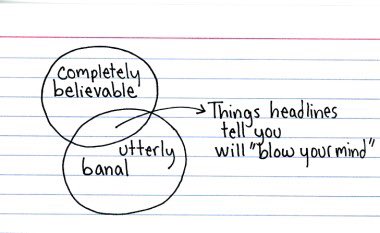

Tomorrow, more charts that will blow your mind.

|

10 painful aspects of trading and what to do about them.

The pain of losing money. (Trade smaller so it is not as painful, it is just an outcome not an emotion).

You start trading a system that did amazing in back-testing and promptly lose 10% of your account. (You have to stick with it so it can win in the long term, you may need to make slight adjustments in position sizing or stops to account for volatility that you may have missed.)

1) What you’re trading – Why are you selecting one instrument to trade (one stock, one index) versus others? Which instruments maximize reward relative to risk?

2) How much you’re trading – How much of your capital are you going to allocate to the trade idea versus other ideas?

3) Why you’re trading – What is the rationale for the trade? Why does the trade idea provide you with an “edge”?

4) What will take you out of the trade – What would lead you to determine that your trade idea is wrong? What would tell you that the trade has reached its profit potential?

5) Where you will enter the trade – Given the criteria that would take you out of the trade, where will you execute your idea to maximize the reward you’ll obtain relative to the risk you’ll be taking?

6) How you will manage the trade – What would have to happen to convince you to add to the trade, scale out of it, and/or tighten your stop loss?

1• Don’t Mixing up Apples and Oranges

2• Don’t’ Winning 7 trades and LOSING ALL Gains on the Next 3 trades

3• When PREMISES FAIL, EXIT TRADE

4• 70% Consistency = 7 out of 10 trades

5• Be BORED = APATHY = EMOTIONAL DETACHMENT

6• DON’T WORRY ABOUT MAKING MONEY

7• Pauses in your Trading. Putting oneself into a position where defeat is impossible.

8• Determine Your STYLE

9• Stops based on type of Trade and Premises

10• Expect to make mistakes

12• Volume is KEY

13• Those who can recognize PATTERNS and Keep an OPEN Mind Will Succeed Faster – The ability to ADAPT – The Ability to REACT – The Ability to Admit Defeat Cut Losses Fast