A general principle in trading for me is that without thorough investigation, comprehension, and experimentation leading to full acceptance, no trading rule or system can be properly executed. If one cannot completely understand and embrace the reasoning behind some method or axiom, whether internally discovered or externally given, the reflex necessary to act without further thinking or doubt is fatally compromised — the circuit between the eyes watching the screen and the finger on the trigger cannot afford even the slightest impedence. One area in my trading which I’ve been struggling over has been the disparity between the success of my entries versus the failure of my exits on profitable trades. If I had the ability to accurately anticipate and identify the origins of a move, why were my attempts in capturing and keeping the bulk of the profits so horribly inept? Why was my timing in closing trades so blatantly pathetic in comparison with their openings, to the point where I would either consistently stop-out on the lows of retracements, or conversely wind up giving back the entire move if I tried to avoid getting shaken out. (more…)

A general principle in trading for me is that without thorough investigation, comprehension, and experimentation leading to full acceptance, no trading rule or system can be properly executed. If one cannot completely understand and embrace the reasoning behind some method or axiom, whether internally discovered or externally given, the reflex necessary to act without further thinking or doubt is fatally compromised — the circuit between the eyes watching the screen and the finger on the trigger cannot afford even the slightest impedence. One area in my trading which I’ve been struggling over has been the disparity between the success of my entries versus the failure of my exits on profitable trades. If I had the ability to accurately anticipate and identify the origins of a move, why were my attempts in capturing and keeping the bulk of the profits so horribly inept? Why was my timing in closing trades so blatantly pathetic in comparison with their openings, to the point where I would either consistently stop-out on the lows of retracements, or conversely wind up giving back the entire move if I tried to avoid getting shaken out. (more…)

Archives of “January 9, 2019” day

rssWhat % of homes have fibre broadband subscriptions? By country. Can U see Name of India ??

You don't have to make it back the way you lost it

Anticipation & Action

The ANTICIPATION Phase: this is where all the left hand chart reading takes place in preparation for the right hand chart battle. It’s the PROCESS that precedes the ACTION to put on a trade. A technical trader anticipates that a past price pattern will repeat again, so he identifies the pattern, locates a current one and determines a suitable match is present. Technical analysis is nothing more than finding previous price patterns matched with current market conditions. Traders anticipate such repetitive behavior based on human nature and seek to take advantage of it. The ACTION phase involves hitting the BUY key based on the previous ANTICIPATION process. Since no one can tell the future or what the right hand side of the chart will reveal, the ACTION is based on the confidence that the trader will do what is right once a trade is put on, which is to exit gracefully at a pre-determined loss line or exit humbly at a pre-determined profit target (P2), fully accepting either/or, or an OUTCOME between one or the other, depending on current market conditions. |

If you truly want to become a profitable trader. This one page alone should be stuck on your wall!

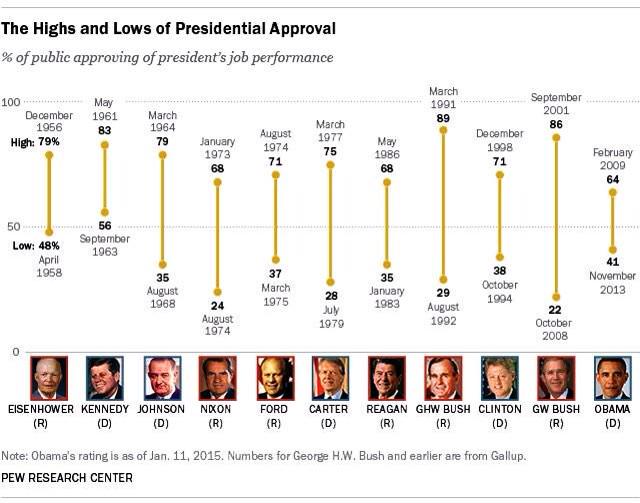

Obama's top approval rating to date is 64%, lowest of any president since Eisenhower.

FEAR

How to prevent Fear in trading ?

How to prevent Fear in trading ?

you have decide to trade a particular system. you get an entry signal, and put on the trade. You put in your protective stop, and you know what will be your signal or target for exit. There is nothing more to you need to do or worry about. The market will do the rest for you. You are along for the ride, and you know when to get out. So there is nothing to be fearful about …

“There is hardly anything productive about worry or fear when you cant do anything about the circumstances” by Buzz Aldrin

Fear is an emotion. It is created by us and therefore we can uncreated it. Fear is created when we think that our trade will lose a lot of money or things that will prevent our trade from losing. The keyword is think which is thoughts in our mind. When you keep on thinking of the thoughts of losing money and fearful of it. STOP!! Take a deep breath to break your connection. Then ask yourself, “Is this probable?” Continue to challenge the thought by asking, “What are the probabilities right now?” Then choose to take control of your thoughts and think term of the current probabilities.

Fear will lead you to disaster if you do not know how to release it. Another way to release fear is to have a shower to calm down yourself. (more…)

I SUCCEED BECAUSE I FAIL

Most of us remember the Michael Jordan “Failure” commercial. It is 30 seconds of pure wisdom for life and for trading. As the market continues its twists and turns and while many churn and burn their trading accounts, now might just be a good time to revisit the basketball legend and the commercial that explains his remarkable success…and can explain ours too!

I missed more than 9000 shots in my career.

I’ve lost almost 300 games.

26 times I have been trusted to take the game winning shot and missed.

I have failed over and over again in my life…and THAT IS WHY I SUCCEED.

Five Things to Avoid In Trading

What Not To Do

1. Have an opinion. One sure way to find yourself trading against the market is to have a

market bias. Trading with an opinion about what the market will do next can limit your

ability to see what the market is actually telling you.

2. Have worse than having your own. Market gurus are notoriously inaccurate in their predictions. s market judgment prevents you from learning to read the market on

your own.opinion has changed.

3. Make your opinion public. Putting your bias into a chat room or forum thread makes it

off an opinion once you have announced it to others.

4. Let your ego get involved. Everyone wants to be right. In trading, you have to ask

yourself

5. Ride a loser. Still wanting to be right? Having a bias, making it public and getting your ego involved will cause you to hold losers far longer than you should.

What to Do

1. Anticipate. Avoid having a bias. Identify areas where the market might turn or continue

and think through what that would look like. Anticipate the alternative ways the market may

trade.

2. Keep your own counsel. Avoid gurus. Learn to read the market and make your own

decisions.

3. Avoid the forums while trading. Use the good ones as a source of education, but refrain

from making your trades public.

4. Check your ego. Be aware of when you want make the correct decision.

5. Cut losses short. Use hard stops. When the market turns against you, exit.

That is up until a point