Typically buildings are started in optimistic, euphoric periods and completed in downturns

Human decisions to sell stocks may have been behind the August rout for equity markets after all, with hedge fund and mutual fund managers selling in response to turbulence and fears for the Chinese economy.

The conclusion, based on work by strategists at JPMorgan, is a riposte to those who have attempted to blame esoteric trading strategies such as “risk parity” for the size and speed of the summer correction.

“Discretionary managers were likely the ones responsible for the recent equity market sell-off,” said Nikolaos Panigirtzoglou, global asset allocation strategist for the bank, in a note to clients.

Macro hedge funds and balanced mutual funds, both of which can invest in a variety of asset classes, took abrupt steps to reduce the risk of stock market losses during the month. The aggregate equity beta of portfolios, a measure of the relationship between equity index movements and those for individual investment funds, declined sharply in August.

The bank also found betas for so-called long-short hedge funds, stock market specialists, declined sharply in August as managers reacted to volatility by paring bets. JPMorgan’s work is based on a regression analysis of index movements, such as the HFRX, a hedge fund benchmark, as a proxy for fund holdings. (more…)

First rule: develop a large appetite for

reading; it will hone your instincts for finding successful companies.

Second

rule: don’t overdiversify; ten stocks, in at least three sectors, are

enough for the average investor.

Third rule: stick with your winners and sell

your losers; do not automatically sell when a stock hits a target price, but

continue to hold it as long as it performs well and has good prospects for the

future.

Fourth rule: look for top-quality, out-of-favor companies; look for

companies that produce an array of high-quality products and/or services.

Fifth

rule: don’t worry about earnings if a company makes a popular product; strong

earnings growth will follow.

Sixth rule: don’t tinker with your portfolio; check

your portfolio’s performance only once or twice a year.

Seventh rule: don’t be

afraid to hold cash; it’s okay to be prepared to purchase stocks with

beaten-down prices after a correction.

How to add an hour to your day (Harvard Business Review)

The Bucket List lie (Jonathan Fields)

Why all happiness and success fades away (Peter Shallard)

Why what you believe gets you nowhere (Peter Shallard)

How to really shake things up (James Altucher)

There are real-life advantages to being a strategic deceiver (New York Times)

Don’t let email run your life (CNN)

Great idea – change your smoke alarm batteries with daylight savings time (Lifehacker)

Yet another reason to get off your duff and exercise (BBC)

We make risk/reward decisions every day, all day long (Tech Crunch)

Tips from Thomas Edison (Open)

It’s looks like it is a really good thing I feel happy while trading (Forbes)

Natural approaches to combating the winter blues (Dr. John Briffa)

There will always be people in life who envy you, who resent your success, who are threatened by your accomplishments, who do what they can to sabotage your efforts.

Those include people in a workplace who place politics and “optics” over productivity and innovation. Those also include naysayers who don’t dare admit the possibility of achievement because that would undermine their excuses, their failure to make a difference.

You know who your friends are when you reach a breakthrough success. Your friends are ready to celebrate with you: they share your joy. Those who cannot celebrate with you? Perhaps they’re struggling with their own demons. Perhaps they are burned out and exhausted. That doesn’t necessarily make them horrible people. They just can’t be your friends. (more…)

These 10 secrets could be applied to your success as a trader, but more importantly they could be applied to ensure success in your personal life. I thought I would share these 10 tips with you as they made me stop and think about my own life.

1) How You Think Is Everything – Always be positive. Think success, not failure. Beware of a negative environment.

2) Decide Upon Your True Dreams & Goals – Write down your specific goals and develop a plan to reach them.

3) Take Action – Goals are nothing without action. Don’t be afraid to get started. Just do it.

4) Never Stop Learning – Go back to school or read books. Get training and acquire skills.

5) Be Persistent & Work Hard – Success is a marathon, not a sprint. Never give up. (more…)

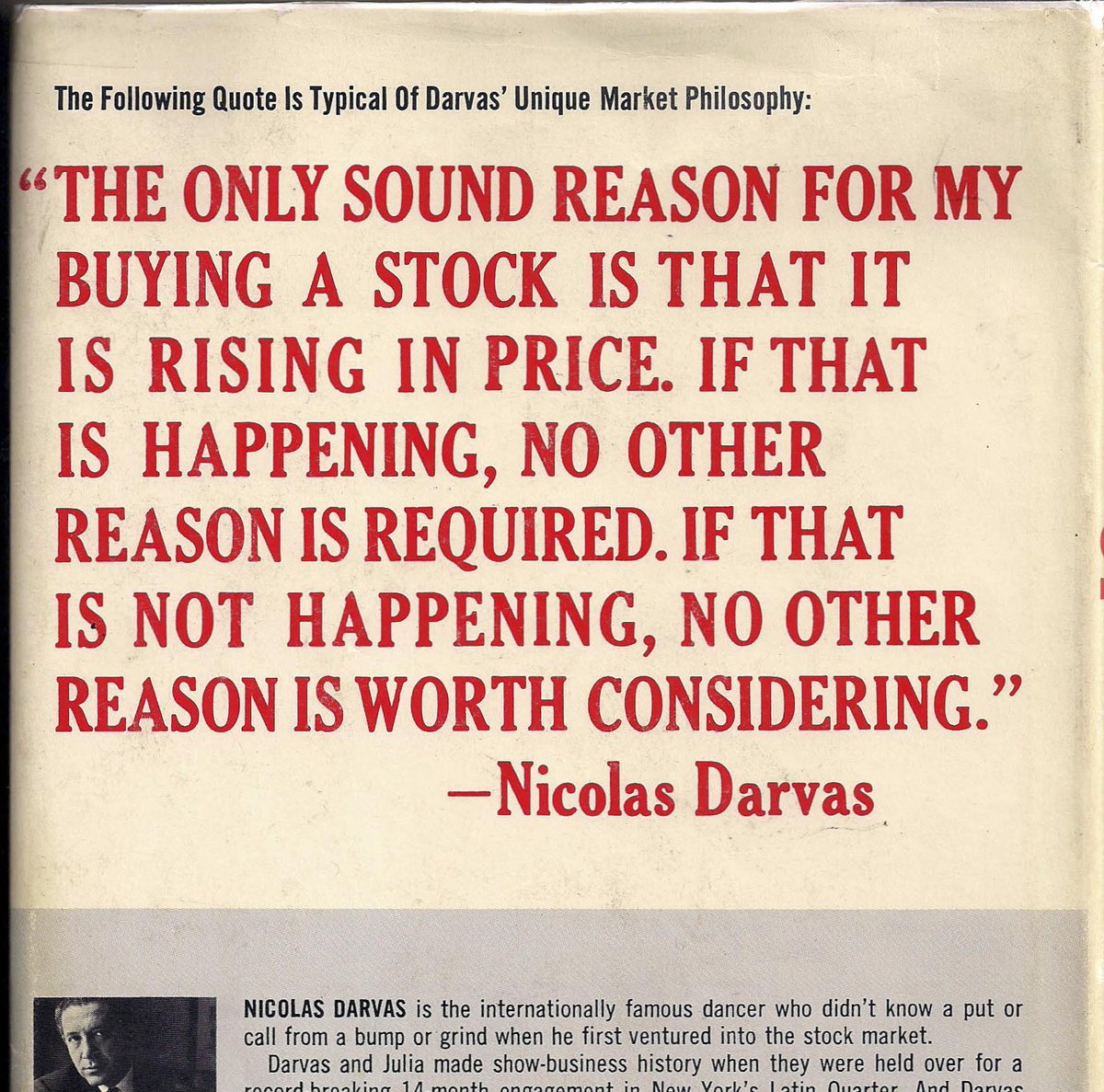

Keep winners as long as they are moving your way. Let the market take you out on a trailed stop.

Dear Traders /Readers on 12th March recommended to buy RELIANCE -Educomp.

-In just 3 sessions both stocks are near their targets.

-Same day written :Only Reliance is looking hot and fiery.And about Educomp my ultimate target is 800+

YES BANK :Recomemnded Boldly to sell at 248- again yesterday at 258 level to our Subscribers….Now stock is bleeding.

Again at this moment ,Iam writing just concentrate on 5184 for Nifty Future.If able to close above this level for 2 consecutive sessions then only will show strength.

-Doors on downside will open and it will be a unexpected move….I expect this move to start from Thursday.

Today ,I recomemnded to Buy REI SIXTEN @ 88 level.Yes Technically Worst is over.Why people running for Pantaloon ?Just search something for this company.Atleast spurt upto 110-120+ not ruled out.

Updated at 12:40/16th March/Baroda