Details of what the much talked about stress test of European banks will examine is out. A total of 91 European banks will be involved in the stress tests (full list of banks being tested are shown below). The test which is being overseen by the Committee of European Banking Supervisors (CEBS) states:

Details of what the much talked about stress test of European banks will examine is out. A total of 91 European banks will be involved in the stress tests (full list of banks being tested are shown below). The test which is being overseen by the Committee of European Banking Supervisors (CEBS) states:

The objective of the extended stress test exercise is to assess the overall resilience of the EU banking sector and the banks’ ability to absorb further possible shocks on credit and market risks, including sovereign risks, and to assess the current dependence on public support measures.

The exercise is being conducted on a bank-by-bank basis using commonly agreed macro-economic scenarios (baseline and adverse) for 2010 and 2011, developed in close cooperation with the ECB and the European Commission.

The macro-economic scenarios include a set of key macro-economic variables (e.g. the evolution of GDP, of unemployment and of the consumer price index), differentiated for EU Member States, the rest of the EEA countries and the US. The exercise also envisages adverse conditions in financial markets and a shock on interest rates to capture an increase in risk premia linked to a deterioration in the EU government bond markets.

On aggregate, the adverse scenario assumes a 3 percentage point deviation of GDP for the EU compared to the European Commission’s forecasts over the two-year time horizon. The sovereign risk shock in the EU represents a deterioration of market conditions as compared to the situation observed in early May 2010.

The scope of the stress testing exercise has been extended to include not only the major EU cross-border banking groups but also key domestic credit institutions in Europe. {…}

The results of the stress test will be disclosed, both on an aggregated and on a bank-by-bank basis, on 23 July 2010.

It should be noted that a stress testing exercise does not provide forecasts of expected outcomes, but rather a what-if analysis aimed at supporting the supervisory assessment of the adequacy of capital of European banks. {…}

We all remember the stress test that was applied to American financial institutions in early 2009. It took months for the Federal Reserve to decide how to conduct the testing and then how to release the results so as not to upset anyone. Will the Europeans tell it like it is, or will they follow Tim Geithner’s past action of ‘just don’t say much’ ?

The full list of European banks that will undergo stress testing:

Austria

- RAIFFEISEN ZENTRALBANK OESTERRREICH AG (RZB)

Belgium

Cyprus

- MARFIN POPULAR BANK PUBLIC CO LTD

- BANK OF CYPRUS PUBLIC CO LTD

Denmark

Finland

France

Germany

- HYPO REAL ESTATE HOLDING AG

- LANDESBANK BADEN-WÜRTTEMBERG

- DZ BANK AG DT. ZENTRAL-GENOSSENSCHAFTSBANK

- NORDDEUTSCHE LANDESBANK -GZ-

- LANDESBANK HESSEN-THÜRINGEN GZ

- DEKABANK DEUTSCHE GIROZENTRALE

- WGZ BANK AG WESTDT. GENO. ZENTRALBK

Greece

- EFG EUROBANK ERGASIAS S.A.

- AGRICULTURAL BANK OF GREECE S.A. (ATEbank)

- TT HELLENIC POSTBANK S.A.

Hungary

- JELZÁLOGBANK NYILVÁNOSAN M?KÖD? RT.

Ireland

Italy

- MONTE DEI PASCHI DI SIENA

- UNIONE DI BANCHE ITALIANE SCPA (UBI BANCA)

Luxembourg

- BANQUE ET CAISSE D’EPARGNE DE L’ETAT

Malta

?Netherlands

- ABN/ FORTIS BANK NEDERLAND (HOLDING) N.V

Poland

- POWSZECHNA KASA OSZCZ?DNO?CI BANK POLSKI S.A. (PKO BANK POLSKI)

Portugal

- BANCO COMERCIAL PORTUGUÊS BANCO COMERCIAL PORTUGUÊSS.A. (BCP OR MILLENNIUM BCP)

- ESPÍRITO SANTO FINANCIAL GROUP S.A. (ESFG)

Slovenia

- NOVA LJUBLJANSKA BANKA (NLB)

Spain

- BANCO BILBAO VIZCAYA ARGENTARIA S.A. (BBVA)

- JUPITER – CAJA DE AHORROS Y MONTE DE PIEDAD DE MADRID (CAJA MADRID); CAJA DE AHORROS DE VALENCIA, CASTELLÓN Y ALICANTE (BANCAJA); CAIXA DÉSTALVIS LAIETANA; CAJA INSULAR DE AHORROS DE CANARIAS; CAJA DE AHORROS Y MONTE DE PIEDAD DE AVILA; CAJA DE AHORROS Y MONTE DE PIEDAD DE SEGOVIA; CAJA DE AHORROS DE LA RIOJA.

- CAIXA- CAJA DE AHORROS Y PENSIONES DE BARCELONA (LA CAIXA); CAIXA DÉSTALVIS DE GIRONA.

- CAM – CAJA DE AHORROS DEL MEDITERRÁNEO (CAM); CAJA DE AHORROS DE ASTURIAS; CAJA DE AHORROS DE SANTANDER Y CANTABRIA; CAJA DE AHORROSY MONTE DE PIEDAD DE EXTREMADURA.

- BANCO POPULAR ESPAÑOL, S.A.

- DIADA – CAIXA DÉSTALVIS DE CATALUNYA; CAIXA DÉSTALVIS DE TARRAGONA: CAIXA DÉSTALVIS DE MANRESA.

- BREOGAN – CAJA DE AHORROS DE GALICIA; CAIXA DE AFORROS DE VIGO, OURENSE E PONTEVEDRA (CAIXANOVA).

- MARE NOSTRUM – CAJA DE AHORROS DE MURCIA; CAIXA DÉSTALVIS DEL PENEDES; CAJA DE AHORROS Y MONTE DE PIEDAD DE LAS BALEARES (SA NOSTRA); CAJA GENERAL DE AHORROS DE GRANADA.

- ESPIGA – CAJA DE AHORROS DE SALAMANCA Y SORIA (CAJA DUERO); CAJA DE ESPAÑA DEINVERSIONES CAJA DE AHORROS Y MONTE DE PIEDAD (CAJA ESPAÑA).

- CAJA DE AHORROS Y M.P. DE ZARAGOZA, ARAGON Y RIOJA

- ANTEQUERA Y JAEN (UNICAJA)

- CAJA SOL – MONTE DE PIEDAD Y CAJA DE AHORROS SAN FERNANDO DE HUELVA, JEREZ Y SEVILLA (CAJA SOL); CAJA DE AHORRO PROVINCIAL DE GUADALAJARA.

- BILBAO BIZKAIA KUTXA,AURREZKI KUTXA ETA BAHITETXEA

- UNNIM – CAIXA DÉSTALVIS DE SABADELL; CAIXA DÉSTALVIS DE TERRASSA; CAIXA DÉSTALVIS COMARCAL DE MANLLEU.

- CAJA DE AHORROS Y M.P. DE GIPUZKOA Y SAN SEBASTIAN

- CAI – CAJA DE AHORROS Y MONTE DE PIEDAD DEL CÍRCULO CATÓLICO DE OBREOS DEBURGOS (CAJA CÍRCULO); MONTE DE PIEDAD Y CAJA GENERAL DE AHORROS DE BADAJOZ; CAJA DE AHORROS DE LA INMACULADA DE ARAGÓN.

- CAJA DE AHORROS Y M.P. DE CORDOBA

- CAJA DE AHORROS DE VITORIA Y ALAVA

- CAJA DE AHORROS Y M.P. DE ONTINYENT

- COLONYA – CAIXA D’ESTALVIS DE POLLENSA

Sweden

- SKANDINAVISKA ENSKILDA BANKEN AB (SEB)

?United Kingdom

- ROYAL BANK OF SCOTLAND (RBS)

Details of what the much talked about stress test of European banks will examine is out. A total of 91 European banks will be involved in the stress tests (full list of banks being tested are shown below). The test which is being overseen by the Committee of European Banking Supervisors (CEBS) states:

Details of what the much talked about stress test of European banks will examine is out. A total of 91 European banks will be involved in the stress tests (full list of banks being tested are shown below). The test which is being overseen by the Committee of European Banking Supervisors (CEBS) states:

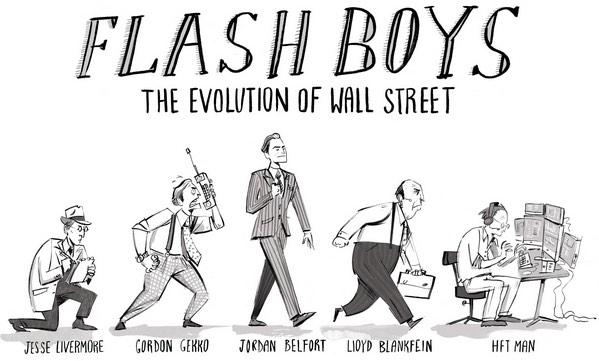

15 Trading Lessons from the The Big Short

15 Trading Lessons from the The Big Short

PESSIMISM

PESSIMISM

![dancing_in_the_rain[1] dancing_in_the_rain[1]](https://www.anirudhsethireport.com/wp-content/uploads/2009/10/dancing_in_the_rain1.jpg)