This started as a quirky post but quickly turned into something probably more useful. I admit the post is based on personal experiences. Luckily, I do not make these mistakes any more….at least not very often ;). Enjoy!

This started as a quirky post but quickly turned into something probably more useful. I admit the post is based on personal experiences. Luckily, I do not make these mistakes any more….at least not very often ;). Enjoy!

1) It is time to sell when…..you find yourself using extra technical indicators on charts to justify holding your position that you didnt use to get into it in the first place!

2) It is time to sell when…..you find yourself going to yahoo message boards to see if someone has some positive news that you don’t know!

3) It is time to sell when…..you find yourself justifying to yourself holding a position for fundamental reasons when you entered it for technical reasons!

4) It is time to sell when…..when you listen to an ” Idiot expert” on Blue Channels or Joker Analysts Websites to chart a stock checking for entry when you are already in it!

Let me know if you readers have any other such fun “indicators” and I shall add them.

at

at

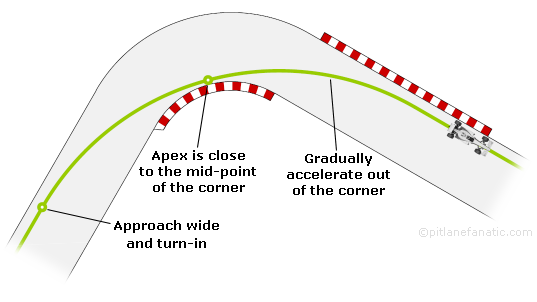

I was watching a formula one race the other evening and it reminded me of the racing line. The racing line is the direction, speed and angle in which a driver goes through a corner. Come in too far from the inside, your exit will be poor. Too far out, someone can pass you. Come out of the corner perfectly but be in the wrong gear, you’re toast.

I was watching a formula one race the other evening and it reminded me of the racing line. The racing line is the direction, speed and angle in which a driver goes through a corner. Come in too far from the inside, your exit will be poor. Too far out, someone can pass you. Come out of the corner perfectly but be in the wrong gear, you’re toast.