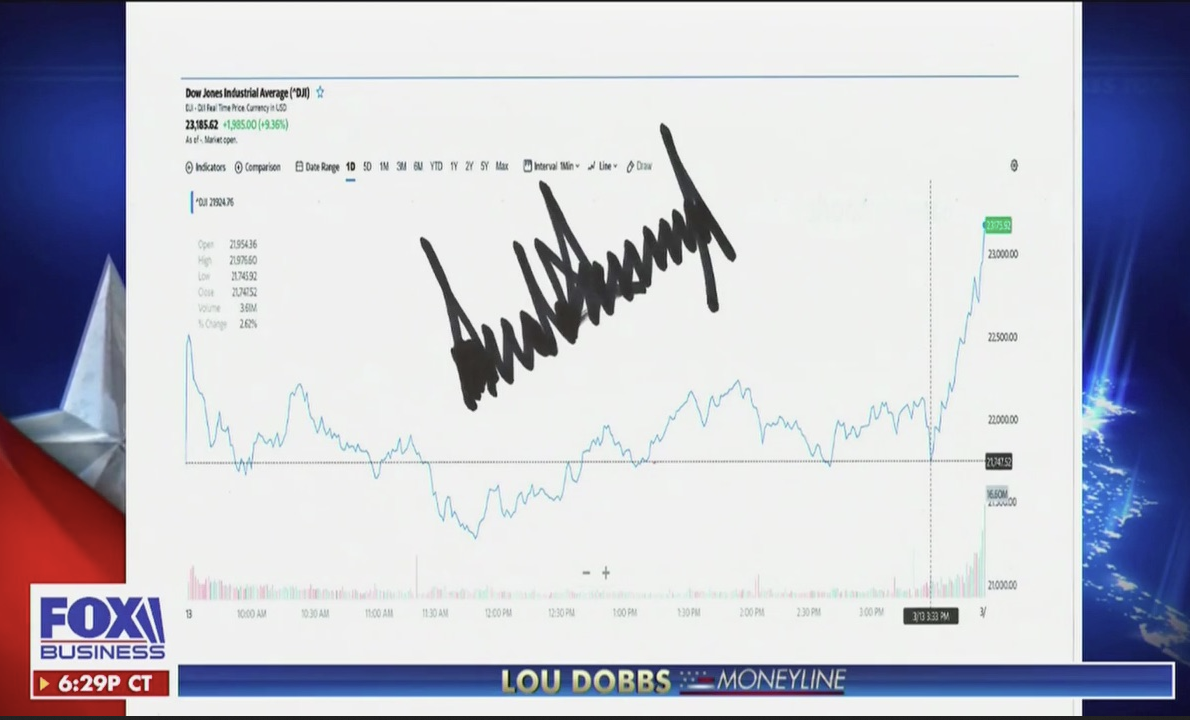

The Fed and Congress inspire an equity rally

- S&P 500 +9.4% — biggest since 2008

- DJIA +11.3%

- Nasdaq +8.0%

The market is like an ocean – it moves up and down regardless of what you want. You may feel joy when you buy a stock and it explodes in a rally. You may feel drenched with fear when you go short but the market rises and your equity melts with every uptick. These feelings have nothing to do with the market – they exist only inside you.

The market is like an ocean – it moves up and down regardless of what you want. You may feel joy when you buy a stock and it explodes in a rally. You may feel drenched with fear when you go short but the market rises and your equity melts with every uptick. These feelings have nothing to do with the market – they exist only inside you.

The market does not know you exist. You can do nothing to influence it. You can only control your behavior.

The ocean does not care about your welfare, but it has no wish to hurt you either. You may feel joy on a sunny day, when a gentle wind pushes your sailboat where you want it to go. You may feel panic on a stormy day when the ocean pushes your boat toward the rocks. Your feelings about the ocean exist only in your mind. They threaten your survival when you let your feelings rather than intellect control your behavior.

A sailor cannot control the ocean, but he can control himself. He studies currents and weather patterns. He learns safe sailing techniques and gains experience. He knows when to sail and when to stay in the harbor. A successful sailor uses his intelligence.

An ocean can be useful – you can fish in it and use its surface to get to other islands. An ocean can be dangerous – you can drown in it. The more rational your approach, the more likely you are to get what you want. When you act out your emotions, you cannot focus on the reality of the ocean.

A trader has to study trends and reversals in the market the way a sailor studies the ocean. He must trade on a small scale while learning to handle himself in the market. You can never control the market but you can learn to control yourself.

A beginner who has a string of profitable trades often feels he can walk on water. He starts taking wild risks and blows up his account. On the other hand, an amateur who takes several losses in a row often feels so demoralized that he cannot place an order even when his system gives him a strong signal to buy or sell. If trading makes you feel elated or frightened, you cannot fully use your intellect. When joy sweeps you off your feet, you will make irrational trades and lose. When fear grips you, you’ll miss profitable trades.

A professional trader uses his head and stays calm. Only amateurs become excited or depressed because of their trades. Emotional reactions are a luxury that you cannot afford in the markets.

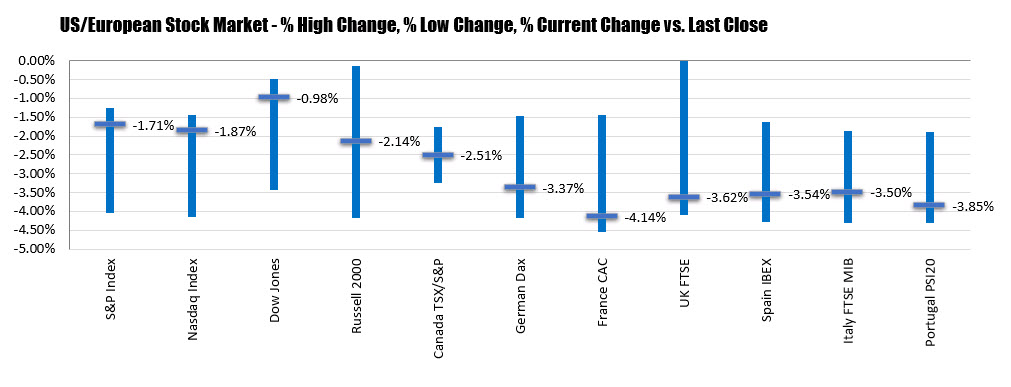

Last week ,The epicenter of many of questions seems to be southern Europe, where Greece, Portugal, Spain and to a lesser extent the remainder of the so-called PIIGS (Portugal, Italy, Ireland, Greece and Spain) have flamed investor concerns that burgeoning public debt may significantly weaken investor demand for sovereign debt and exacerbate an already trouble budgetary crisis.

Many investors have taken to selling the euro is as a means by which to reduce exposure to these problem areas and/or speculate on one or more of these crises spiraling out of control.

-Just look at above chart :Weekly chart includes a powerful rally of Year 2009 and more recently and two-stage selloff, starting in the first half of December and picking up steam over the course of the past 3 ½ weeks as traders looked to capitalize on weakness stemming from the problems in Greece, Portugal and Spain.

Just watch 136 level.Three consecutive close below this level+ Weekly close will take to 131.70-130 level.

-If not breaks 136 & trades above 138 level will create buying upto 140-141 level.

-Best Strategy :Sell on Rise.

-Will update more very soon.

Updated at 13:10/8th Feb/Baroda

![]()

![]()

You need to do your own thinking. Don’t get caught up in mass hyste-ria. As Ed Seykota pointed out, by the time a story is making the cover of the national periodicals, the trend is probably near an end. Independence also means making your own trading decisions. Never listen to other opinions. Even if it occasionally helps on a trade or two, listening to others invariably seems to end up costing you money-not to mention confusing your own market view. As Michael Marcus stated in Market Wizards, “You need to follow your own light. If you combine two traders, you will get the worst of each.”

You need to do your own thinking. Don’t get caught up in mass hyste-ria. As Ed Seykota pointed out, by the time a story is making the cover of the national periodicals, the trend is probably near an end. Independence also means making your own trading decisions. Never listen to other opinions. Even if it occasionally helps on a trade or two, listening to others invariably seems to end up costing you money-not to mention confusing your own market view. As Michael Marcus stated in Market Wizards, “You need to follow your own light. If you combine two traders, you will get the worst of each.”

A related personal anecdote concerns another trader I interviewed in Market Wizards. Although he could trade better than I if he were blindfolded and placed in a trunk at the bottom of a pool, he still was interested in my view of the markets. One day he called and asked, “What do you think of the yen?” The yen was one of the few markets about which I had a strong opinion at the time. It had formed a particular chart pattern that made me very bearish. “I think the yen is going straight down, and I’m short,” I replied. (more…)

Here are a list of ten types of traders I have observed on social media. We have all likely been more than one of these types at some time or another while trading. But we need to focus like a laser on the only real reason we should be trading: to make money and once we have made it, to keep it.

Try to find a long term trend and ride it up. Stay with the trend and don’t be tempted to grab a quick profit. Patience is one of the most important traits of a trend follower.

Try to find a long term trend and ride it up. Stay with the trend and don’t be tempted to grab a quick profit. Patience is one of the most important traits of a trend follower.“Old Rules…but Very Good Rules”

There is no “genius” in these rules. They are common sense and nothing else, but as Voltaire said, “Common sense is uncommon.” Trading is a common-sense business. When we trade contrary to common sense, we will lose. Perhaps not always, but enormously and eventually. Trade simply. Avoid complex methodologies concerning obscure technical systems and trade according to the major trends only.

1)Nobody is bigger than the market.