German DAX, -0.16%, France’s CAC, -0.36%

The major European indices are now close for the day and indices are closing lower but well off the lows for the day. The provisional closes are showing:

- German DAX, -0.16%. It was as low as -1.26%

- France’s CAC, -0.36%. It was as low as -1.25%

- UKs FTSE 100, -1.25%. It was as low as -1.69%

- Spain’s Ibex, -0.16%. It was as low as -1.47%

- Italy’s FTSE MIB bucked the trend and rose by 0.19% That is up from a low of -1.10%.

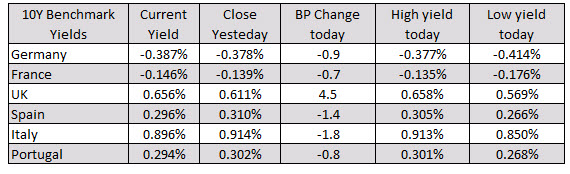

In debt market, the benchmark 10 year yields are mostly lower with the exception of the UK. The ranges and changes are currently showing:

In other markets:

In other markets:- Spot gold is trading up $10.07 or 0.64% $1576.09

- WTI crude oil is up $0.27 or 0.53% of $51.45

in the US equity market, the earlier declines in stocks have been mostly raised in the broad indices at least. The Dow is still negative:

- S&P index is down -1.5 points or -0.5% at 3378. The hi reached 3380.36

- NASDAQ index is unchanged at 9725.40. The high reached 9732.87.

- Dow is down 78 points or -0.27% at 29471.4.

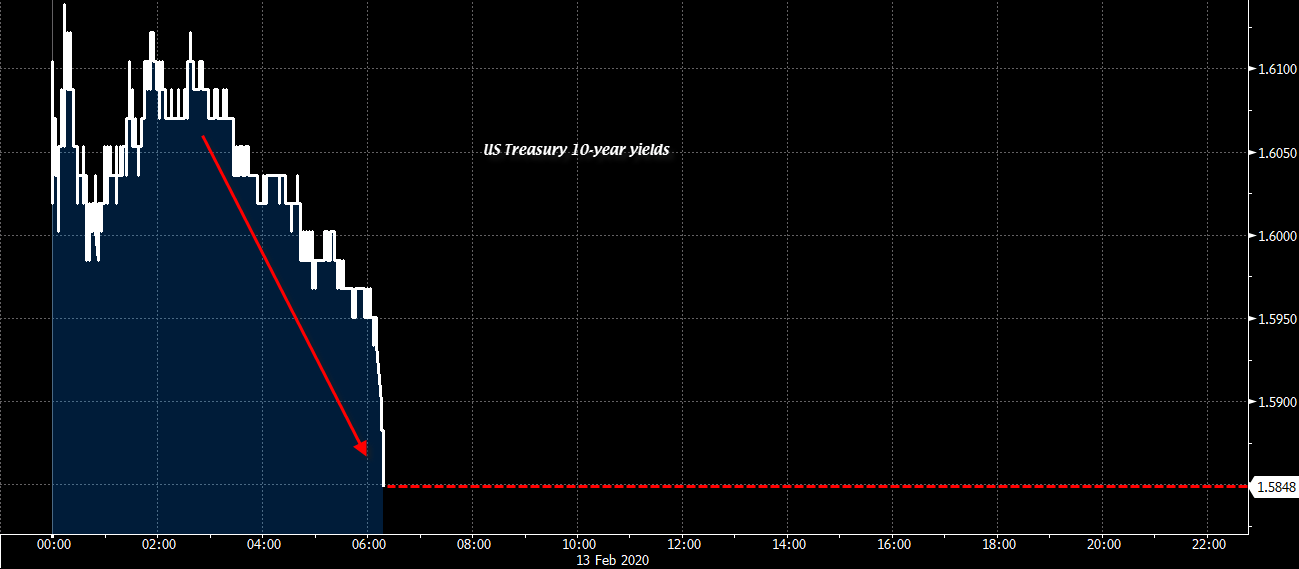

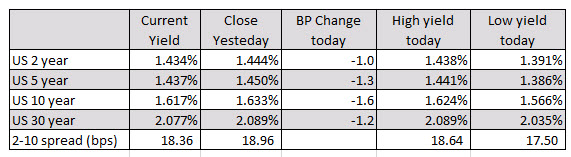

In the US debt market, yields are off lows but still remain modestly lower on the day.

The ranking of the major currencies shows the GBP is the strongest and the NZD is the weakest.