Book summary:

The famous turtle program was the fruit of the debate between Richard Dennis and William Eckhardt, on the issue of whether traders are can be nurtured. Dennis believed it can but Eckhardt thought otherwise. Hence, they decided to make a bet by recruiting people from diverse background and most without experience. The book covered the entire story of the turltes, from the beginning of the program to what happened after the program. Instead of summarizing the process of how the turtles were hired etc, I will only focus on the information and attributes that makes one a good trader which I picked up from the book. In addition, I will introduce the turtle trading method.

What makes a successful trader?

Courageous probability trader

A successful trader thinks in terms of odds and always enjoys playing the game of chance. He or she will experience losses but must be able to hold the nerves and keep trading like they have yet lost. Richard Dennis was $10mil down in a single day but was able to finish off with a $80mil profit for the year. Something that makes “mere mortals lose sleep”. It was said that great traders like Dennis, process information differently from majority of the investors. He does not take conventional wisdom for granted or accept anything at face value. “He knew that traders had a tendency to self-destruct. The battle with self was where he focused his energies.” During the interviews with the potential turtles, one of the abilities he was looking for was “to suspend your belief in reality”.

“Great training alone was not enough to win for the long run. In the end, a persistent drive for winning combined with a healthy dose of courage would be mandatory for Dennis’s students’ long-term survival.”

Eckhardt emphasized that they are not mean reversion traders who believe the market will always return to the mean or fluctuate around the mean. Dennis and co. believe the market trends and often come unexpected, which also means the payout will be very rewarding.

Emotionless and disciplined

Dennis taught the turtles not to think trading in terms of money so they can detach themselves from it and no matter what their account size, they would still be able to make the correct trading decisions.

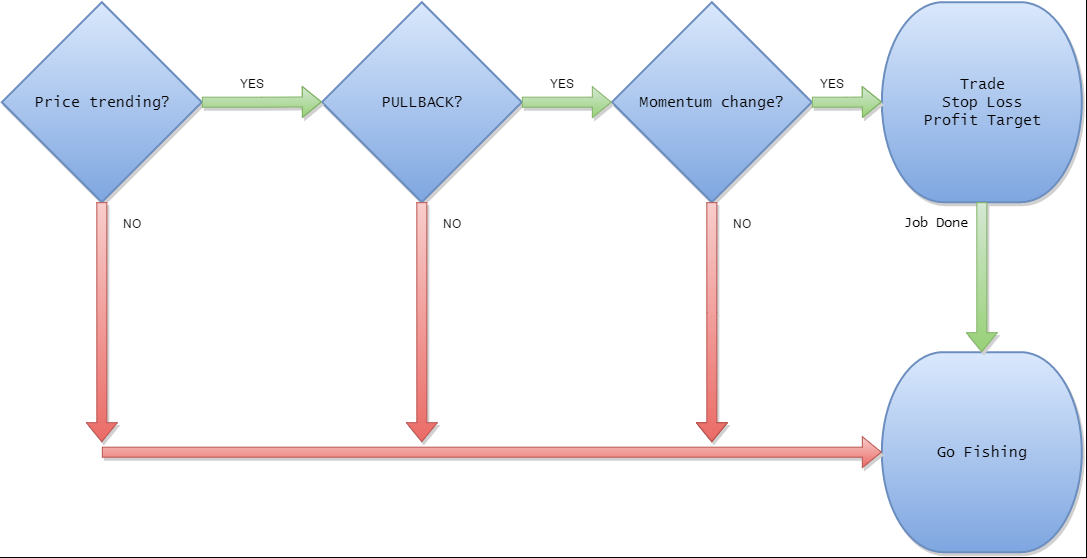

The turtles were taught to be trend followers where they used a system of rules to tell them the bet size, entry and exit points. Rules “worked best” as they eliminate human judgements which do not work well in the market. That being said, even if rules are followed religiously, traders are not expected to be right all the time and it is crucial that they cut their losses and move on when they are wrong. It is important to make every trade a good trade rather than a profitable trade. As long as good trades are made, profits will come in the long run. (more…)

Technical analysis

Technical analysis