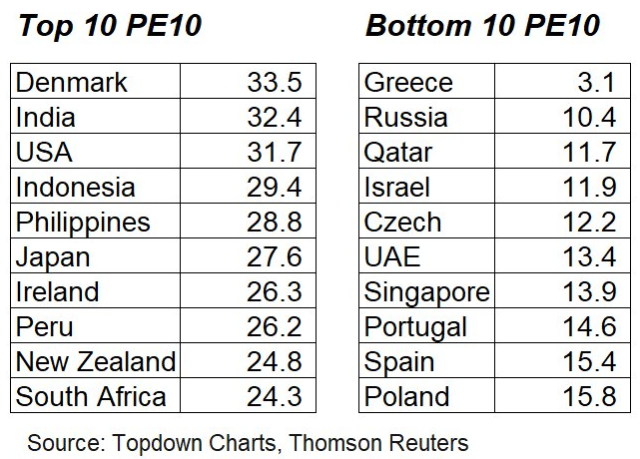

… look at the table ranking the top and bottom 10 countries by PE10 valuation. The bottom features a couple of usual suspects (Russia and Greece), although in the case of Greece you might argue that earnings are now structurally lower so the PE10 is less useful for that particular market. At the top end, it’s likewise many usual suspects: America and a selection of high growth Asian countries (and Japan). While there are some similarities between those at the top and bottom it’s hard to make a broad sweeping statement which generalizes the two groups –

Archives of “January 31, 2019” day

rssNothing like a good pep talk to light a fire under your team.

China's Neighbors are Nervous

What is Money

I came across the nugget of wisdom last night in Farmer Boy.

He waited till Father stopped talking and looked at him.

“What is it, son?” Father asked.

Almanzo was scared. “Father,” he said.

“Well, son?”

“Father,” Almanzo said, “would you–would you give me–a nickel?”

He stood there while Father and Mr. Paddock looked at him, and he

wished he could get away.

“What for?”

Almanzo looked down at his moccasins and muttered:

“Frank had a nickel. He bought pink lemonade.”

“Well,” Father said, slowly, “if Frank treated you, its’ only right

you should treat him.” Father put his hand in his pocket. Then he

stopped and asked:

“Did Frank treat you to lemonade?”

Almanzo wanted so badly to get the nickel that he nodded. Then he

squirmed and said:

“No, Father.”

Father looked at him a long time. Then took out his wallet and opened

it, and slowly he took out a round big silver half-dollar. He asked:

“Almanzo, do you know what this is?”

“Half a dollar,” Almanzo answered.

“Yes. But do you know what half a dollar is?”

Almanzo didn’t know it was anything but half a dollar.

“It’s work, son,” Father said. “That’s what money is; it’s hard work.”

……

“How much do you get for half a bushel of potatoes?”

“Half a dollar,” Almanzo said.

“Yes,” said Father. “That’s what’s in this half-dollar, Almanzo. The work that raised half a bushel of potatoes is in it.”Almanzo looked at the round piece of money that Father held up. It looked small, compared to all that work.”You can have it, Almanzo,” Father said. Almanzo could hardly believe his ears. Father gave him the heavy half dollar.”It’s yours,” said Father. “You could buy a suckling pig with it, if you want to. You could raise it and it would raise a litter of pigs,worth four, five dollars apiece. Or you can trade that half-dollar for lemondade, and drink it up. You do as you want, it’s your money.”

A look inside the Wall Street/DC money machine.

A memo sent out to vice-presidents and higher-level employees at Barclays Capital provides a rare glimpse into how Wall Street flexes its political muscles around election times.

A memo sent out to vice-presidents and higher-level employees at Barclays Capital provides a rare glimpse into how Wall Street flexes its political muscles around election times.

While Wall Street has traditionally been regarded as a bastion of free-market Republicanism, this impression has largely been disproved in recent years. Wall Street invested far more in Democratic candidates and campaigns in the 2008 election cycle, when Barack Obama was elected president.

Goldman Sachs [GS 169.20  -1.87 (-1.09%)

-1.87 (-1.09%) ![]() ], for instance, saw 75 percent of its donations go to the Democratic political machinery in 2008. And in this cycle, the latest figures available show 54 percent of Wall Street contributions going to Democrats. The political action committee money is even more skewed toward Democrats, with 57 percent hitting in that direction. (Those numbers don’t include the third-quarter contributions, which may have balanced out the numbers a bit.) (more…)

], for instance, saw 75 percent of its donations go to the Democratic political machinery in 2008. And in this cycle, the latest figures available show 54 percent of Wall Street contributions going to Democrats. The political action committee money is even more skewed toward Democrats, with 57 percent hitting in that direction. (Those numbers don’t include the third-quarter contributions, which may have balanced out the numbers a bit.) (more…)

WISDOM FROM BERNARD BARUCH – For Traders & Investors

From the SAME AS IT EVER WAS file: Bernard Baruch, a colleague and friend of Jesse Livermore’s, who made a fortune shorting the 1929 crash, and then who later advised presidents Woodrow Wilson and Franklin D. Roosevelt on economic matters, listed the following investment rules in his autobiography published in 1958 entitled Baruch: My Own Story. These rules are still as applicable today.

1. Don’t speculate unless you can make it a full-time job.

2. Beware of barbers, beauticians, waiters–of anyone–bringing gifts of “inside” information or “tips.”(Avoid Blue channels )

3. Before you buy a security, find out everything you can about the company, its management and competitors, its earnings and possibilities for growth. (Don’t Trust Indian Management )

4. Don’t try to buy at the bottom and sell at the top. This can’t be done–except by liars.

5. Learn how to take your losses quickly and cleanly. Don’t expect to be right all the time. If you have made a mistake, cut your losses as quickly as possible.

6. Don’t buy too many different securities. Better have only a few investments which can be watched.

7. Make a periodic reappraisal of all your investments to see whether changing developments have altered their prospects.

8. Study your tax position to know when you can sell to greatest advantage.

9. Always keep a good part of your capital in a cash reserve. Never invest all your funds.

10. Don’t try to be a jack of all investments. Stick to the field you know best.

Alexander ELDER – Trading For A Living

See This 1991 Advertisement :All Products in Ad -Now in Your Smartphone

Knight's Trading loss

Going around Wall Street last week….

Going around Wall Street last week….

Knight lost $440mil in ~45 minutes

That works out to ~$9.8mil a minute

Just for an idea of the speed at which they lost the money… they were losing money FASTER than the entire S&P was making it! (and we’re just talking Revs here not net income!)

The 500 names in the S&P made $5.06T in the trailing 12 months

Here is the math…

S&P trailing 12 Revs $5,062,957,971,936

per day $13,871,117,731

per hour $577,963,239

per min $9,632,721

Knight loss $440,000,000

per minute $9,777,778