Thought For A Day

While much of the focus on trading is around chart patterns, scanners, analytical techniques, indicators, quantitative techniques etc., most of it is commodity. Everyone has access to same tools, techniques, books, research or analysis. So why is it that some traders are very successful and some are not. You can largely divide the traders in to those with consistently good returns, those with mediocre returns and those who are unsuccessful. Most of the time you will find mediocre traders continue to have mediocre returns for long time and their best years never exceed beyond a certain thresh hold.

While much of the focus on trading is around chart patterns, scanners, analytical techniques, indicators, quantitative techniques etc., most of it is commodity. Everyone has access to same tools, techniques, books, research or analysis. So why is it that some traders are very successful and some are not. You can largely divide the traders in to those with consistently good returns, those with mediocre returns and those who are unsuccessful. Most of the time you will find mediocre traders continue to have mediocre returns for long time and their best years never exceed beyond a certain thresh hold.

Much of the same things you will notice in life in general. Vast majority remains stuck in sea of mediocrity. It has nothing to do with innate talent or efforts. Much of it has to do with mental models.

Mental models are deeply held mental images, beliefs, and assumptions. The mental models play a very important role in dealing with world around us. We interpret the world according to our mental models. Two people with different mental models react and interpret same data and same situations differently. Mental models include what a person thinks is true but not necessarily what is actually true.

Successful people in most walks of life have different mental models than mediocre people. That is why successful people can see and act on opportunities which others do not see.

One thing which you can do to be successful in trading or in life in general is to change your mental models. But in reality it is one of the most difficult things to do. Movies often have very dramatic scenes of mental model change leading to transformation in leading character. But in real life changing mental models requires a sustained and structured process and many times requires facilitation by an outside entity. There is a vast array of books and techniques dealing with this field. I have spent years studying this fascinating field of mental modeling.

Once you have the right mental models you see the markets and the trading opportunities differently.

Always take your profit too soon.

Always take your profit too soon.

Sell too soon. Don’t hope for winning streaks to go on and on. Don’t stretch your luck. Expect winning streaks to be short. When you reach a previously decided-upon ending position, cash out and walk away. Do this even when everything looks rosy, when everyone else is saying the boom will keep roaring along.

The ONLY reason for not doing it would be that some new situation has arisen, and this situation makes you all but certain that you can go on winning for a while.

Except in such usual circumstances, get in the habit of selling too soon. And when you’ve sold, don’t torment yourself if the winning continues without you.

When the ship starts to sink, don’t pray. Jump.

Learning to take losses is an essential speculative technique. MOST never learn it. Take losses at once and move on. Take small losses to protect yourself from the big ones.

Beware the 3 obstacles to jumping ship:

– fear of regret ( that the loser will turn out to be a winner when you’ve bailed-out )

– Unwillingness to abandon part of an investment ( become willing to abandon )

– Difficulty of admitting you made a mistake.

Trading in the markets is a process, and there is always room for self improvement. So as we start the new year, here are my 11 rules that help me navigate the markets. By no means is this list exhaustive or exclusive.

Rule #1 Be data centric in your approach : Take the time and make the effort to understand what works and what doesn’t. Trading decisions should be objective and based upon the data.

Rule #2 Be disciplined : The data should guide you in your decisions. This is the only way to navigate a potentially hostile and fearful environment. (more…)

![]() Taken from the April 26, 2013 issue of The Validea Hot List

Taken from the April 26, 2013 issue of The Validea Hot List

Most investors wouldn’t give a fund described as “relatively prosaic, dull, conservative” a second glance. That, however, is exactly how John Neff described the Windsor Fund that he headed for more than three decades. And, while his style may not have been flashy or eye-catching, the returns he generated for clients were dazzling — so dazzling that Neff’s track record may be the greatest ever for a mutual fund manager.

By focusing on beaten down, unloved stocks, Neff was able to find value in places that most investors overlooked. And when the rest of the market caught on to his finds, he and his clients reaped the rewards. Over his 31-year tenure (1964-1995), Windsor averaged a 13.7 percent annual return, beating the market by an average of 3.1 percent per year. Looked at another way, a $10,000 investment in the fund the year Neff took the reins would have been worth more than $564,000 by the time he retired (with dividends reinvested); that same $10,000 invested in the S&P 500 (again with dividends reinvested) would have been worth less than half that after 31 years, about $233,000. That type of track record made the understated, low-key Neff a favorite manager of many other professional fund managers — an “investor’s investor”, if you will. (more…)

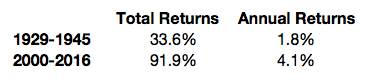

From the peak of the tech bubble in early 2000 the returns on the stock market have been underwhelming. In fact, if you line up the peak of the market in 2000 with the peak of the market in 1929 just before the stock market collapsed, the returns aren’t that far off:

Although the Great Depression was far more severe than what we experienced during the Great Recession, there are some similarities that these time frames share. There were two massive bear markets in the 1930s along with two recessions that saw stocks fall over 80% from 1929-1932 and another 50% in 1937. In the latest period, stocks were cut in half in both the 2000-2002 and 2007-2009 bear markets.

Here’s the breakdown of how government bond yields and long-term valuations changed over each period as well:

Qatar: 7.7

Russia: 4.3

Germany: 3.7

France: 3.4

UK: 2.7

US: 2.4

Japan: 2.3

China: 1.8

India: 0.6