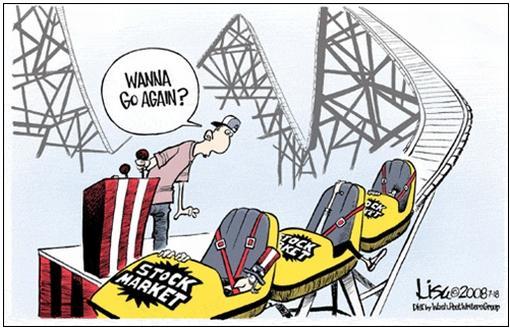

The stock market today -Settlement Day (and pretty much every day lately)

| Hedge Fund Analyst | A person who spends their day tracking the activities of people whose job they would have liked. |

| Quantitative Researcher | A person who can attach probabilities to future events by looking backwards. |

| Portfolio Manager | A person who has an enormous breadth of knowledge across a range of industries and is an expert in none of them. |

| Strategist | A person who spends their day looking down at global events from 25,000ft but never has to land to take an active decision themselves (see “ Journalist” and “Consultant”). |

| Head of Quantitative Solutions | A person qualified to Ph.D level who used to earn an annual bonus at a CTA. |

| Head of Risk | The person who stops portfolio managers earning a bonus. |

| In-House Marketer | A person who can ascribe someone else’s success in the firm to their own activities. |

| Chief Operating Officer | The person who is thought to keep hedge funds running as businesses. |

| Deputy Chief Operating Officer | The person who actually keeps hedge funds running as businesses. |

| Chief Investment Officer | The guy whose name is on everyone’s business card. |

| Head Trader | Chief Algo Selector |

| Compliance Officer | Fulfills the statutory requirement to have a fifth column in every firm in the financial sector. |

| Head of Compliance | Chief Snitch |

| Head of Technology | The only person in the firm authorised to have self-defined mission-critical costs no-one else understands. |

| Head of Investor Relations | The person that works with the most important existing clients to tidy up the s*** created by the CIO. |

| Chief Executive Officer | The person individually chosen by the founder and Chief Investment Officer to buy the paperclips and liaise with the auditors. |

I’ve seen this study making the rounds on several websites now as a type of neuroeconomic confirmation of Buffetological principles…

Perhaps procedure might be slightly useful as a means of seeing physical brain improvement by training– such as that found through meditative practices.

“Traders who buy more aggressively based on NAcc signals earn less. High-earning traders have early warning signals in the anterior insular cortex before prices reach a peak, and sell coincidently with that signal, precipitating the crash. These experiments could help understand other cases in which human groups badly miscompute the value of actions or events.”

“I can’t sleep” answered the nervous one. |