Archives of “January 19, 2019” day

rssTraits of the Successful Trader

1. Find the plays that make the most sense to you.

1. Find the plays that make the most sense to you.

Build from your unique personality. Some traders will make a career of momentum trading, killing anything that is moving. They could care less about a balance sheet or even the actual full name of the symbols they trade. They just want to play and are damn good at it. Some will find this intellectually suffocating. They will want to trade all the markets, reading as much about as many longer term opportunities as possible. This fits their inner need to learn, think, and grow intellectually. Both are totally acceptable save if the momo trader is forced to trade macro plays.

2. Spend as much time trading, thinking about trading and talking about trading as you can possible stand.

The past years have gifted us a treasure of research on elite performance which provides a clear path for our success. Time at our craft, experience, practice, reps gained determining plays are the road to successful trading. Put down Boring New Book About Some New System You Do Not Understand and start reading The Talent Code, Bounce, Talent is Overrated, Mindset, Drive, Outliers, The Art of Learning.

3. Find a GREAT mentor.

And I do not mean necessarily at a trading firm. Before Dr. Steenbarger went off-line and joined one of the great hedge funds of our time, I peppered him with questions. Phil Mickelson, considered one of our greatest golfers ever, has three coaches watching his game. Peyton Manning has a head coach, offensive coordinator, quarterback coach, and father providing him feedback. There is little evidence of elite performers reaching their potential without high level coaching.

My Trading Quotes Collection

Great Quote by Thomas Phelps -Legendary Investor

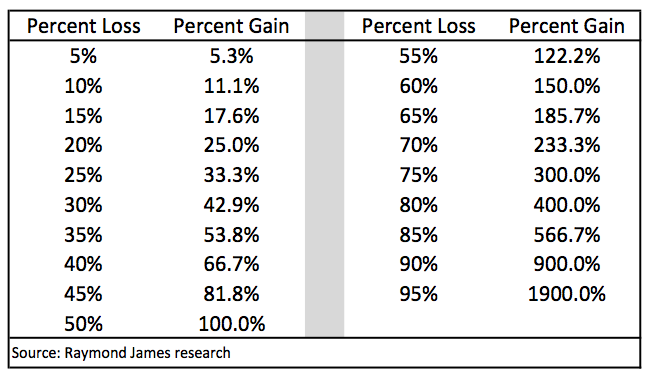

The % gain necessary to get back even, after a certain percentage loss.

Trade imbalance worries FM

The Union finance minister, Mr Pranab Mukh-erjee, on Sunday expressed concern over the spiralling inflation, the country’s increasing current account deficit and trade imbalances. “These are the issues which raise concerns. Inflationary pressures are there and non-oil imports are rising,” he told reporters on the sidelines of an event here on Sunday. He said that imports of capital goods, raw materials and intermediaries are rising, widening the trade gap. Though financing the trade gap was now manageable, he cautioned that if the situation continued to be like this, the scenario would be uncertain. The finance minister said the import bill would rise further due to high oil prices. “I do not know to what extent we will be able to control import of petroleum products,” he said. |

Warren Buffett: Markets are like sex

There’s nothing like getting a big bang for your buck, and no one knows that more than billionaire investor Warren Buffett.

The 83-year-old founder of Berkshire Hathaway, whose investments have consistently beaten the stock market over the past 50 years, shared a few tips in this year’s annual letter to shareholders, including comparing the stock market with sex.

Mr Buffett said new investors tend to buy shares when the markets are rising and optimism is high, only to get disillusioned when prices fall.

Quoting the late money manager Barton Biggs, whose attention to emerging markets in the 1980s marked him as one of the world’s first and foremost global investment strategists, Mr Buffett added: “A bull market is like sex. It feels best just before it ends.”

He advised investors to “keep things simple” by “accumulating shares over a long period, and never sell when the news is bad and stocks are well off their highs”.

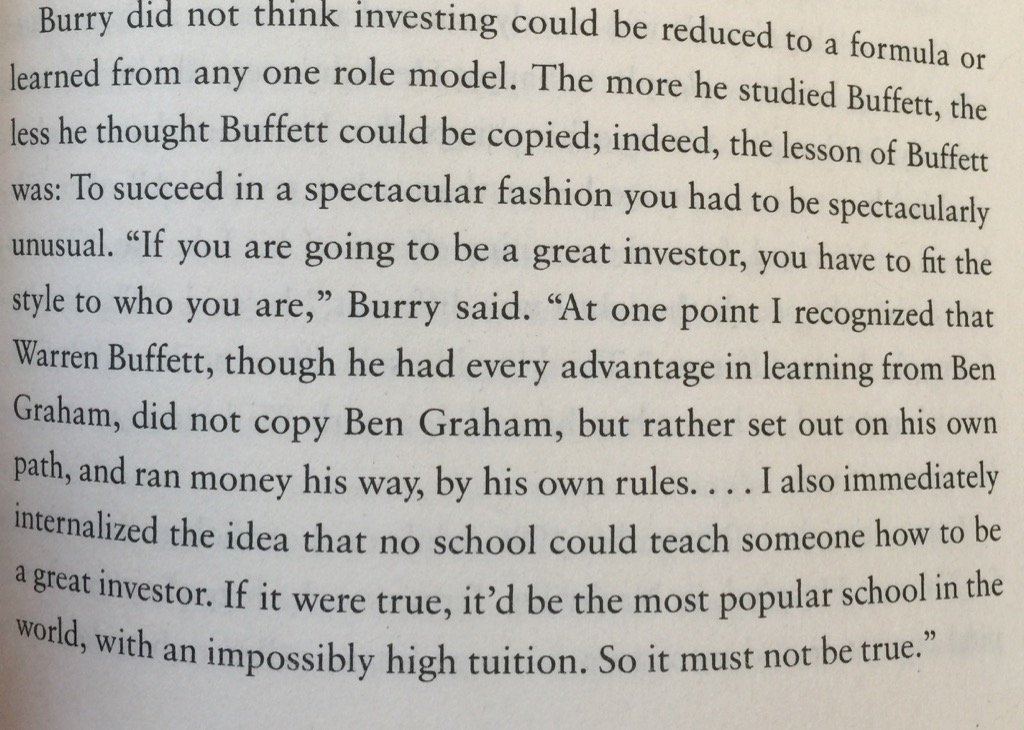

Michael Burry on what it takes to be a great investor. From The Big Short

Paul Tudor Jones Speaks…

Trading Errors

1. Trying to catch a falling knife. 2. Picking Tops 3. Failure to wait for confirmation. 4. Lack of patience. 5. Lack of a clear strategy. 6. Failure to assume responsibility. 7. Failure to quantify risk. |