- Develop a competent analytical methodology.

- Extract a reasonable trading plan from this methodology.

- Formulate rules for this plan that incorporate money management techniques.

- Back-test the plan over a sufficiently long period.

- Exercise self-management so that you adhere to the plan. The best plan in the world cannot work if you don’t act on it.

Archives of “January 15, 2019” day

rssInternet Censorship

Interesting interactive graphic showing what nations are censoring the internet, what content they are restricting, and the methods they using.

Click Image or Above Link to Read !

12 Economies' Stock Markets Versus GDP

5 Obstacles For Traders ,Just Cross Them & See Great Results

- YOUR EGO: It wants you to PROVE you are right, it wants you to trade big, the ego wants you to be confident in your ability to trade before you are competent in your trading through the right education and experience.

- YOUR FEARS: Fear makes you afraid to take your entry when it is triggered and afraid to let a winner run thinking it will turn into a loser. Fear comes from a lack of faith and lack of faith arises from lack of the proper study before you start trading.

- YOUR GREED: It makes you trade too big and too much. Greed makes you want to risk too it all to get rich quick. Greed usually leads to get broke quick trades. Greed wants to take a short cut to success and you have to travel the full road to get to where you really want to go. You have to go through the work and experiences to get to success.

- NO TRADING PLAN: If you do not have a map it does not matter where you want to go you will end up somewhere else. Every trade should be planned when the market is closed and then executed reacting to prices when the market is open. With no plan long term results are virtually impossible.

- YOU: The weakest part of any trading system is the trader that is suppose to follow it. If you do not put in the work to develop a trading plan that fits you, develop and keep discipline, manage your risk, and stick to the plan regardless of how you feel then no trading system will work for you.

Trader's mindset

How does someone know that they reached the trader’s mindset? Here are a few characteristics:

How does someone know that they reached the trader’s mindset? Here are a few characteristics:

1. No anger whatsoever.

2. Confidence and being in control of the self

3. A sense of not forcing the markets

4. An absence of feeling victimized by the markets

5. Trading with money you can afford to risk

6. Trading using a chosen approach or system

7. Not influenced by others

8. Trading is enjoyable

9. Accepting both winning and losing trades equally

10. An open mind approach at all times

11. Equity curve grows as skills improve

12. Constantly learning on a daily basis

13. Consistently aligning trades with the market’s direction

14. Ability to focus on the present reality

15. Taking full responsibility for your actions

"Traders who can both be right and sit tight are uncommon…one of the hardest things to learn."

Optimal Thinking

Rosalene Glickman, Ph.D. offers views on “Optimal Thinking”:

“The quality of the questions you ask determines the quality of your life. When you ask the best questions of yourself and others, you invite the best answers. You can discover what “the best” means in whichever context you choose. You simply create the best path to your most desired outcomes.”

Most Profitable Questions:

* What’s my most profitable activity?

* How can I maximize the profitability of this activity?

* What’s the most profitable use of my time right now? (more…)

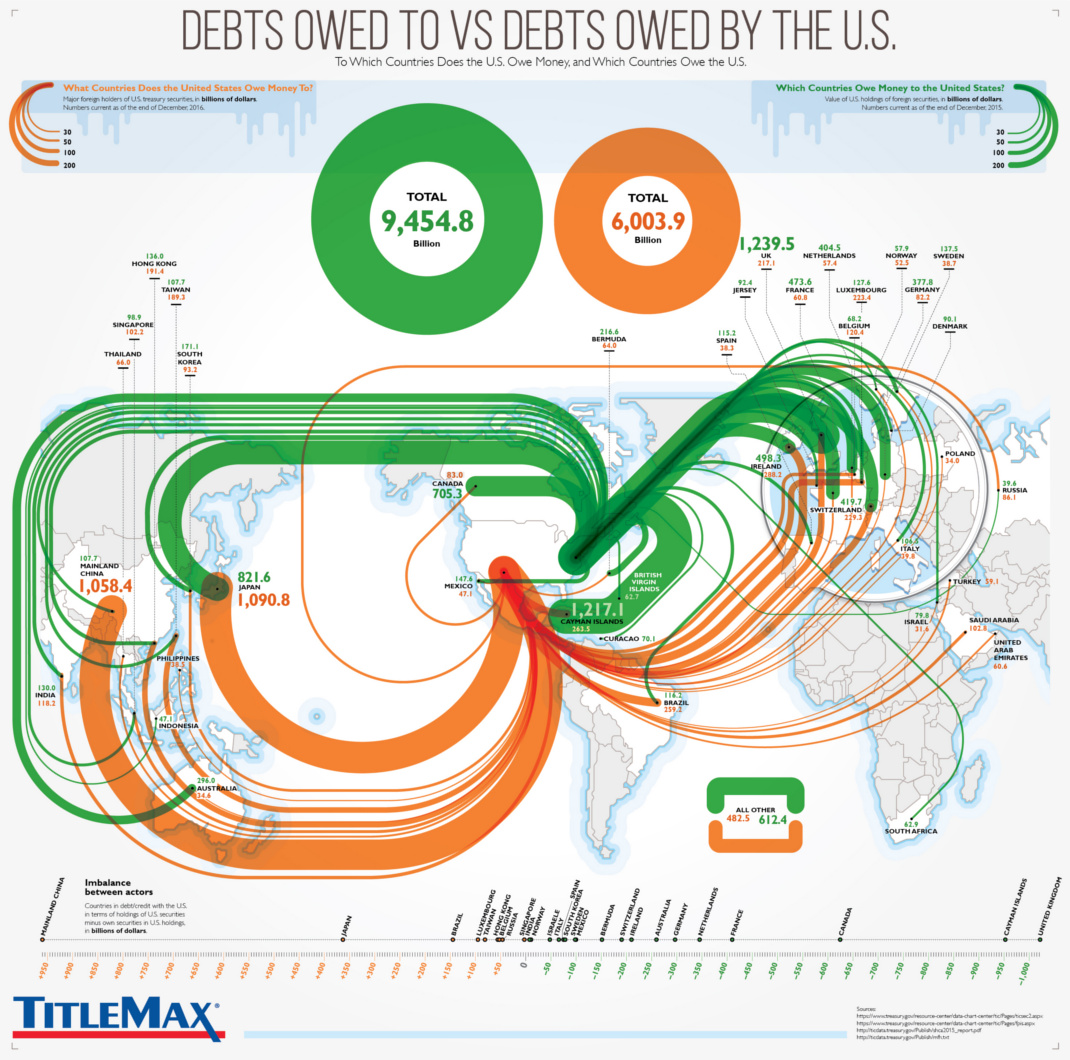

Who Holds U.S. Debt Internationally

Can we teach ourselves to be luckier? Yes, we can!

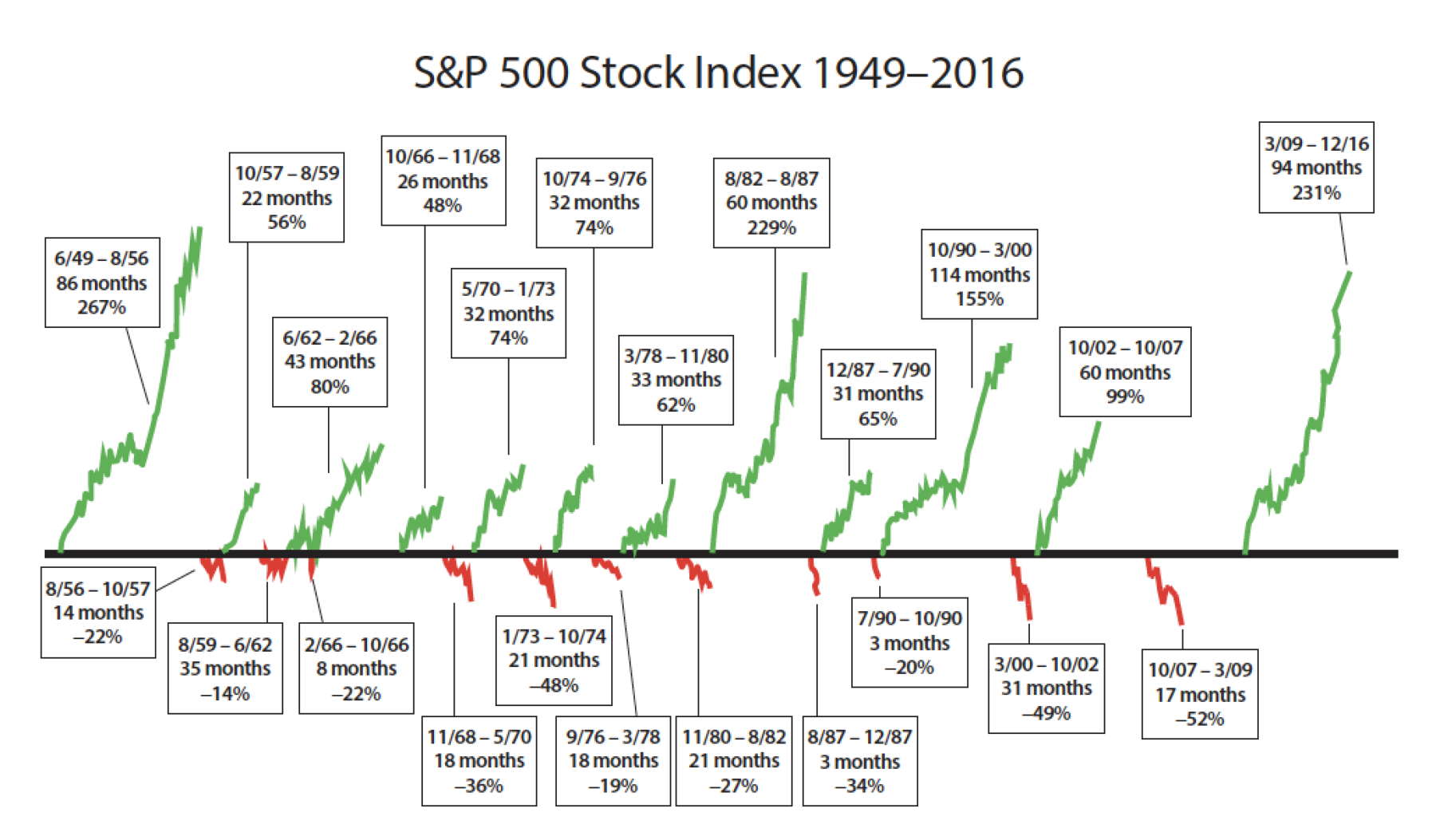

S&P 500 Stock Index 1949-2016 -Chart