Q: Can you discuss the concept of drawdowns a bit? Novice traders seem to think experienced traders become proficient to the point that they are right much more than not and thus experience very small drawdowns. But talking to experienced traders this does not seem to be the case.

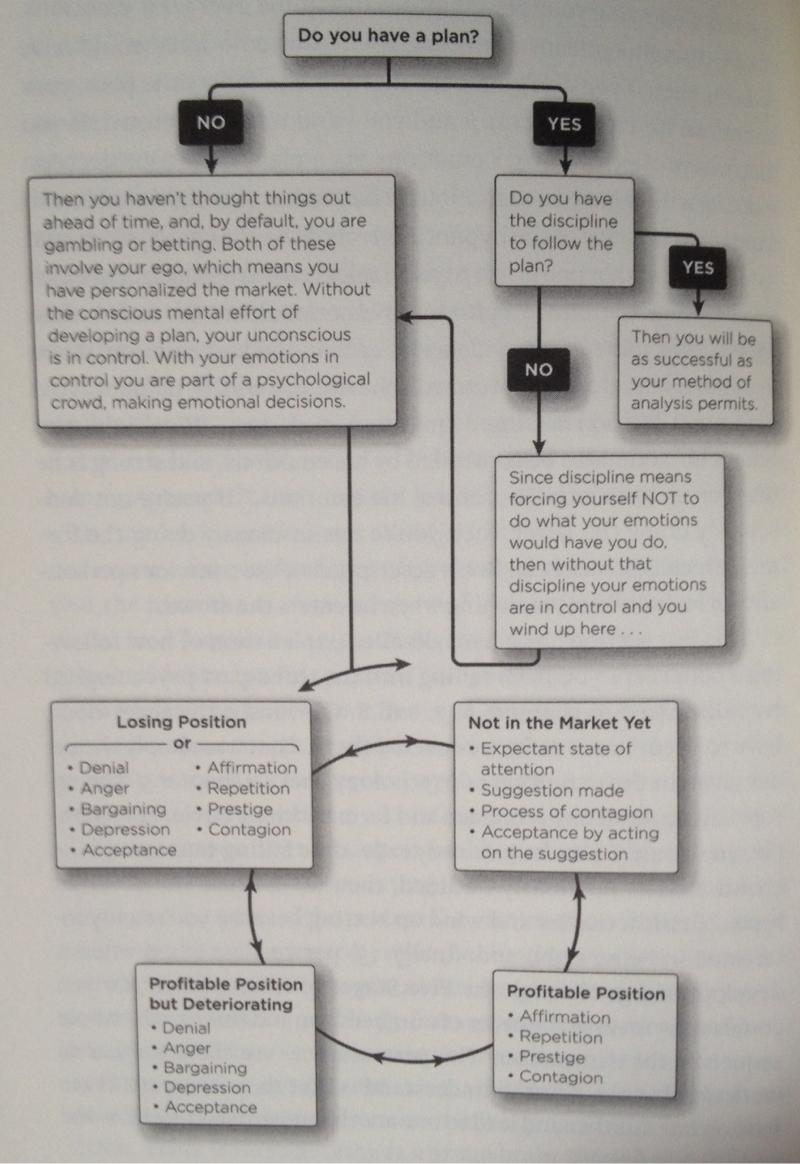

A: In my view, the biggest difference between a successful trader and one who is not is how they manage their mistakes. Note, I am of the opinion that those who trade well don’t make fewer mistakes but they simply have learned how to handle them when they occur. This opinion is based on years of experience but also more recently working closely one-on-one with other traders. The fastest way I’ve learned to be of help to others is to show them how to recognize, quickly admit, and then take aggressive action when a mistake has been made. Losers tend to make bigger mistakes out of small ones. They let their egos get in the way and double-down in losing trades and make matters worse when a mistake is made.

Ultimately, the best you can do in this business is try to be “more right than wrong,” especially at key turning points and be quick to repair and take remedial action when you are wrong as well as managing your risk through proper trading size, stop losses, and simple diversification.

Q: I know that Alexander Elder recommends trading less often for better results. And after reading your blog for the last couple of years I know that you follow this strategy for the most part as well. What do you do in a range bound time such as what we are experiencing, have you been doing more day trading?

A: I’ve been very inactive recently. In fact, when you see more posts at the website (especially those link posts that take so much time and energy to do), you pretty much can count on that I’m doing a lot of sideline sitting. In many ways, this blog helps me stay patient as it keeps me busy and focused without feeling the necessity to make trades that don’t offer exactly what I’m looking for. All good traders seem to have different ways to cope when the environment is not receptive and I recommend you find ways to cope as well. As for day trading, that is fine if you love doing that, but that’s never been my desire. Day trading for pennies a trade seems too much like work and I don’t need that kind of stress. I can afford to be patient and pick my spots.

To send in your question(s) for next mailbag, please send me e-mail at [email protected] Although I may not directly answer your question in these posts, it is extremely helpful to know what topics are of interest to you so that I can find links and look for opportunities to discuss and cover your interests in the future. Thank you!

There are no good or bad stocks. There are only stocks that rise in price and stocks that decline in price, and that price is based on the laws of supply and demand in the marketplace

There are no good or bad stocks. There are only stocks that rise in price and stocks that decline in price, and that price is based on the laws of supply and demand in the marketplace