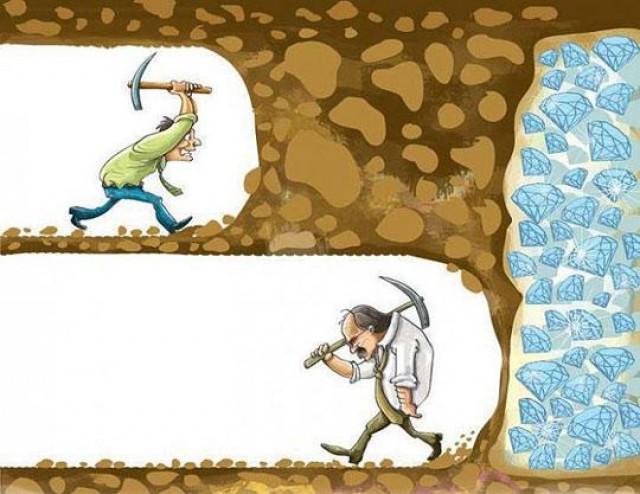

Perseverance

You stop trading your plan and start “shooting from the hip” you are losing or winning so you believe that you are above your own rules, you start trading your opinions instead of your plan.

When you actually disagree with the market and believe it is wrong and you are right. Price is reality wherever it is, your job is to trade trend and price action not your own opinion.

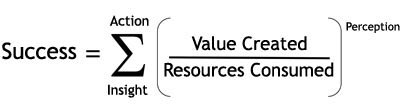

Expectancy along with position sizing are probably the two most important factors in trading/investing success. Sadly most people have never even heard of the concept.

Expectancy is the average amount you can expect to win (or lose) per rupee at risk.

Here’s the formula for expectancy:

Expectancy = (Probability of Win * Average Win) – (Probability of Loss * Average Loss)

As an example let’s say that a trader has a system that produces winning trades 30% of the time. That trader’s average winning trade nets 10% while losing trades lose 3%.

Expectancy, position-sizing and other aspects of money management are far more important than discovering the holy grail entry system or indicator(s). Unfortunately entry techniques are where the vast majority of books and talking heads focus their attention. You could have the greatest stock picking system in the world but unless you take these money management issue into consideration you may not have any money left to trade the system. Having a system that gives you a positive expectancy should be in the forefront of your mind when putting together a trading plan.

Many of you spend too much time worrying about things like other peoples trading signals, what price pattern it is you are looking at, which strike price to select, how to read implied volatility, etc when you haven’t constructed the basic tenets of portfolio management or asset allocation.

Many of you spend too much time worrying about things like other peoples trading signals, what price pattern it is you are looking at, which strike price to select, how to read implied volatility, etc when you haven’t constructed the basic tenets of portfolio management or asset allocation.

Shame on you.

To your defense, I can’t make any assumptions when I have no idea what your time frame is, what your financial standing is, your risk tolerance, your investing objectives, or anything else looks like about you. What I do know is this… I don’t care who you are or what you are trying to accomplish, you will not last long in the pursuit of becoming a decent trader without creating a firm foundation of these basic principles, which are…

Risk management- Plan your loss before planning your profit.

Diversification- Be bullish, be bearish, be involved in various groups/markets.

Proper Position Sizing- Trade small, trade safe.

Effective Trading Plan- Make sure your plan works, and/or makes money.

Cutting Losses Short- Enter a trade that offers a small loss.

Letting Winners Run- Don’t kill your winners.

Curbing Your Emotion- This is a bi product of trading small.

The speculator’s deadly enemies are: Ignorance, greed, fear and hope. All the statue books in the world and all the rule books on all the Exchanges of the earth cannot eliminate these from the human animal. |