I’ve noticed that my trading is more and more characterised by periods of doing a lot of trading, followed by periods of doing nothing except watching.

This seems to be a positive thing, as the old days consisted of trading every day no matter what the conditions, where as now I find that the markets will go into a mode that I just do not like the look of. In such cases if I try to force something, to “find a trade”, then I’ll get burned for sure.

To some degree I think this is because I have not yet spent much time on developing my strategies for trading insides large consolidation patterns. Of course it gets easier as they become more developed but by that time they are also getting old, and in the past I start making good trades in them just as they are about to end. The hard parts to trade are the start of trends / end of consolidation, and the end of trends / start of consolidation. These are times when the market is changing its basic mode, and are great places to lose money.

Archives of “January 13, 2019” day

rssDiagnosing trading problems.

1) Problems of training and experience – Many traders put their money at risk well before they have developed their own trading styles based on the identification of an objective edge in the marketplace. They are not emotionally prepared to handle risk and reward, and they are not sufficiently steeped in markets to separate randomness from meaningful market patterns. They are like beginning golfers who decide to enter a competitive tournament. Their frustrations are the result of lack of preparation and experience. The answer to these problems is to develop a training program that helps you develop confidence and competence in identifying meaningful market patterns and acting upon those. Online trading rooms, where you can observe experienced traders apply their skills, are helpful for this purpose.

2) Problems of changing markets – When traders have had consistent success, but suddenly lose money with consistency, a reasonable hypothesis is that markets have changed and what once was an edge no longer is profitable. This happened to many momentum traders after the late 1990s bull market, and it also has been the case for many scalpers after volatility came out of the stock indices. Here the challenge is to remake one’s trading, either by retaining the core strategy and seeking other markets with opportunity or by finding new strategies for one’s market. The answer to these problems is to reduce your trading size and re-enter a learning curve to become acquainted with new markets and methods. Figuring out how you learned the markets initially will help you identify steps you need to take to relearn new patterns.

3) Situational emotional problems – These are emotional stresses that are recent in origin and that interfere with decision making and performance. Some of these stresses might pertain to trading, such as frustration after a slump or loss. Some might stem from one’s personal life, as in a relationship breakup or increased financial pressures due to a new home or child. Very often these problems create performance anxieties by putting the making of money ahead of the placing of good trades. The answer to these problems is to seek out short-term counseling to help you gain perspective on the problems and cope with them effectively. (more…)

Modi Wave :Business Sentiment Indicator..Going Down Down Down

JOHN KENNETH GALBRAITH ON STOCK MARKET MEMORY LOSS

Where else but in the markets can short term memory loss be both beneficial and profitable?

Where else but in the markets can short term memory loss be both beneficial and profitable?

John Kenneth Galbraith, an economist, says the financial markets are characterized by…

“…extreme brevity of the financial memory. In consequence, financial disaster is quickly forgotten. In further consequence, when the same or closely similar circumstances occur again, SOMETIMES IN A FEW YEARS, they are hailed by a new, often youthful, and always extremely self-confident generation as a brilliantly innovative discovery in the financial and larger economic world. There can be few fields of human endeavor in which history counts for so little as in the world of finance.” [emphasis mine].

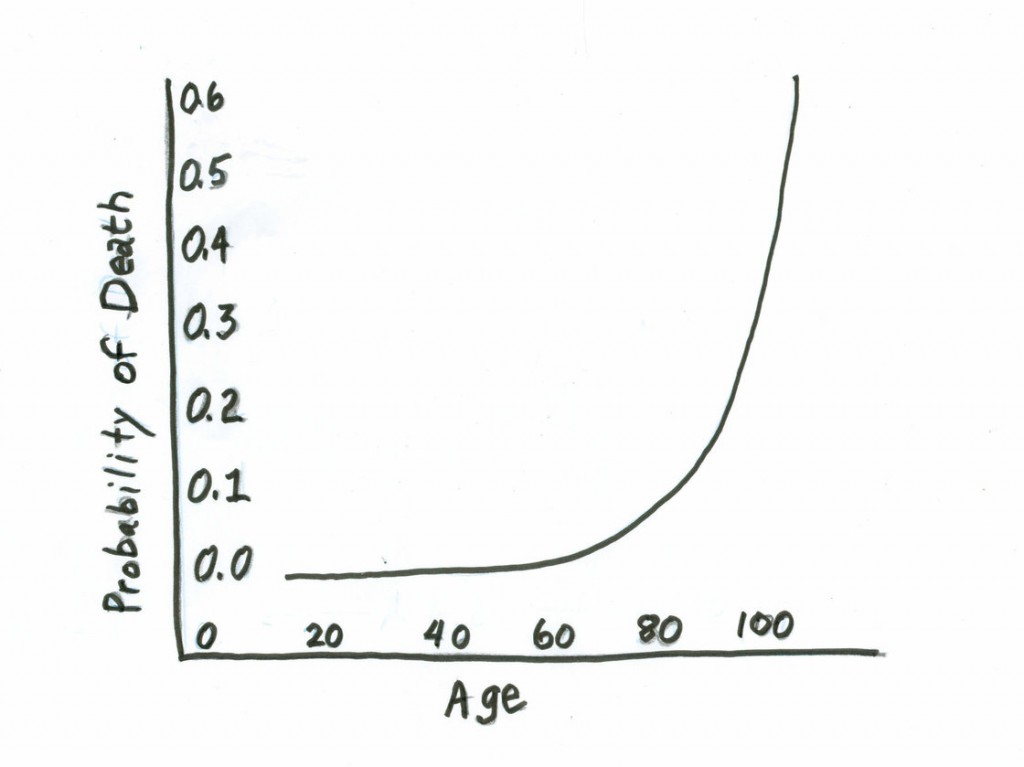

Every 8 Years, Your Chances of Dying Double

Robert Krulwich revisits the mysterious but true Gompertz Law of Human Mortality, named for the British actuary who had originally discovered this mathematical fact back in 1825.

via NPR:

Obviously, when you’re young (and past the extra-risky years of early childhood), the chances of dying in the coming year are minuscule — roughly 1 in 3,000 for 25-year-olds. (This is a group average, of course.)

But eight years later, the tables said, the odds will roughly double. ”When I’m 33 [the chances of my dying that year] will be about 1 in 1,500.”

And eight years after that…the odds double again: “It will be about 1 in 750.”

And eight years later, there’s another doubling. Looking down the chart, you’ll see that keeps happening and happening and happening. “Your probability of dying during a given year doubles every eight years.”

A helpful, if horrifying, chart:

Distribution goes logarithmic.

Coaching signals – math edition

1995 – 80 million (1% penetration) 2014 – 5.2 billion (73% penetration)

The Overt & Covert Danger of Leverage

Buying stocks with borrowed money doesn’t make anything a better investment or increase the probability of gains.

It merely magnifies whatever gains or losses may materialize. And then, leverage brings destruction if things go bad…really bad. And they often do.

Nassim Taleb says that we should judge people by the costs of the alternative, that is if history played out in another way.

As he wrote in his brilliant book Fooled by Randomness – “Clearly, the quality of a decision cannot be solely judged based on its outcome, but such a point seems to be voiced only by people who fail (those who succeed attribute their success to the quality of their decision).”

In the same way, be very careful of judging your stock market success by the outcome you achieve, but by the decision you made.

“Leverage can help me magnify my returns” is a great statement to make. But more often now, leverage – which is a result of arrogance created by good short-term returns or a result of survivorship bias, which is concentrating on the people or things that “survived” some process and inadvertently overlooking those that did not – will not only your destroy your savings and sleep, it will also destroy your reputation. (more…)

What characterizes great and successful traders

Conclusion:Isolate yourself from the opinions of other people. Make trading decisions your own. Focus on proper execution. Have the courage to do the right thing because it is right.