Countries by S&P credit rating

Lehman by TBP_Think_Tank on Scribd

1. Be with the trade you are in at the moment. Stop trying to control anything but your own trade. The markets are going to do exactly what they want to and when they want to. YOU have the power to control what YOU feel, think, believe and do.

1. Be with the trade you are in at the moment. Stop trying to control anything but your own trade. The markets are going to do exactly what they want to and when they want to. YOU have the power to control what YOU feel, think, believe and do.

2. All that matters for you is the trade you are in. You may never see that trade again. Savor it, cherish it and be with it for as long as it lasts.

3. Celebrate your victories with yourself. Celebrate the trade and with the trade. The instruction is to refrain from boasting or grandiose behavior when you make a winning trade. The markets will humble you, and pride always comes before a fall. Napoleon said that the most dangerous moments come with victory. Decry and avoid hubris.

Also celebrate your defeats with yourself and the trade because they are mistakes. Mistakes are our greatest teachers because it is through them that we learn. What do we learn? Not to make them again!

Constantly strive to look inward, to know yourself, to raise yourself to the highest level of authenticity. Be rigorously honest about who you are.

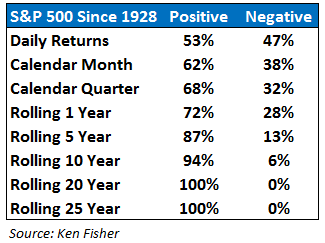

You can see that daily returns in the market are more or less a fifty-fifty proposition. Since loss aversion means that losses make us feel worse than gains make us feel better by a factor of 2:1, this means that if you check the value of your stock portfolio on a daily basis, you will feel terrible every single day.

Every good feeling you get from gains will get completely wiped out by the terrible feelings from the down days. But lengthen your time horizon and the effects of loss aversion slowly start to fade. (more…)

The 10 Bad Habits of Unprofitable Traders

Legendary short seller Jim Chanos gave an extensive interview to Salon.com about how to spot fraud and corruption in business.

It’s an incredible coincidence that the story was published today, since the news broke that former Enron CEO Jeff Skilling, a man Chanos helped put behind bars, could be getting out of jail early.

Enron is held up as the paragon of 1990s corporate greed. There, not everything was as it seemed despite excellent press all over the business world and a great reputation.

The point is that companies can build amazing brands without being amazing businesses, and as Chanos points out, part of that brand can be doing charity work. (more…)

Pre-market

After market close

Obviously, any questions that are repeatedly marked with a ‘No’ or an ‘X’ over a period of time will clearly highlight what you need to work on.

Finally, note how these questions make no reference to whether you made a profit or a loss. You can break every trading rule on a given day and make money. You can also trade perfectly on a given day in accordance with your rules and lose money.

The thing is, the more faithful you are to your process, you increase the probabilities of being successful over the long-term. Creating good habits will help you achieve this.