Here is a checklist that might be useful for self-evaluation:

1) Have you experienced one or more recent large losses in markets that shook you emotionally?

2) Have you experienced a recent painful loss in your personal life that has left you feeling more vulnerable in your finances and/or your personal sense of security?

3) Have you experienced a recent threat to personal safety that shook you emotionally, such as a violent attack or a serious accident?

4) Do you find yourself emotionally “overreacting” to what should be normal trading stresses and losses? Are you experiencing significant anxiety, frustration, anger, or depressed feelings when trades don’t work out?

5) Do you find yourself “overreacting” in your trading behaviors during what should be times of normal stress? Are you freezing up and not acting on your ideas or impulsively lurching into trades after losing periods in markets?

6) Do you look back on your trading and feel confusion, shame, or puzzlement over actions that you took that run completely contrary to your plans for the day?

7) Have you tried to reduce your emotional and/or behavioral reactivity to markets, only to see the same destructive patterns return during times of stress? (more…)

Archives of “January 11, 2019” day

rssWhat To Expect in Year 2020 ?

Really We are Progressing………………………Very Fast !

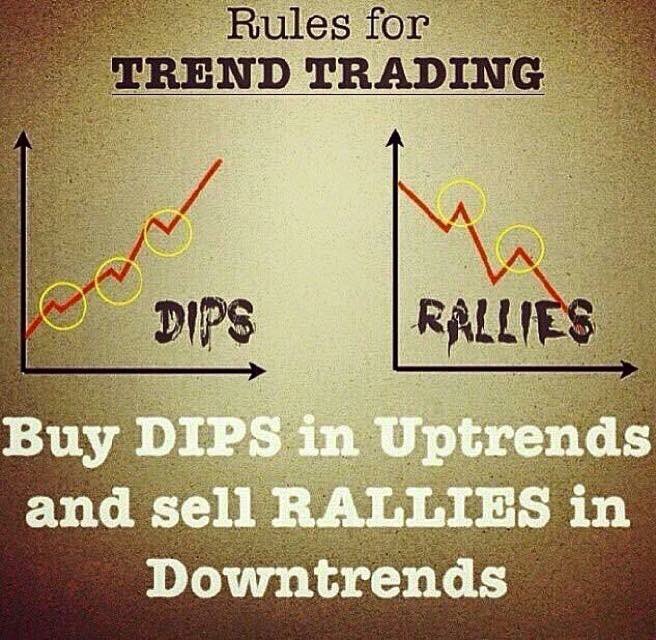

No Brainer :Simple Rule For Trend Trading

Trading Facts

-All traders have their own opinions.

-Yes, but traders who invent their own facts go broke

Politics Determine who has the Power ,not who has truth

10 Rules for Traders

Never add too a losing trade. In adding to a losing trade you are already wrong but now become more wrong with a bigger trading size. Adding to losers makes you a counter trend trader that usually ends badly.

- Never lose more than 1% to 2% of your trading capital on any one trade. This means use position sizing and stop losses so when you are wrong the loss is not a big deal.

- Never trade anything you do not understand 100%. Stay away from trading futures, forex, or options until you understand the risk and how exactly they work.

- Always trade with the trend in your own time frame.

- Only look for low risk, high reward, high probability setups , when there is nothing to trade, trade nothing.

- Trade the chart and price action, not your own opinions or predictions.

- You have to trade your own way, the trading style that you are comfortable with that fits you.

- If you do not have a full trading plan with rules on entries, exits and risk management stop trading until you create one.

- The size of your wins and losses ultimately determine your trading success regardless of your winning percentage.

Your risk management rules will ultimately determine the success of your technical trading system.

Well said…

Mysterious, woman-like figure captured on Mars by NASA’s Curiosity rover- VIDEO

Know Yourself & Educate Yourself

Know yourself– Understand what style fits your personality. Can you hold a position for a few days or only a few hours? Are you okay with larger draw downs or can you only take small ones? Are you more comfortable trading pullbacks or breakouts? Most importantly, don’t try to use a style that doesn’t “fit” your personality.

Educate yourself – But don’t over educate yourself or fall into the trap of reading to many biographical trading books. They may be entertaining, but you will learn little about the current state of trading. Stick to my ”Holy Trinity” of books “How To Make Money In Stocks” by O’Neil, “The Disciplined Trader” by Mark Douglas, and “The StockTwits Edge” by Howard Lindzon. The rest you can learn from online trading communities and blogs.

Quotes by Paul Tudor Jones II

Paul Tudor Jones II is one of the most successful hedge fund managers. He has never suffered a losing year. His fund has returned 23% annualized gain since its inception in 1986. Paul Tudor is a momentum trader, who believes that price move and trend unfold only because of investors’ behavior.

Markets have consistently experienced “100-year events” every five years. While I spend a significant amount of my time on analytics and collecting fundamental information, at the end of the day, I am a slave to the tape and proud of it.

I see the younger generation hampered by the need to understand and rationalize why something should go up or down. Usually, by the time that becomes self-evident, the move is already over.

There is no training — classroom or otherwise — that can prepare for trading the last third of a move, whether it’s the end of a bull market or the end of a bear market. There’s typically no logic to it; irrationality reigns supreme, and no class can teach what to do during that brief, volatile reign. The only way to learn how to trade during that last, exquisite third of a move is to do it, or, more precisely, live it.

Fundamentals might be good for the first third or first 50 or 60 percent of a move, but the last third of a great bull market is typically a blow-off, whereas the mania runs wild and prices go parabolic.