Archives of “January 7, 2019” day

rss10 Thoughts from Mark Douglas

1. The four trading fears

95% of the trading errors you are likely to make will stem from your attitudes about being wrong, losing money, missing out, and leaving money on the table – the four trading fears

2. The proverbial empathy gap

You may already have some awareness of much of what you need to know to be a consistently successful trader. But being aware of something doesn’t automatically make it a functional part of who you are. Awareness is not necessarily a belief. You can’t assume that learning about something new and agreeing with it is the same as believing it at a level where you can act on it.

3. The market doesn’t generate happy or painful information

From the markets perspective, it’s all simply information. It may seem as if the market is causing you to feel the way you do at any given moment, but that’s not the case. It’s your own mental framework that determines how you perceive the information, how you feel, and, as a result, whether or not you are in the most conducive state of mind to spontaneously enter the flow and take advantage of whatever the market is offering. (more…)

Doing Bla Bla on Channels Very Easy-Trading is Really Difficult

Book Review : The Disciplined Trader by Mark Douglas

This is one heck of a slow read. Douglas dangles a carrot in front of you each chapter saying ” I will show you how to do this”; but never actually does! I thought there was quite a bit of carry over between this book and “Trading in the Zone”, so by one or the other but on the whole I would say Trading in the Zone would be the one to plump for as there are more trading references. In The Disciplined Trader Douglas does go off on a tangent for many pages and you wonder whether you are reading a book on amateur psychology.

This is one heck of a slow read. Douglas dangles a carrot in front of you each chapter saying ” I will show you how to do this”; but never actually does! I thought there was quite a bit of carry over between this book and “Trading in the Zone”, so by one or the other but on the whole I would say Trading in the Zone would be the one to plump for as there are more trading references. In The Disciplined Trader Douglas does go off on a tangent for many pages and you wonder whether you are reading a book on amateur psychology.

The first 5 Chapters read well with some nice takeaways even in the Intro and Preface. Such as defining Self Confidence as “an absence of fear and self-trust”. I think we all know what he means ny that definition don’t we ?!

Chapters 6 thru to 14 were laboured in my view. Where the depth of Douglas’ attempt to describe the mental state of the trader really was a little abstract at times and to be honest lost me.

For me the best bit of the book was his penultimate chapter on the Steps for Success :

1)Stay focussed on what you need to learn

2)Deal with Losses

- Predefine the loss at time of trade is vital

- Execute them immediately on their occurence

3)Become an expect at just one market behaviour

4) Learn how to execute your trading system flawlessly

5) Learn to think in Probabilities

6) Learn to be Objective

- You feel no Pressure to do anything

- You have no feelings of fear

- You have no sense of rejection

- There is no right or wrong

- You recognise what the market is telling you and you know what you have to do

- You can observe the market from the perspective of not being in a position even when you are.

- You are not focussed on money but the structure of the market

7) Learn to Monitor yourself

So if you can borrow this from a friend, download it as an e-book cheaply or get a 2nd hand one on ebay for the beginning third and last 2 chapters – it’s worth it.

Must Read…….!!

The Zen of Trading

This is the “Zen of Trading;” It is more than an overview — it’s an investment philosophy that can help you develop an investing framework of your own.

1. Have a Comprehensive Plan: Whether you are an investor or active trader, you must have a plan. Too many investors have no strategy at all — they merely react to each twitch of the market on the fly. If you fail to plan, goes the saying, then you plan to fail.

Consider how Roger Clemens approaches a game. He studies his opponent, constructs his game plan and goes to work.

Investors should write up a business plan, as if they were asking a Venture Capitalist for start-up money; just because you are the angel investor doesn’t mean you should skip the planning stages.

2. Expect to Be Wrong: We’ve discussed this previously, but it is such a key aspect of successful investing that it bears repeating. You will be wrong, you will be wrong often and, occasionally, you will be spectacularly wrong.

Michael Jordan has a fabulous perspective on the subject: “I’ve missed more than 9,000 shots in my career. I’ve lost almost 300 games. Twenty six times, I’ve been trusted to take the game-winning shot and missed. I’ve failed over and over and over again in my life. And that is why I succeed.”

Jordan was the greatest ball player of all time, and not only because of his superb physical skills: He understood the nature and importance of failure, and placed it appropriately within a larger framework of the game.

The best investors have no ego tied up in a trade. Those who refuse to recognize the simple truism of “being wrong often” end up giving away unacceptable amounts of capital. Stubborn pride and lack of risk management allow egotists to stay in stocks down 30%, 40% or 50% — or worse.

3. Predetermine Stops Before Opening Any Position: Sign a “prenuptial agreement” with every stock you participate in: When it hits some point you have determined before you purchased it, that’s it, you’re out, end of story. Once you have come to understand that you will be frequently wrong, it becomes much easier to use stop-losses and sell targets.

This is true regardless of your methodology: It may be below support or beneath a moving average, or perhaps you prefer a specific percentage amount. Some people use the prior month’s low. But whatever your stop-loss method is, stick to it religiously. Why? The prenup means you are making the exit decision before you are in a trade — while you are still neutral and objective.

4. Follow Discipline Religiously: The greatest rules in the world are worthless if you do not have the personal discipline to see them through. I can recall every single time I broke a trading rule of my own, and it invariably cost me money.

RealMoney’s Chartman, Gary B. Smith, slavishly follows his discipline, and he notes that every time some hedge fund — chock full of Nobel Laureates and Ivy League whiz kids — blows up, the mea culpa is the same: If only we hadn’t overrode the system.

In Jack Schwager’s seminal book Market Wizards, the single most important theme repeated by each of the wizards was the importance of discipline. (more…)

A Critical Difference between Good Traders /Average Traders

Knowledge and hard work will help you become successful. But it is attitude that takes you all the way!

10 brilliant quotes by WarrenBuffett

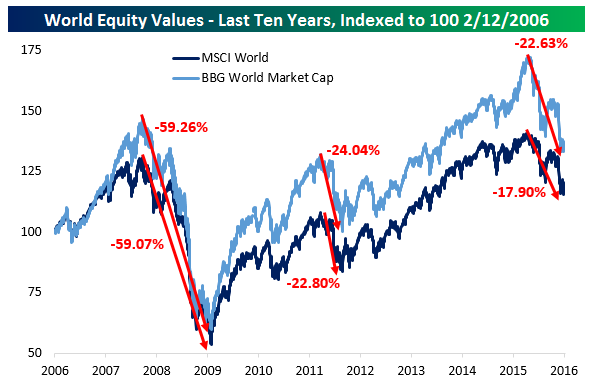

World Equity Values – Last Ten Years, Indexed to 100

Niederhoffer and the type of investor who blows up w/derivatives.