1. Have a plan before you initiate a trade. A detailed trading plan is your blueprint to success. It will help you define you as a trader, the way you trade, will help you find, execute and manage trades with ease and most importantly will help you put the education puzzle together.

2. Always analyze all closed trades, winners and losers. Having a trading journal will help you identify what works for you and what not; it will funnel you in the right direction. It is by far the most helpful method of personal trading introspection.

3. Maintaining a positive trading attitude will improve your money management and risk management skills. A negative trading mentality will alter your thinking and mindset. Your attitude will determine whether or not you are profitable with your trading. Your attitude is more important than your market knowledge and even your level of experience. It is important how you react to the market and not what the market will do to you.

4. Controlling Emotions. Emotional swings and emotional stresses impact your mental state of mind and will affect your trading decisions. When you trade with emotions you don’t trade clearly and rationally. Some books talk about separating your emotions from trading. But how is this possible? To even try to separate emotions is like fighting a losing battle, taking control over them that is a different story. Trading involves the most emotional COMMODITY in the world which is….money. Money outlasts hate, love, greed and anything else you can ever imagine. The only way to control your emotions as a trader is to have a solid trading plan.

5. Trade in the zone –Focus is key in trading. Make sure you are do not have any distractions around, no internet browsing, no phone answering, no kids playing, it should be just you and the charts. Let the charts speak to you and they will tell you what to do. (more…)

Archives of “January 6, 2019” day

rssPatience pays :Unexpected Money !

And Just see …In this series ,I had recomemmended to Buy :

Wel.Corp ,NLIGNITE ,SCI ,VIDEOCON ,MLL & GE Shipping

Now every 2nd person is running for these stocks……….!!

Do u Know……..Why ?

Because they dont know to look at chart ,While u Trade always keep stoploss mentioned for Particular stock (Don’t be rigid in loss or while making Profit )

Lack of “patience” and “discipline.”

While these two virtues are over-worked and very often mentioned when determining what unsuccessful traders lack, not many will argue with their merits. Indeed. Don’t trade just for the sake of trading or just because you haven’t traded for a while. Let those very good trading “set-ups” come to you, and then act upon them in a prudent way. The market will do what the market wants to do — and nobody can force the market’s hand.

You All Need 4 things :Money ,Mind ,Method & Target !!

(Everybody is having Money ,Mind (Not for Trading purpose )…Nobody is having Method and 101% No Trader is having Target (In a Day …What to Expect ?Or in Week or in Month)

Updated at 8:01/29th Sept/Baroda

Trading and alpine climbing

“To climb mountains is to make decisions…. Good decisions are contextual, based on actual circumstances, and cannot be reduced to a set of rules…. In fact rules, guidelines, and codes, although useful for introducing concepts, ultimately become counterproductive when it comes to actually making choices… The simplest climb involves circumstances far too complex to be adequately addressed by rules. The mountain environment itself forces you to rely on your own skills of observation, your understanding of what you observe, and an accurate assessment of risks and of your own abilities.”

“To climb mountains is to make decisions…. Good decisions are contextual, based on actual circumstances, and cannot be reduced to a set of rules…. In fact rules, guidelines, and codes, although useful for introducing concepts, ultimately become counterproductive when it comes to actually making choices… The simplest climb involves circumstances far too complex to be adequately addressed by rules. The mountain environment itself forces you to rely on your own skills of observation, your understanding of what you observe, and an accurate assessment of risks and of your own abilities.”

The authors continue: “Rules must be replaced by that mysterious quality called judgment. The acquisition of judgment begins with a mountaineer’s very first climb and continues throughout the climber’s entire career. It is a process that cannot be bypassed nor ever be considered complete.”

Principles that help guide decision making are:

Anticipate changes. “Continually look forward. Every change in terrain, route difficulty, or hazard may require a new strategy, mode of movement, or protective system to deal with new circumstances.” (p. 15)

Keep options open. “Any given decision can either maximize or limit other possible options in the future.”

Analyze benefits and costs. “Addressing one risk or solving one problem often entails introducing other risks or aggravating other problems.”

Maintain momentum. “Staying focused on forward movement means always being a little bit stressed, but in such a potentially dangerous environment, some level of stress is, arguably, appropriate.”

Gather information. “Preparing ahead of time will give you a head start…. Above all, remember what you see. Every glimpse is a new piece of the puzzle.”

Recognize and correct errors. “Rather than expecting perfection, strive to recognize errors as early as possible, and take steps to correct the situation. Do not carry on blindly, hoping that everything will work out. Denial causes delay, piling error upon error until only good luck can prevent things from spiraling out of control.” (p. 16)

Assess your own skill and knowledge. “An honest and dispassionate self-critique is indispensable. For example, the capacity to observe, predict, and respond to cues improves over time, just as movement skills and climbing ability improve with practice; but on the other hand, competence can be degraded temporarily by states such as fear or fatigue or by inadequate information and inaccurate perception.” (p. 17)

Alpine climbers take on considerably more risk than traders. After all, traders lose only money; climbers can lose their lives. But the way to the top demands similar decision-making processes.

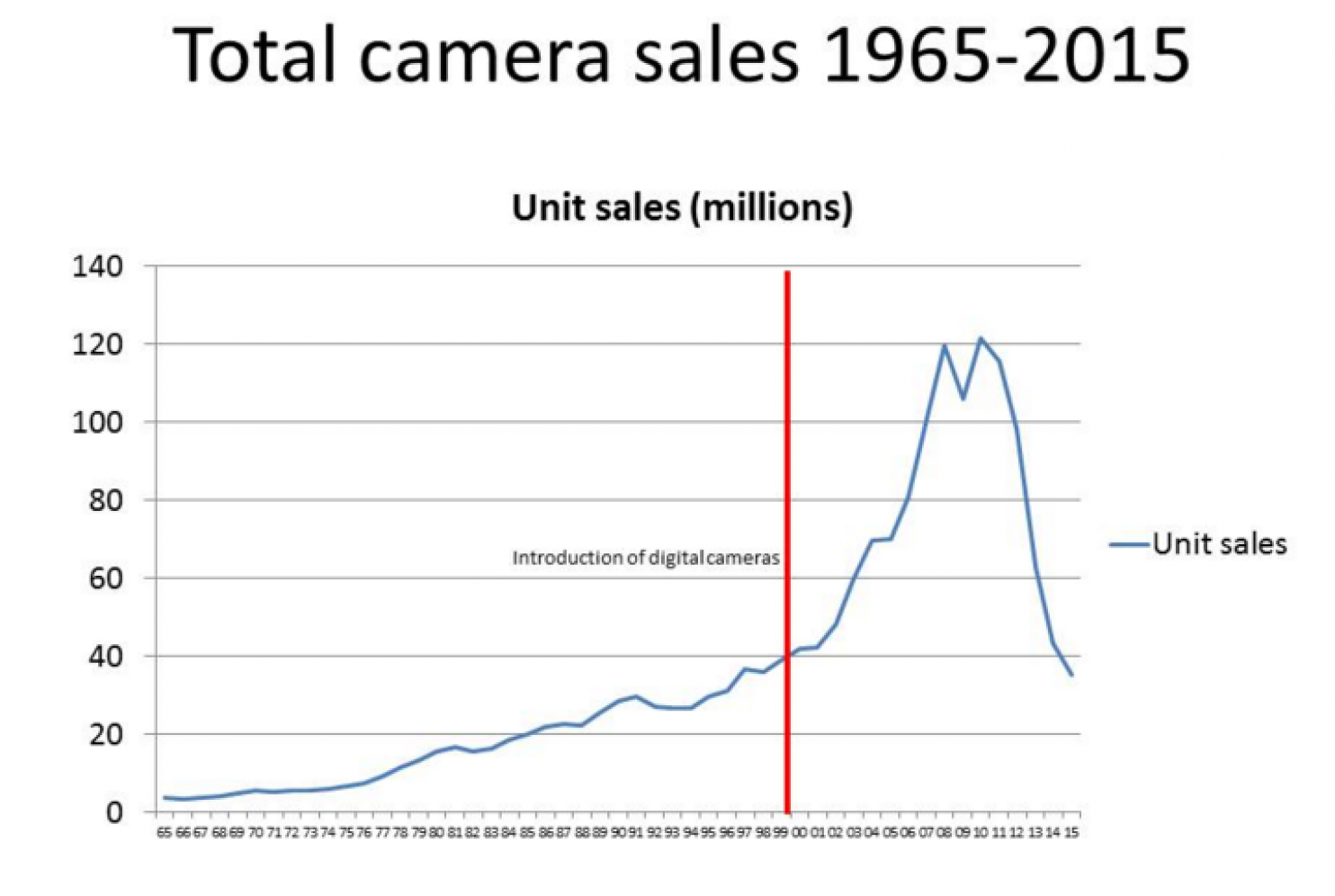

What the iPhone has done to cameras is completely insane

Reaction in Your Brain When Your Market View Is Completely Wrong

Eric Barker has a new article (link here) on how to win every argument. The article had a point which made me think whether the same situation happens in trading.

So it quoted an experiment by psychologist Drew Westen, which showed to supporters, footage of their favorite candidates completely contradicting himself. The experiment found that as soon as the people realized that the information contradicted their world view, the parts of the brain that handle reason and logic went dormant, while the parts of the brain that handle hostile attacks – the fight-or-flight response – lit up. Essentially logic gets thrown out the window, and it just becomes a fight where you do anything to win.

So it quoted an experiment by psychologist Drew Westen, which showed to supporters, footage of their favorite candidates completely contradicting himself. The experiment found that as soon as the people realized that the information contradicted their world view, the parts of the brain that handle reason and logic went dormant, while the parts of the brain that handle hostile attacks – the fight-or-flight response – lit up. Essentially logic gets thrown out the window, and it just becomes a fight where you do anything to win.

A similar situation occurs in trading, when you have a certain expectation of how the market should behave. E.g. you might for various reasons, think that the market will go up. So when the market does not follow what you expect, you might initially make up excuses for it. However when the market continues to go completely in the opposite direction of what you expect, your logic and reasoning centers would shut down, your fight-or-flight response kicks in, you treat it like a hostile attack on you, and you would do anything to win (or not lose), e.g. keep averaging down. I’m sure this sequence of events led to many traders blowing up their accounts. It is pretty interesting that the experiment showed this as a ‘natural expected’ behavior.

As always, trade what you see, not what you think.

Favorite passage from the 1934 edition of Benjamin Graham's SECURITY ANALYSIS. It never grows old.

Women

Do you know the relation between two eyes?

Do you know the relation between two eyes?

They never see each other………. BUT

They blink together

They move together

They cry together

They see things together

They sleep together

They share a very deep bonded relationship

However, when they see a woman, one will blink and another will not.

Moral of the story: Woman can break any kind of relationship!!!

Who’s won the most Nobels? USA.

Our AIM -Mint Money 24x7x 366 Days ,Yes to Remain in 5% Winning Segment only.

Average net connection speed

1 S. Korea 2 Hong Kong 3 Japan 4 Singapore 5 USA 6 UK 7 Canada 8 Russia 9 GRM 10 POL