Archives of “January 5, 2019” day

rssTraders' Resolutions for the New Year-2013

What are our top trading resolutions for 2013?

D iscipline

R esults

I ntegrity

V ictory (Over Emotions)

E ducation

Discipline

Most traders could benefit from being more disciplined with their trading. Discipline in trading takes many forms. But it can be summarized as just doing what we know needs to be done.

For example, a common New Year’s resolution is to lose weight. Losing weight is simple in theory—we just need to eat healthy foods and exercise more. Just say no to the doughnut and yes to the salad—simple! Of course, sticking to your plan is anything but easy, which is where discipline comes into play. Just do what we know needs to be done.

If I could target only two things to be more disciplined in next year’s trading they would be:

- Cut losing trades: Do everything to keep losses small.

- Let profits run: Don’t fall prey to the fear of a small profit slipping away. (more…)

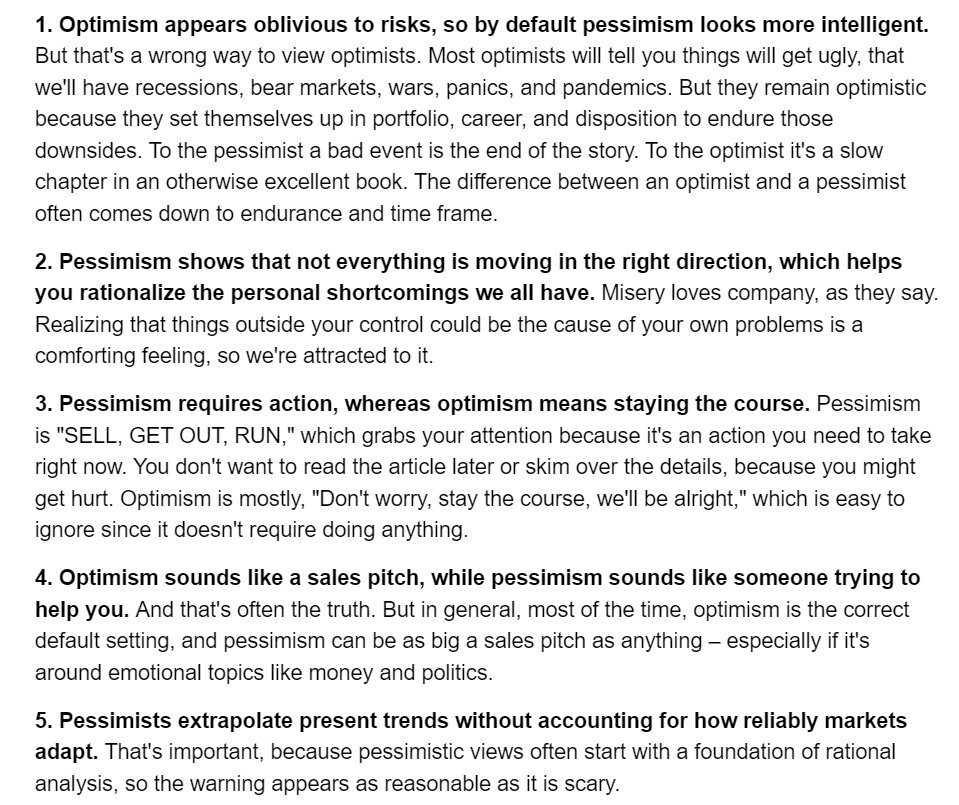

Optimism vs. pessimism in markets.

ALERT :RBI Tax to dry FII Tap ?

Foreign investors funneled more than $15 billion to Indian equities in 2009, sending stocks up more than 75% and strengthening the rupee . With expected positive growth rates for the year and higher interest rates differentials that favor emerging markets, investors are looking to India as a good place to stash their wealth.

Foreign investors funneled more than $15 billion to Indian equities in 2009, sending stocks up more than 75% and strengthening the rupee . With expected positive growth rates for the year and higher interest rates differentials that favor emerging markets, investors are looking to India as a good place to stash their wealth.

The Reserve Bank of India (RBI) has already taken the necessary precautions to stave off a potential asset bubble forming in India’s stock and real estate markets. India’s officials are welcoming the fund inflows with open arms, but Finance Minister Pranab Mukherjee says monetary tools will be implemented if inflows become disruptive to the economy.

RBI could stem inflows by:

We are expecting very soon by Next month or First week Jan’10

- Imposing taxes on inflows; this is considered to be the most likely tactic the government would take, especially when it comes to inflows that could lead to a housing bubble

- Auctioning quotas for foreign credit to increase the cost of raising funds

- Using market intervention bonds and raising cash reserve ratios

"Never buy or sell on a broker's judgment..The brokers borrow their feelings from the market"

Everyone is afraid of each other

The warrior of the light knows: everyone is afraid of each other.

This fear can generally be seen in two forms: through aggression, or through submission. They are two sides of the same problem.

That is why, upon being confronted by a someone who inspires terror, the warrior recalls: the other man is insecure, stressed, or scared. He has overcome similar obstacles, and has lived the same problems.

But he knows how to deal with the situation better.

Why? Because he uses fear as a motor, not as a brake.

Thus the warrior learns from his opponent, and keep cool, waiting for the storm to pass

Listen to Market

The market has a lot to say, just pay attention and you will find loads of useful information. For example, the principle “Do not add to your positions unless the markets prove it”. This is shockingly true in the Futures markets. The players in the futures markets are generally those with high risk appetite. Most of the time they are well equipped, skilled and well informed. It is not a surprise that they are correct most of the time.

The market has a lot to say, just pay attention and you will find loads of useful information. For example, the principle “Do not add to your positions unless the markets prove it”. This is shockingly true in the Futures markets. The players in the futures markets are generally those with high risk appetite. Most of the time they are well equipped, skilled and well informed. It is not a surprise that they are correct most of the time.22- Books Everyone Should Read on Psychology and Behavioral Economics

In no order and with no attribution:

- Risk Savvy: How to Make Good Decisions by Gerd Gigerenzer

- The Righteous Mind: Why Good People Are Divided by Politics and Religion by Jonathan Haidt

- The Checklist Manifesto: How to Get Things Right by Atul Gawande

- The Darwin Economy: Liberty, Competition, and the Common Good by Robert H. Frank

- David and Goliath: Underdogs, Misfits, and the Art of Battling Giants by Malcolm Gladwell

- Predictably Irrational, Revised and Expanded Edition: The Hidden Forces That Shape Our Decisions by Dan Ariely

- Thinking, Fast and Slow by Daniel Kahneman

- The Folly of Fools: The Logic of Deceit and Self-Deception in Human Lifeby Robert Trivers

- The Hour Between Dog and Wolf: Risk Taking, Gut Feelings and the Biology of Boom and Bust by John Coates

- Adapt: Why Success Always Starts with Failure by Tim Harford

- The Lessons of History by Will & Ariel Durant

- Poor Charlie’s Almanack

- Passions Within Reason: The Strategic Role of the Emotions by Robert H. Frank

- The Signal and the Noise: Why So Many Predictions Fail–but Some Don’tby Nate Silver

- Sex at Dawn: How We Mate, Why We Stray, and What It Means for Modern Relationships by Christopher Ryan & Cacilda Jetha

- The Red Queen: Sex and the Evolution of Human Nature by Matt Ridley

- Introducing Evolutionary Psychology by Dylan Evans & Oscar Zarate

- Filters Against Folly: How To Survive Despite Economists, Ecologists, and the Merely Eloquent by Garrett Hardin

- Games of Strategy (Fourth Edition) by Avinash Dixit, Susan Skeath & David H. Reiley, Jr.

- The Theory of Political Coalitions by William H. Riker

- The Evolution of War and its Cognitive Foundations (PDF) by John Tooby & Leda Cosmides.

- Fight the Power: Lanchester’s Laws of Combat in Human Evolution by Dominic D.P. Johnson & Niall J. MacKay.

Which Dictator Killed The Most People ?

Before the Trade

1. Do you know the name and numbers of all your counterparts, especially if your equipment breaks down?

2. When does your market close, especially on holidays?

3. Do you have all the equipment you’ll need to make the trade, including pens, computers, notebooks, order slips, in the normal course and in the event of a breakdown?

4. Did you write down your trade and check it to see for example that you didn’t enter 400 contracts instead of the four that you meant to trade?

5. Why did you get into the trade?

6. Did you do a workout?

7. Was it statistically significant taking into account multiple comparisons and lookbacks?

8. Is there a prospective relation between statistical significance and predictivity?

9. Did you consider everchanging cycles?

10. And if you deigned to do a workout the way all turf handicappers do, did you take into account the within-day variability of prices, especially how this might affect your margin and being stopped out by your broker?

11. If a trade is based on information, was the information known to others before you?

12. Was there enough time for the market to adjust to that information?

13. What’s your entry and exit point?

14. Are you going to use market, limit or stop orders?

15. If you don’t get a fill how far will you go? And what is your quantity if you get filled on all your limits?

16. How much vig will you be paying if you use market or limit orders and how does that affect the workouts you did knowing that if you use stops you are likely to get the worst price of the day and all your workouts will be worthless because they didn’t take into account the changing price action when you use stops, to say nothing of everchanging cycles?

17. Are you sure your equipment is as good and as fast as the big firms that take out 100 million a day with equipment that takes into account the difference between being 100 yards away from an exchange and the time it takes the speed of light to reach you?

18. Are you going to exit at a time or based on a goal? And did you take into account what Jack Aubrey always did which is to have an escape route in case all else fails?

19. What important announcements are scheduled? and how does this affect when and what kind of order to use? For example, a limit before employment is likely to be down a percent or two in a second. Or else you won’t get filled and you’ll be chasing it all day.

20. Did you test how to change your size and types of orders based on announcements?

21. What’s the money management on this trade?

22. Are you in over your head?

23. Did you consider the changing margin requirements when the market gets testy or the rules committee with a position against you increases the margins against you?

24. How will a decline in price affect your margin and did you take into account what will happen when you get stopped out because of margin?

25. What will happen if you need some money for living expense or family matters during the trade? Or if you have to buy a house or lend money to a friend? (more…)