Archives of “January 5, 2019” day

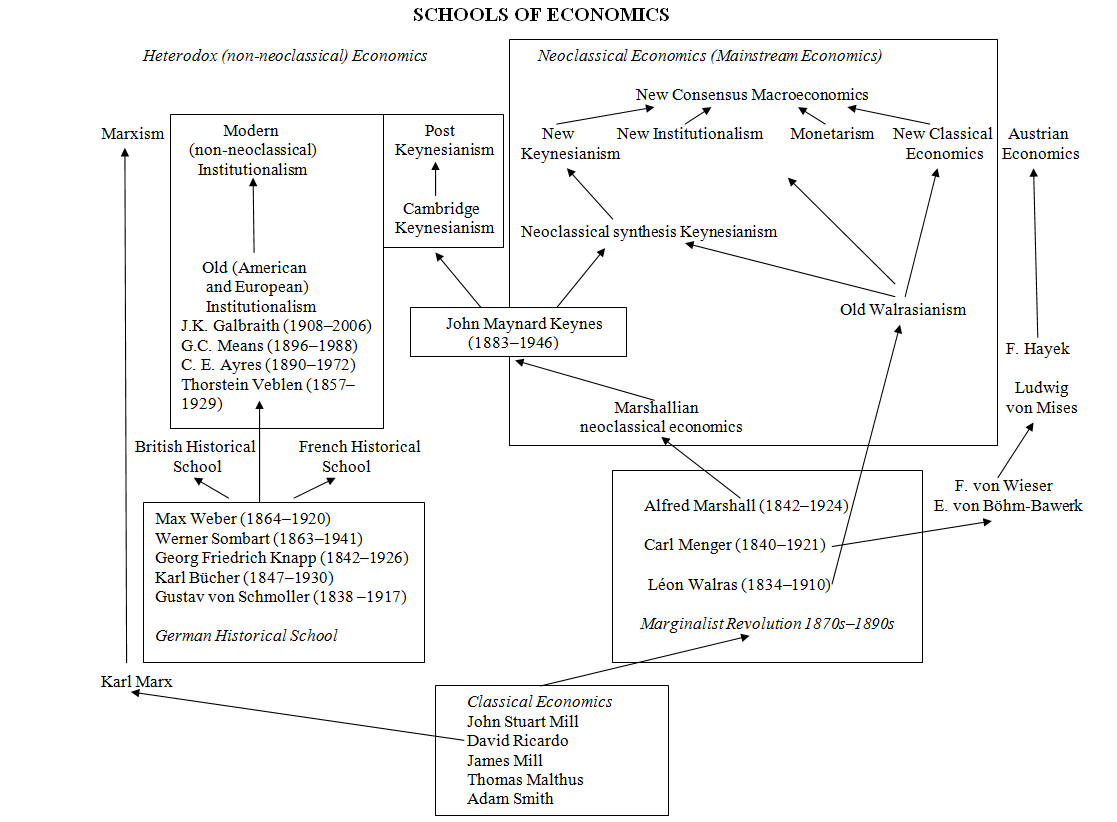

rssSchools of Economics

The mindset of a successful trader

A TRADER’S PRAYER

Stock and options trading is difficult to master, much like life at times. We all go through times of hardship. I believe our country (and world) is going through one right now. But difficult times have come and gone in the past and I have faith that this is just another one of those times. Here is my prayer for the trader…in and out of the charts.

May the sun always shine bright with energy when rising and glimmer with comfort in descent

May your charts whisper to your burning ears

May your flowers be full of bees and your weeds choke on fallen nectar

May your wins humble and your losses teach

May still waters massage your aches and clean water quench your thirst

May fear give way to peace and greed surrender to charity

May the eyes of a child sooth the wrinkles of age

May a logical life give new meaning to an illogical chart

May you outlive your mother and father and die honored before your children

May the life within bring beauty to the life without

Top 10 Reversal Candle stick Patterns

Would You Bet Your $ on These Two?

Respect the Trend

One of my favorite trading tales involves a very wise, veteran trader who, when asked his thoughts on the market, would simply respond by saying “It’s a bull market,” or “It’s a bear market.” Younger traders simply seeking out a hot tip from the seasoned pro would often leave discouraged – or even annoyed, believing they were being fed a line. JL himself didn’t understand until years later the wisdom that was actually being dispensed with those words: The veteran was simply relaying the path of least resistance, or the trend for the general market, and therefore giving the trader an incredible edge in determining one of the many variables that makes up stock trading. (more…)

Paul Tudor Jones-Tells us what advice he would give to his 18-year-old self -Video

24 Quotes from Reminiscences of a Stock Operator

Reminiscences of a Stock Operator is one of them, I think. I have come cross that book several times in many reading list, but somehow, I skipped it. Until last month. Finally i decided to give a go to that book. And i regret that i have not read it before. I am amazed with its style and frankness and still contemporary, relevant content, after almost a century. It is a book, it deserves to be read more than once and if not, some parts must be noted down to go through time to time. Therefore, i extracted some quote from the book, for future references.

Reminiscences of a Stock Operator is one of them, I think. I have come cross that book several times in many reading list, but somehow, I skipped it. Until last month. Finally i decided to give a go to that book. And i regret that i have not read it before. I am amazed with its style and frankness and still contemporary, relevant content, after almost a century. It is a book, it deserves to be read more than once and if not, some parts must be noted down to go through time to time. Therefore, i extracted some quote from the book, for future references.You don't need to nail the big call. Get things "about right" most of the time.

One of my favorite trading tales involves a very wise, veteran trader who, when asked his thoughts on the market, would simply respond by saying “It’s a bull market,” or “It’s a bear market.” Younger traders simply seeking out a hot tip from the seasoned pro would often leave discouraged – or even annoyed, believing they were being fed a line. JL himself didn’t understand until years later the wisdom that was actually being dispensed with those words: The veteran was simply relaying the path of least resistance, or the trend for the general market, and therefore giving the trader an incredible edge in determining one of the many variables that makes up stock trading.

One of my favorite trading tales involves a very wise, veteran trader who, when asked his thoughts on the market, would simply respond by saying “It’s a bull market,” or “It’s a bear market.” Younger traders simply seeking out a hot tip from the seasoned pro would often leave discouraged – or even annoyed, believing they were being fed a line. JL himself didn’t understand until years later the wisdom that was actually being dispensed with those words: The veteran was simply relaying the path of least resistance, or the trend for the general market, and therefore giving the trader an incredible edge in determining one of the many variables that makes up stock trading.