Dramatic move late

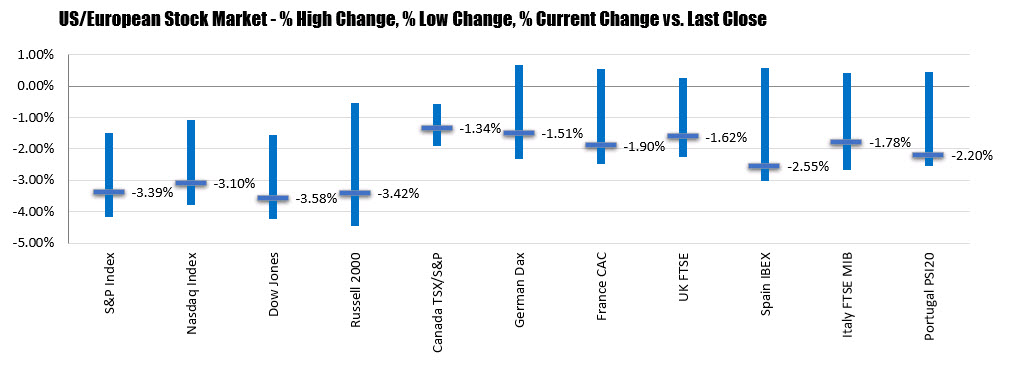

The S&P 500 finished the day down just 24 points at 2954 in a big win for the bulls late in the day.

The index gained more than 70 points in the final 15 minutes of trading in a huge bid, that was likely helped by month-end rebalancing. The huge rallies in bond and selling in stocks this month left pensions and other balanced funds heavily overweight bonds, so they’re forced to buy to get back on target.

There may also be hopes for an emergency Fed cut on the weekend or some good coronavirus news. There’s no doubt the market could have overshot this week, with the S&P 500 posting its worst weekly performance since October 2008 — when Lehman Brothers collapsed.

The intraday chart shows the huge reversal that kicked off a test of the earlier low of 2880.

On the day:

- S&P 500 -25 points to 2954 (-0.8%)

- Nasdaq – flat

- DJIA -1.4%

On the week:

- S&P 500 -11.5%

- DJIA -12.4%

- Nasdaq -10.5%

The weekly chart is still ugly but at least the bulls have some lift as we closed off the weekly lows:

We will have to get back above the 200-dma at 3046 to generate any real optimism.