What is the outlook for the US dollar

The USD has been steady versus a basket of major currencies since the start of 2019. The dollar index is trading close to September highs, which, in turn, are at the maximum levels since 2017.

The USD has been steady versus a basket of major currencies since the start of 2019. The dollar index is trading close to September highs, which, in turn, are at the maximum levels since 2017.The current week, however, hasn’t been very positive for the American currency. So, what future awaits it? In this article, you will find the fundamental outlook for the greenback.

US economy has faltered

Life shows that it’s not possible to fight in trade wars and stay unharmed. The data released on Tuesday showed that the US manufacturing sector is in its worst condition in a decade: ISM Manufacturing PMI dropped from 49.1 to 47.8 in September.

A reading below 50 indicates industry contraction. Given how low the latest number is, it’s certain that even if the underlying picture changes and positive factors come into play, the situation won’t be able to improve fast.

And so far, there are few reasons to believe that the United States and China will achieve a big breakthrough in their negotiations. Representatives of the nations will meet next week on October 10 and 11.

Although soothing comments may cheer the stock market, it will take the mutual renunciation of tariffs to amend the damage done to the economy. If talks fail, there will be more tariff hikes in the following months and hence an even stronger economic pain.

Moreover, recent rumors indicate that Donald Trump is considering limiting American investment flows to China. This step, if taken, would further escalate the trade conflict.

Remember that everything is interdependent in the economic world. Considering the external troubles, it’s now up to US consumers to drive economic growth. For them to be able to do that, they need ample wages.

(more…)

The USD has been steady versus a basket of major currencies since the start of 2019. The dollar index is trading close to September highs, which, in turn, are at the maximum levels since 2017.

The USD has been steady versus a basket of major currencies since the start of 2019. The dollar index is trading close to September highs, which, in turn, are at the maximum levels since 2017.

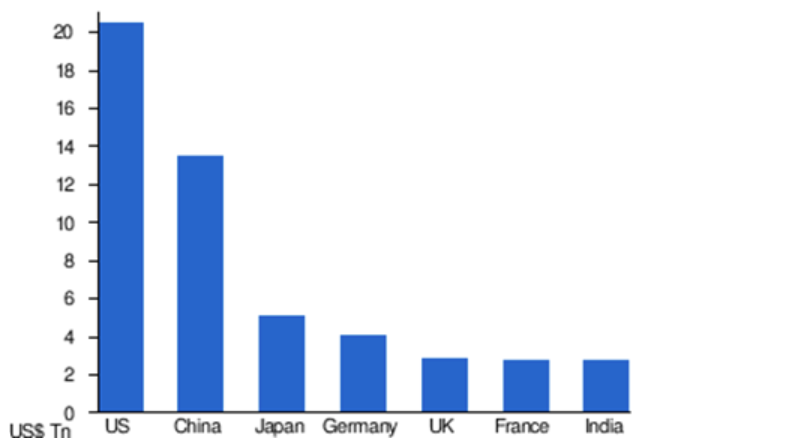

The focus of the market on the China-US trade war is acute due to China’s and the United States economic weight. In 2018 the US’s GDP was above $20 trillion and China’s GDP over $14 trillion, which makes them the world’s two largest economies by nominal GDP.

The focus of the market on the China-US trade war is acute due to China’s and the United States economic weight. In 2018 the US’s GDP was above $20 trillion and China’s GDP over $14 trillion, which makes them the world’s two largest economies by nominal GDP.