The infectious and mortality rates of the new coronavirus have become the main force driving the pendulum of investor sentiment toward fear. The move is all the more dramatic as the investors had been positioned for a continuation of the historic bull market in equities and eager to take on new risks.

The coronavirus has surpassed the earlier precedents of SARS (2003) and the Swine Flu (2009). The World Health Organization declared an international health emergency, which will free up resources and boost efforts to contain the pathogen. It took roughly 20 months to devise a vaccine for SARS, and it is estimated that a vaccine is possible within a month or so now to begin the testing process. Although China is expected to return from the extended Lunar New Year on February 2, more than a dozen provinces and cities will be closed several days longer, which ballpark estimates suggest are responsible for a little more than 2/3 of GDP and 3/4 of exports. Supply-chain and business disruptions will likely last longer still.

Investors fear that the health crisis will turn into an economic crisis. Although President Xi is understood to be the strongest Chinese leader in a generation, the challenges that China faces are immense: US rivalry and trade conflict, Hong Kong, Taiwan, and a highly leveraged domestic economy underpinned by a deteriorating demographics. China recently reported its birthrate fell to a record last year. Still, some argue that the situation is even more dire as the official figures exaggerate both the population and the birth rate. More monetary and fiscal stimulus is expected to be delivered to cushion the impact. Some forecasts show the Chinese economy slowing to around 4.5% in Q1 20 from 6.0% in Q4 19.

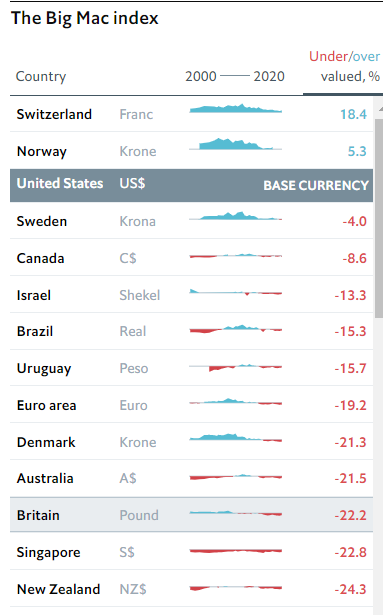

Since the onshore yuan (CNY) stopped trading for the holiday, the dollar appreciated by a net of a little less than 1% against the offshore yuan (CNH). A catch-up move of roughly the same magnitude would bring the greenback toward CNY7.0. While the last time the dollar rose through that threshold, the US accused China of currency manipulation, this time is considerably different. Moreover, of all times, this is the time when China could likely get away with manipulation if it wanted. It is not just because of the macro shock, but also because the US has played the card once and relatively quickly reversed itself. (more…)