Archives of “business” tag

rssTrump warns he will obliterate Turkey if they go offside

Trump talks about his “great and unmatched wisdom”

As I have stated strongly before, and just to reiterate, if Turkey does anything that I, in my great and unmatched wisdom, consider to be off limits, I will totally destroy and obliterate the Economy of Turkey (I’ve done before!). They must, with Europe and others, watch over…the captured ISIS fighters and families. The U.S. has done far more than anyone could have ever expected, including the capture of 100% of the ISIS Caliphate. It is time now for others in the region, some of great wealth, to protect their own territory. THE USA IS GREAT!

Big Tech wins US talent war as Trump visa policy hurts Indian IT

While the immigration policies of U.S. President Donald Trump give the impression of slamming the door on foreign talent, a closer look at visa data shows that the big four American tech companies are accelerating their drive to attract and retain highly skilled professionals.

In contrast, the biggest losers are Indian information technology companies, such as Cognizant Technology Solutions, Infosys and Tata Consultancy Services, who had long been the biggest employers of foreign IT talent in the U.S.

At issue is the H-1B visa, the permit that allows foreign talent with specialized skills to reside and work in the U.S. for up to six years. People from India, especially with computer skills, account for the biggest percentage — 74% — of H-1B visa applicants, followed by those from China at 11%.

Workers who enter the U.S. under the H-1B have the opportunity to apply for permanent residency and start their own business. The prospect of the American dream has enabled the U.S. to attract some of the best minds in the world and has been the engine of innovation in the country.

Platts on the oil price impact of the Saudi attack

- Attacks increases concerns on about supply security in the Middle East

- Oil price risk premium should heighten

- sudden change in geopolitical risk warrants elimination of the $5-10 a barrel discount on bearish sentiment and also adds potential $5-10 a barrel premium to account for threats to supply, sudden elimination of spare capacity

- prices are likely to break out of the current $55-65 a barrel options range

- test high $70s

- could move higher still if Saudi output is curtailed for a more substantial period

EBITDA-Humour or Making Fool ?

6 Key Ideas For Traders

1). The typical trader who is struggling will look for outside information that completes the puzzle or “holy grail” of trading. Go and look at yourself in the mirror. This is the missing piece in the trading puzzle.

2). Mental rehearsal (of both positive and negative scenarios), positive imagery, inducing a relaxed state of mind, and developing daily rituals can help put you in the flow state of mind for trading.

3). The most important question a trader can ask: “Am I acting in my own best interest right now?”. Menaker explains why this question will help you define your risk and maximize your opportunities and trading results.

4). The very largest traders are focused primarily on risk management. Accepting and managing risk is a big part of trading. Some traders have difficulty following rules in this area. We should spend time learning about the mental biases humans have against suffering losses (see: Prospect Theory) and become aware of these showing up in our trading. Keep a trading journal to highlight awareness of these events.

5). “If I was forced to rank the importance of [various aspects] of trading, setups would be at the bottom of the list. Position sizing, risk management, and psychology are really what’s going to keep you out of trouble and ahead of the game. The best traders understand this and have internalized it.”.

6). You need to learn to do more of what works and less of what doesn’t. While it sounds obvious, many traders have difficulty with this as their unmanaged emotions are interfering with their perceptions and trading process.

Teach Yourself to Be Great

Can you teach yourself to trade? Do you realize how important learning on your own is if you really want to be a successful trader? Everything about Kevin Bruce’s trading is self-taught. He started in the basement of the University of Georgia library: The school had old editions of the Wall Street Journal on microfilm. In the basement dungeon, he would compile his own record of the open, high, low, and closing prices for all markets. At the time, Bruce was actually working at a gas station at night, and between cleaning bugs off windshields and pumping gas, he had time to think and research–which is where he would analyze that price data. Bruce had a Texas Instruments handheld calculator that helped him sort through price data collected from the library. He figured out how to mathematically define a trend (in order to profit from its movement). It was a basic trend trading system. It was the same system he had used for the trading game in school with slight tweaks. Ultimately, it was the same one he would use with real money in the decades to follow.

Lessons from Paul Tudor Jones

-Never play macho man with the market. Never over-trade relative to the equity in your account

-his first mentor has “steel hard emotional control”

-always liquidate half his position below new highs or lows

-after having 60-70% draw-down, he was so depressed he nearly quit. “Mr. Stupid, why risk everything on one trade? Why not make your life a pursuit of happiness rather than pain?”

-he then first decided to learn discipline and money management. Become disciplined and business-like about trading

-“Now I spend my day trying to make myself as happy and relaxed as I can be. If I have positions going against me, I get right out; if they are going for me, I keep them”

-Be quicker and more defensive. Always think about losing money as opposed to making money. He always has a mental stop. If it hits that number, he is out no matter what

-“Risk control is the most important thing in trading” Stop out at near 10% monthly draw-down. He never wants to lose 10% in a month

25 Rules of Trading Discipline

- The market pays you to be disciplined.

- Be disciplined every day, in every trade, and the market will reward you. But don’t claim to be disciplined if you are not 100 percent of the time.

- Always lower your trade size when you’re trading poorly.

- Never turn a winner into a loser.

- Your biggest loser can?t exceed your biggest winner.

- Develop a methodology and stick with it. don?t change methodologies from day to day.

- Be yourself. Don?t try to be someone else.

- You always want to be able to come back and play the next day.Once you reach the daily downside limit, you must turn your PC off and call it a day. You can always come back tomorrow.

- Earn the right to trade bigger. Remember: if you are trading poorly with two lots you must lower your trade size down to a one lot.

- Get out of your losers.

- The first loss is the best loss.

- Don?t hope and pray. If you do, you will lose.

- don?t worry about news. it?s history. (more…)

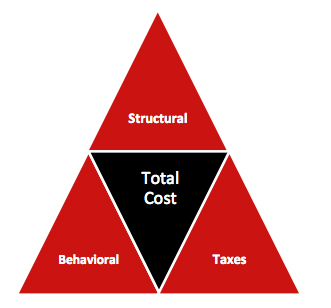

Rick Ferri’s Triangle of Investor Costs

Rick Ferri has a new book coming out that I can’t wait to read. In the meantime, here’s something he put together illustrating the three costs that investors must control if they’re going to be successful…

Figure 1: The Investment Cost Triangle with Components

Some costs in Figure 1 are easy to identify and quantify while others are not. Structural costs are generally available because most fund fees and expenses are required to be disclosed by law. However, tax costs are more difficult in that they have to be extracted from tax return data. Behavioral costs are the most elusive and difficult to quantify because there’s very little data available. It also doesn’t help that human beings are overconfident and don’t want to be reminded of behavioral shortcomings.

Read the rest, this is the important stuff – much more important than the latest macro opinions on Greece or Guernica.