The leaders who work most effectively, it seems to me, never say “I”…

Most new traders overtrade.

Most new traders overtrade.

Overtrading is when you (hoping to receive the maximum possible profit) opens a huge position consisting of multiple lots.

Considering the typical market activity, it’s easy to lose half or even all your trading capital.

This problem is sometimes directly connected to insufficient trading capital.

But it’s more likely due to the trader lacking knowledge of money management principles, which means lack of competence to control their trading capital properly.

Your trading capital is used to earn money. You should treat each rupee is like a newborn baby.

Your first and foremost responsibility is to protect it. If you lose it, you have less to help you earn money.

Have you written down your trading rules? Do you have rules for entry and for exit with a profit and with a loss? Do you have a rule telling you whether a market is trending and what the trend is? Do you have rules stating when the market is in a trading range and what that range is? Do you have rules saying what markets you will trade and what has to happen to trade them?

Or do you simply shoot from the hip and call it artistry or intuition? Does this work for you?

Do you follow your rules rigidly without flexibility or discretion? Does this serve you over time?

Do you abandon your rules in the heat of trading, only to regret it? Do you stubbornly go against your rules thinking this time you know better? What would happen if you didn’t do this? (more…)

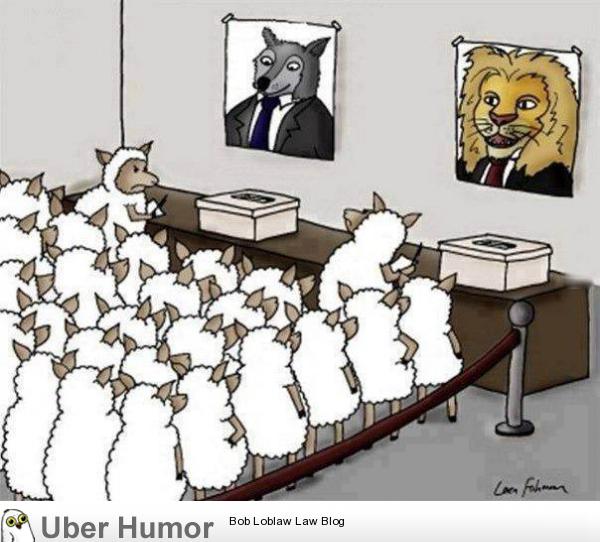

Remember One Thing :95% Traders will lose Money

& U are Wasting Your Time ,Money ,Energy too.

Untill & Unless U are having Solid Strategy to Trade ….Don’t Trade @ all.

1. Know what you want. Know who you are, not who you think you should be. Self-awareness gives you the power to pursue what really feeds your soul and the belief that you deserve it.

2. Know the cost of getting what you want. Realize the trade-offs of every choice. People often think if they are clever they can make choices without experiencing any downside. Any road you choose means there is a road you won’t experience.

3. Be willing to pay the cost. People often try to negotiate to win a choice without cost. Every choice involves a price; we get to decide what cost we want to pay.

If you invest in the stock market you’re almost 100% certain to have heard of Warren Buffett. Indeed, you’ve probably read books about him, or you might have read his annual shareholder letter, or even been to the spectacle that is the Berkshire Hathaway annual shareholders meeting.

Now’s your chance to watch an interesting documentary that offers an intimate look at the life of Warren Buffett. The documentary offers an eye opening view of how he runs the company (complete with a tour of his office), the annual shareholders meeting of Berkshire Hathaway, and a peak at his many eccentricities.

Of course the film also reviews how he made his money, how he operates, how he came to operate in the way he does, and how he thinks about his wealth which is in the tens of billions of dollars.