Wisdom Quote From Rogue Trader-Nick Leeson

An edge is an advantage that a trader has over his competitors, allowing him to generate and retain profits from other traders . There can be many types of trading edges through risk management, psychological management, and through better trading methods.

Here are a few:

| A man ought not to be led into trading by tokens. He should wait until the tape tells him that the time is ripe. As a matter of fact, millions upon millions of dollars have been lost by men who bought stocks because they looked cheap or sold them because they looked dear. The speculator is not an investor. His object is not to secure a steady return on his money at a good rate of interest, but to profit by either a rise or a fall in the price of whatever he may be speculating in. Therefore the thing to determine is the speculative line of least resistance at the moment of trading; and what he should wait for is the moment when that line defines itself, because that is his signal to get busy. ——-REMINISCENCES OF A STOCK OPERATOR by Edwin LeFevre |

I “see” the market through the lens of four primary metrics: fundamentals, technical, structural and psychology.

When viewed in isolation, each of those approaches has inherent flaws.

1. Fundamentals are best at the top and worst near a low.

2. Technical indicators often trigger buy signals higher, on breakouts, and sell signals lower, after a stock has broken down.

3. Structural factors — debt, derivatives and currency effects — can self-sustain in a cumulative manner until such time they overwhelm the system.

4. Psychology, such social mood and risk appetites, can gain momentum until they snap under the weight of the herd mentality.

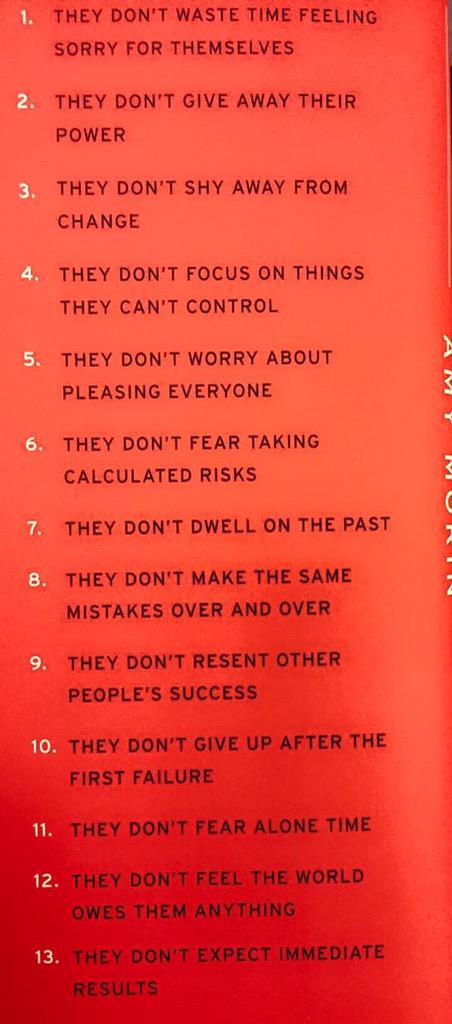

The goal of any trader is to turn profits on a regular basis, yet so few people ever really make consistent money as traders. What accounts for the small percentage of traders who are consistently successful is psychological—the consistent winners think differently from everyone else.

The goal of any trader is to turn profits on a regular basis, yet so few people ever really make consistent money as traders. What accounts for the small percentage of traders who are consistently successful is psychological—the consistent winners think differently from everyone else.

The defining characteristic that separates the consistent winners from everyone else is this: The winners have attained a mind-set—aunique set of attitudes—that allows them to remain disciplined, focused,and, above all, confident in spite of the adverse conditions.

Those traders who have confidence in their own trades, who trust themselves to do what needs to be done without hesitation, are the ones who become successful.They

no longer fear the erratic behavior of the market. They learn to focus on the information that helps them spot opportunities to make a profit, rather than focusing on the information that reinforces their fears.

You don’t need to know what’s going to happen next to make money; anything can happen, and every moment is unique, meaning every edge and outcome is truly a unique experience.

The trader that it’s his attitude and “state of mind” that determine his results.