This is the trader’s ability to attend to the smallest details of his or her trading plan. I believe a trader must have rules for entering and exiting a trade before the trade is made. In the beginning these rules can be in the form of a checklist wherein before each trade all the details of your rules are checked and verified. With time, the rules become such as a part of your psyche that the checklist is in your head and can be confirmed with quick precision. The key is to never change the rules. When the rules stay the same your mind will not be able to play tricks on you. |

Archives of “January 2019” month

rssThe markets will not be as easy as your trading system planned for, but we still have to follow our trading plan.

Don't……

Personal finance tips meet reality

Who's Thirsty?

Worries of Day Traders

Here is what traders choose to worry about (among others I am sure). These so-called worries are usually in the form of a question and revolve around losing money:

Here is what traders choose to worry about (among others I am sure). These so-called worries are usually in the form of a question and revolve around losing money:

1. Will this trade make money?

2. Will this trade hit a profit target?

3. Will this trade reverse quickly against me?

4. Will my gain turn into a loss?

5. Will unknown news affect my trade?

6. What if I have not done enough homework?

7. What if my strategy is not sound?

8. Will Cramer disagree (I had to throw this one in)?

9. What if I get out too soon?

10. Did I buy the right stock?

11. What if I miss a potential move?

Being wrong can be random but staying wrong is a choice.

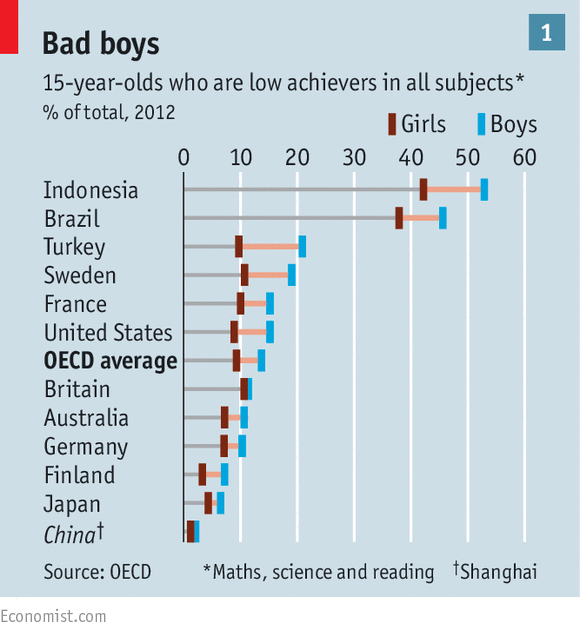

Across the rich world, girls are now outclassing boys at both school and university.

What Happened to IT STOCKS in Year 2000,Can we see same in Solar Stocks ?